The British pound flash crashed to 1.20 before bouncing to 1.24, but things are unstable, to say the least. The team at Goldman Sachs analyzes the downside potential for sterling:

Here is their view, courtesy of eFXnews:

We revised our forecasts for Sterling sharply lower in July, bringing in particular our 3-month forecast for GBP/$ to 1.20. In the period that followed, however, Cable refused to fall in line with our forecast for two reasons.

First, the Bank of England didn’t ease in July, preferring to wait until its August meeting. This delay, though in line with the expectations of our UK economists, was nonetheless a disappointment for markets, and broke what up to that point had been clear momentum to the downside in GBP/$.

Second, the immediate aftermath of the Brexit vote saw a political vacuum in the UK, with some possibility that Article 50 might never actually be triggered. As a result, markets began to trade the short-term data flow, which was better-than-expected, and speculative short positioning in Sterling was squeezed.

Prime Minister May’s announcement that Article 50 will be triggered by March next year has changed all that and refocused markets on what we see as one of the cleanest macro trades out there. In a sign of how times have changed from a month or so ago, discussion has now switched to how much downside there potentially is in Sterling, away from the recent focus on positioning and data flow.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

We forecast that Sterling will fall about another 5 percent on a trade-weighted basis in the next three months, which translates into 1.20 for GBP/$.

This forecast reflects two considerations.

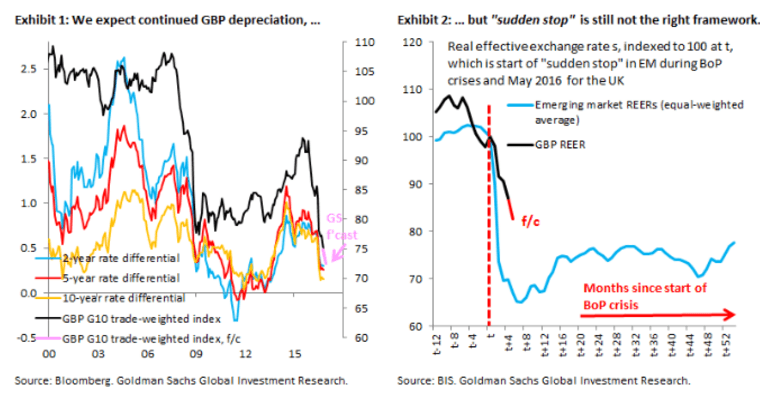

First, we see a continued catch-down of trade-weighted Sterling with longer-dated rate differentials (Exhibit 1), which in this low policy rate environment have become the main driver of G10 exchange rates.

Second, we continue to believe that a “sudden stop” of the kind seen in emerging markets – when a sudden stop in capital inflows forces a large devaluation of the currency in the face of a current account deficit – is unlikely in the UK, given that rule of law and institutions are stable. Exhibit 2 shows that our forecast for a further 5 percent depreciation of Sterling roughly splits the difference relative to the kind of devaluations that emerging markets tend to see during balance of payments crises. That said, as our economists have highlighted, the process of Brexit involves large uncertainty i.e., could easily turn out to be more complicated and drawn out than expected. Risks to our Sterling forecast are therefore to the downside.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.