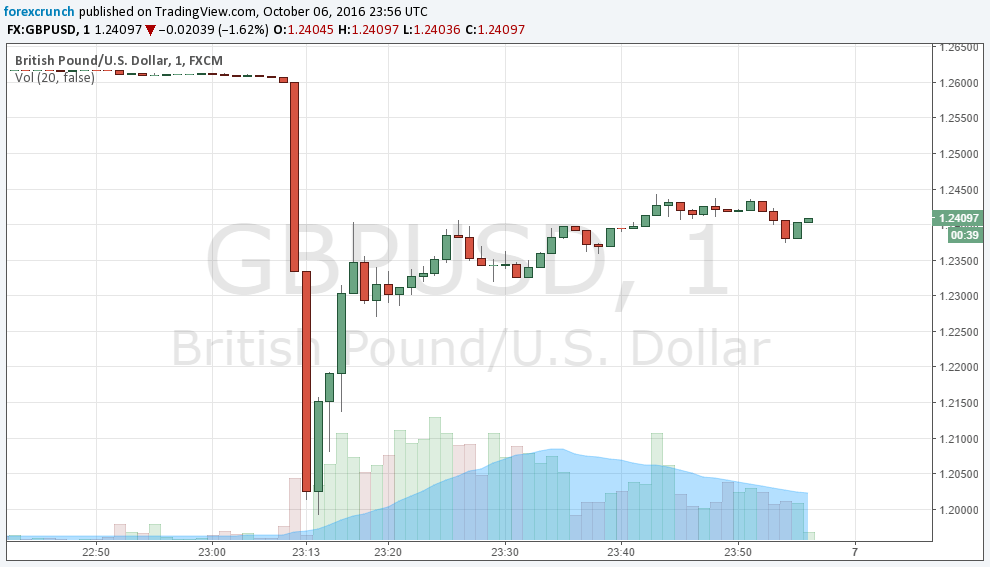

Thin liquidity + big downside pressure = flash crash. The British pound collapsed after the end of the US session and as Asian hardly began trading: only Australian and New Zealand were in play. A fat finger or just a run on stop losses? It doesn’t really matter.

GBP/USD crashed quickly from around 1.26 all the way to 1.1992 and is now trading just under 1.24.

For all the related news: GBP flash crash – all the updates in one place

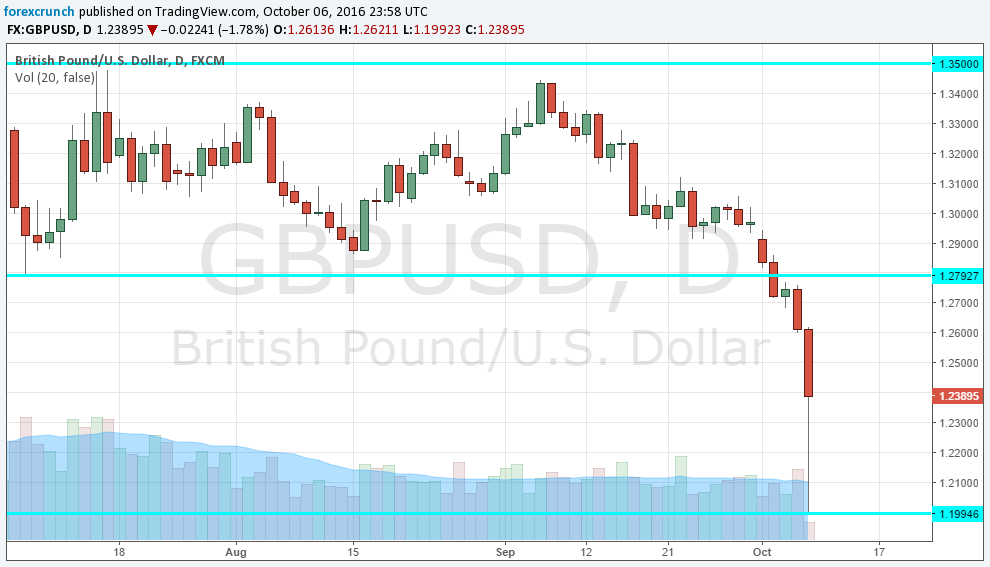

The British pound has been under immense pressure due to talk about a “Hard Brexit“. This intensified when the reporting became an outright declaration by British PM Theresa May in the Birmingham Conservative Conference. GBP/USD opened the week with new 31 year lows.

Since then, the pressure continued and after trading at the 1.27 handle, the pair continued lower to the 1.26 handle. But this is already something totally different.

More:

- GBP: ‘Accident Waiting To Happen’; Turning More Bearish Sterling Targeting 1.22 – Credit Suisse

- How Much Sterling Downside Ahead And Why? – Goldman Sachs

- GBP/USD has more room to the downside – 3 opinions

- We Stay Bearish Sterling as Hard Brexit Has Become A ‘Meaningful Risk – Deutsche Bank

- EUR/GBP > 0.90 on pound crash – why this will NOT last

- GBP/JPY dips under 125 – why there is more to come

What could be behind the move? The French President Hollande offered tough words regarding Britain’s Brexit negotiations, basically echoing German comments before the vote: out means out. But a better explanation seems the mix of a fat finger, cascading stop losses and also very thin liquidity in the “after hours” US market.

Here is how it looks on the daily chart:

The huge move is slowly being undone, with cable bouncing back to 1.2440. Nevertheless, like with Trump’s words, cannot be undone. The slide may have caused freezes in traders’ screens, margin calls and perhaps even a “mini SNBomb”.

The original SNBomb caused a much bigger flash crash from 1.20 to 0.85 and back to over parity on EUR/CHF within seconds, on January 15th 2015. It left some brokers bruised, others battered and some bankrupt.