- NASDAQ price retreats slightly due to some disappointing tech stock performance

- Core Inflation Published Today Should Provide a Good Indicator On The Path Ahead

- Coronavirus concerns and rising cases in several states also dragging on the US100

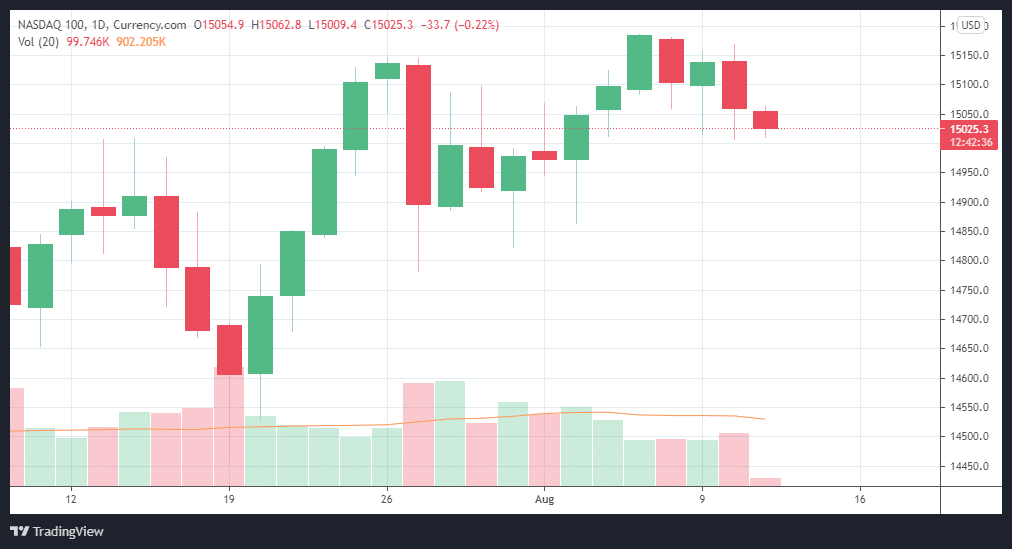

The NASDAQ price seems to have settled down after several days of a continual rise. After reaching fresh all time highs last week, the US100 fell slightly back over the past few days and is now trading at the 15023 level or a minuscule drop of 0.14%.

The Fed warnings on a persistently higher inflation rise over the next few years and further coronavirus concerns seem to have dampened investor sentiment somewhat. This was surprising after the excellent Non-Farm Payroll Report published last Friday where expectations were exceeded.

The NASDAQ price was slightly off also due to slightly disappointing results from NVIDIA, PayPal as well as Microsoft. The announcement of US headline and core inflation data today should also provide some guidance over where inflation is heading.

After the landmark passing of the $1.2 trillion Infrastructure Bill yesterday, the market has reacted in a rather subdued manner. The long-term implications of this bill are huge as hundreds of thousands of jobs are expected to be created over the long term. This should provide a boom to the economy and of course the stock markets.

If you’re interested in trading forex and haven’t yet started off, then you should take a look at this How To Trade Forex Beginner’s Guide.

Short Term Prediction For NASDAQ Price: Some Retracement Expected Before Move Forward Resumes

After having peaked at 15124 on Aug 9, the NASDAQ price retraced slightly and began flirting with the 15000 mark which is psychologically significant. As indicated, the market’s reaction to the passing of the Infrastructure Bill has been slightly muted but one has to wait to see what exactly happens.

If a bullish thesis were to prevail then the NASDAQ price should once again recover from the recent slump and re-establish itself above the 15100 level. However, the US100 has now fallen twice over the last couple of days so a period of correction seems imminent.

The short-term performance of the NASDAQ price may also be affected by the continually deteriorating Covid19 situation in various Southern states. The ‘pandemic of the unvaccinated’ is continuing at a rather fast level and this is proving to be a damper on the economic resurgence of the US.

If you want to begin trading forex you could do worse than take a look at these Top Forex Brokers.

Long Term Prediction For US100: Tapering support and Covid19 concerns remain major issues

As the US economy continues to re-open, several challenges remain that should continue to affect markets on a long-term basis. Rising inflation remains a worry although the CPI rate is expected to drop in July to 4.3% from 4.5% in June. This was the highest rate seen since 1992.

Covid19 concerns continue to be a drag on markets with cases rising substantially in states where vaccination programmes have lagged behind. The NASDAQ price is expected to continue bullish although a period of retracement and sideways performance also seems to be on the cards.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.