Idea of the Day

Markets are now fully priced for the Fed to remain on hold for the rest of the year, so today’s Fed meeting is seen as a low risk event for the dollar. Remember that in September, the Fed failed reduce the monthly amount of bond purchases because they wanted to see “more evidence that progress will be sustained”. The main issue will be the extent to which the statement is adjusted in light of the recent government shut down and debt ceiling negotiations and more specifically, the on-going uncertainty that has been created by the short-term extensions to both. If the statement leans on this to any degree, then the current expectation that March next year is the most likely time for tapering to be enhanced. Stock markets have continued to push higher on the expectation of continued easy money from the US and volatility in FX markets has declined. But with bond yields lower, stocks higher and the dollar having bounced from the lows, there is little need for the Fed to sound dovish, with the markets already positioned for such an outcome.

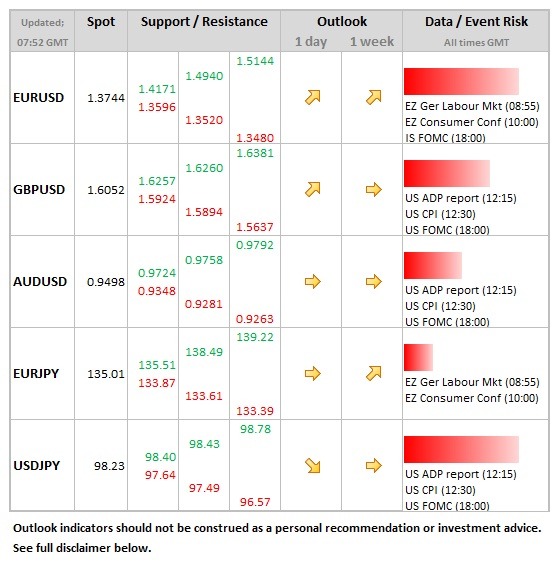

Data/Event Risks

USD: The Fed meeting dominates (see below), but ADP and CPI data ahead of that. ADP is designed to give an idea of next week’s payrolls report, expectation of a 150k rise in private payrolls on this measure (from 166k in the previous month). Core CPI seen steady at 1.8%, with headline falling to 1.2% (from 1.5%).

EUR: German labour market data is expected to show the unemployment rate steady at 6.9%, with unemployment change seen flat after 25k rise last month. Low risk event for euro, which appears more focused on potential for comments from officials.

Latest FX News

EUR: The one thing holding the single currency back has been the fear of comments from officials ‘talking down’ the currency, so the fact that an ECB board member (Nowotny) said yesterday that he doesn’t see any tool a central bank could use against a strong currency. The initial 50 pip rally was soon unwound. We have to remember that this is just one view of many on the governing council and history is littered with many voices talking on the euro, often with conflicting messages.

AUD: A modest bounce in the Aussie during Asia trade after the weakness seen in recent sessions which finds AUDUSD nudging above the 0.9500 level in early European trade. The currency remains bruised after the comments from RBA’s Stevens yesterday.

GBP: For the past two years, sterling has struggled for air above the 1.60 level and this is again proving to be the case. There have been 5 periods of pushes above here, with the longest it has remained above 1.60 on a closing basis being just over 2 weeks in September of last year.

Further reading:

CB Consumer Confidence plunges in October to 71.2 points

All is quiet before the FOMC announcement