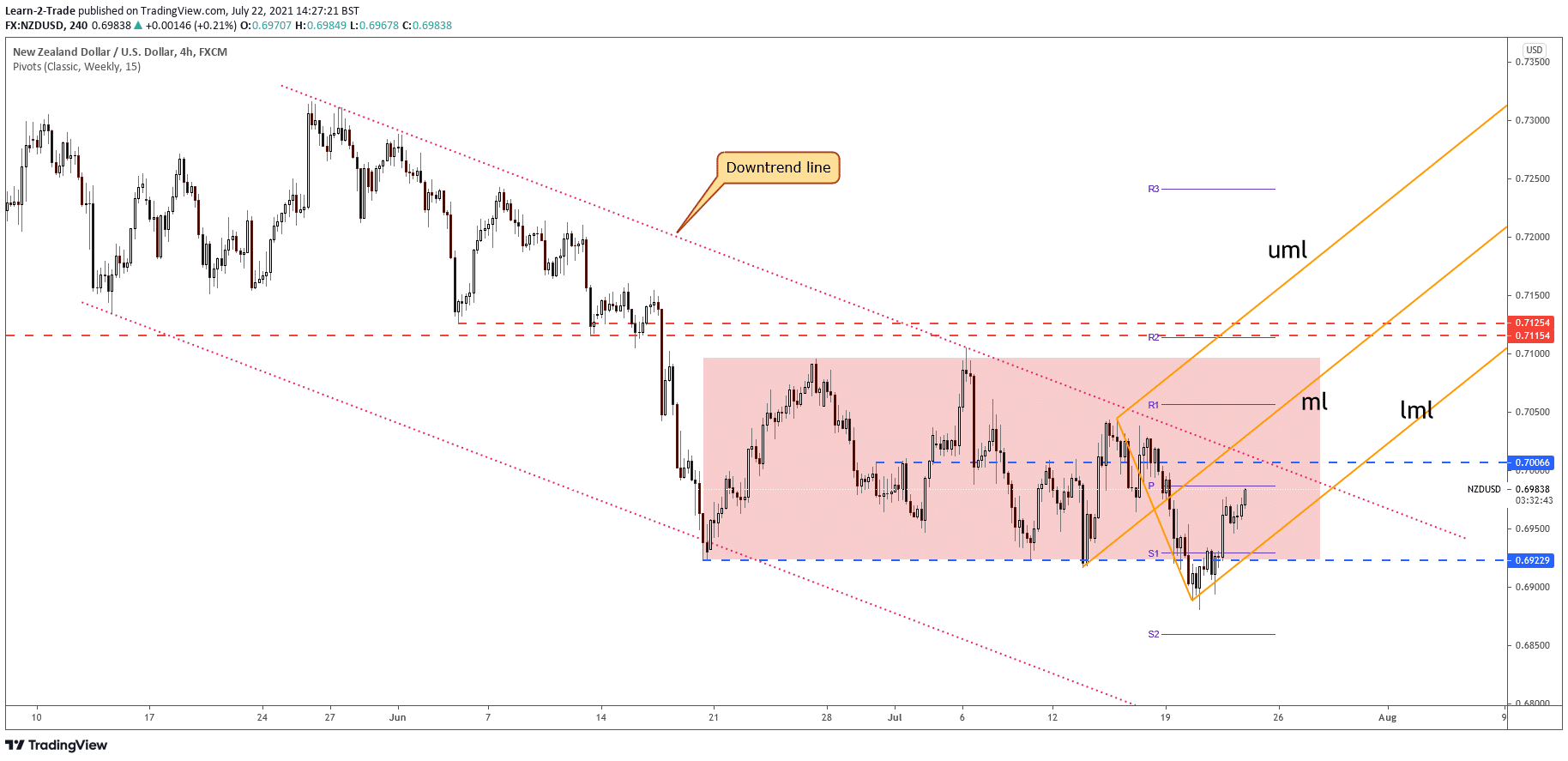

The NZD/USD price has rebounded in the short term, but this could still only temporarily bounce. So, the pressure is still on the upside as long as it stays within the major channel’s body. Nevertheless, the pair has managed to rise as the Dollar Index has plunged.

–Are you interested to learn more about forex options trading? Check our detailed guide-

It remains to see what will really happen on the DXY after reaching strong support. The NZD/USD pair is trading in the red right now at 0.6958 level, far below 0.6985 today’s high.

Surprisingly or not, the Greenback is still strong even though the US unemployment Claims increased unexpectedly in the last week. The economic indicator was reported at 419K above 350K expected and compared to 368K in the previous reporting period.

The US existing home sales increased from 5.80M to 5.86M, failing to reach the 5.89M estimate, while the CB Leading Index increased only by 0.7% versus 0.8% expected.

Tomorrow, the US Flash Manufacturing and Services PMI data could be decisive. Better than expected figures could lift the DXY and could send the NZD/USD lower. Only poor figures could weaken the Greenback.

NZD/USD price technical analysis: sweet spots to catch

The NZD/USD price has surged, and it reached near the weekly pivot point (0.6987) level. However, the pressure remains high as long as it stays under the down trendline. Failing to reach and retest the down trendline signals a downside breakout from the ascending pitchfork’s body.

–Are you interested to learn about forex robots? Check our detailed guide-

Technically, the pair has escaped from the narrow range, but it has failed to stay under 0.6922 to be able to resume its decline. Dropping again under this level could bring us a selling opportunity.

The NZD/USD price failed to approach and reach the down channel’s support. That is why we can think of an upside breakout as long as it stays near the downtrend line. Registering a valid breakout through the down trendline could signal an important upwards movement.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.