Some think the Fed tilted to the hawkish side but the team at Danske beg to differ, saying the November Fed decision does not imply a hike.

Here is their view, courtesy of eFXnews:

As expected, the FOMC maintained the Fed funds target rate at 0.25-0.50%. Neither analysts nor investors expected the Fed to hike so close to the election day next week. As this was one of the small meetings without a press conference or updated ‘dots’, focus quickly shifted to the FOMC’s statement. As expected there were no major changes in the FOMC’s statement.

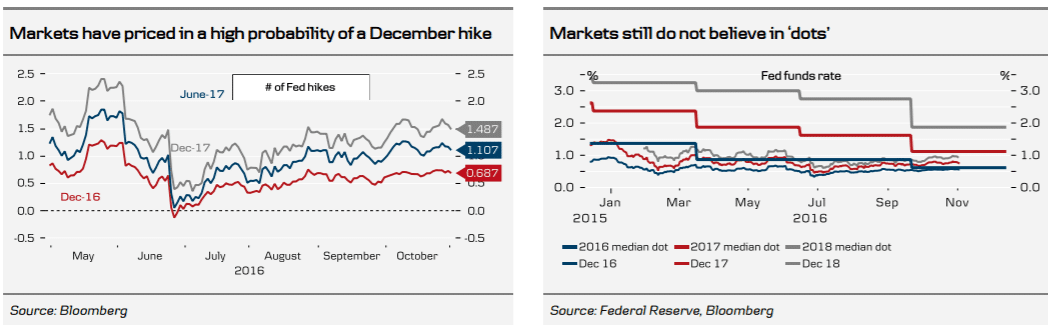

Most importantly, it now says the case for a rate hike ‘has continued to strengthen’ (previously ‘has strengthened’) but that it had ‘decided, for the time being, to wait for some further evidence of continued progress toward its objectives’. In other words, we still have some important data releases left, starting with the jobs report for October tomorrow, which the Fed wants to take into account before making up its mind. Also, it was not necessary for the Fed to make major changes to the statement, as the September statement was already quite hawkish, markets have more or less priced in a Fed hike by year-end and the Fed still wants some flexibility to refrain from hiking if circumstances change. It is worth noting that there is no explicit mention of the December meeting in the statement. This is unlike the FOMC statement in October 2015 (the meeting before the December 2015 meeting when the Fed raised rates for the first time), which had an explicit reference: ‘In determining whether it will be appropriate to raise the target range at its next meeting’.

For some time, we have had the non-consensual view that the Fed will not raise the Fed funds target range this year. Although the probability of a December hike has definitely increased, as economic data have been better than we had expected, we still think it is too early to say a December hike is a done deal, as there are still valid arguments for not hiking at all this year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.