- NZD/USD surged to mid-0.7100, maintaining a winning streak for the second straight week.

- US ADP and NFP figures reported a dismal scenario for the US dollar that supported the Kiwi bulls.

- Delta variant is decreasing while RBNZ is determined to hike the rates.

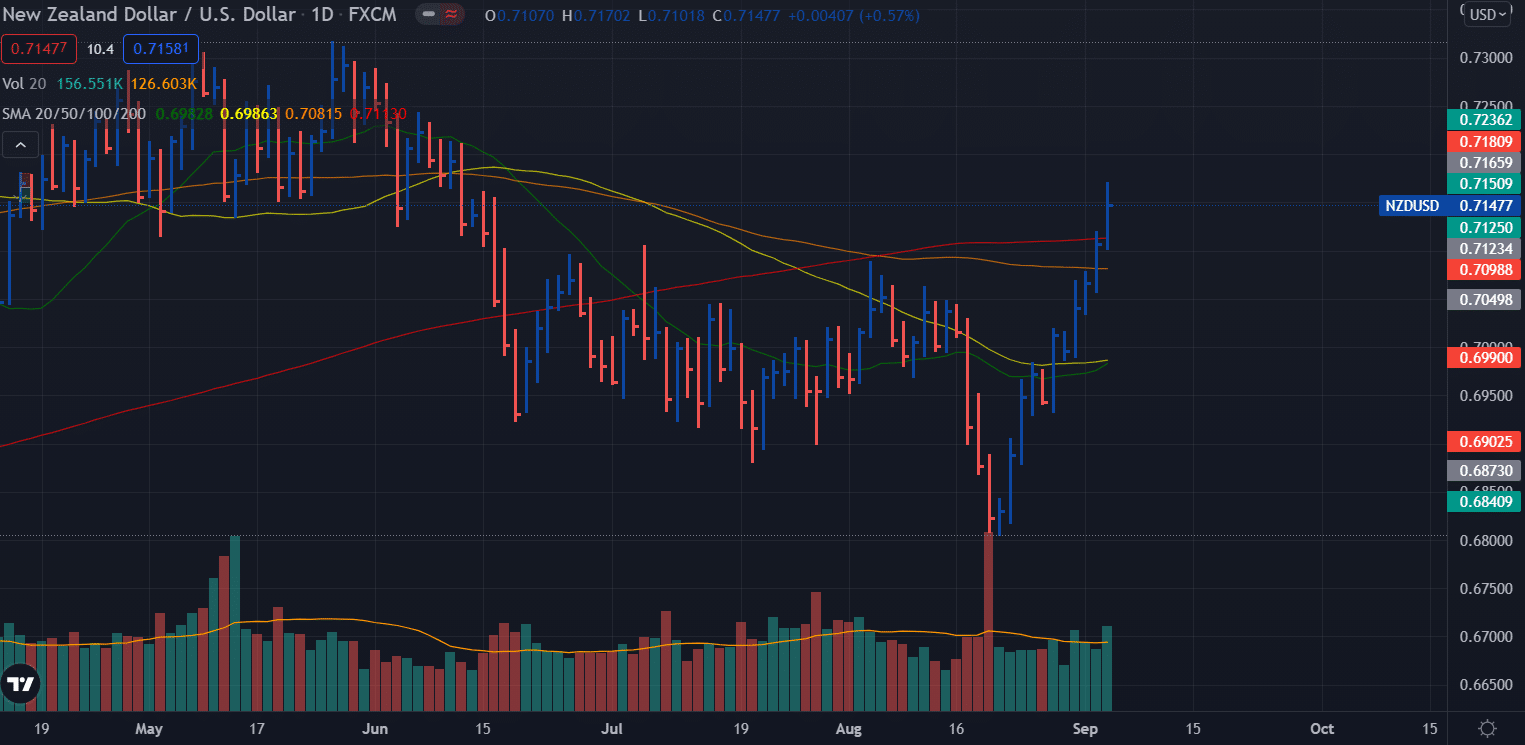

The weekly forecast for the NZD/USD pair is bullish and may aim for a run to 0.7300. However, a technical retracement can be seen too.

The NZD/USD pair remains broadly in a bullish trend above the mid-0.7100 area as the week ended. The Kiwi is benefitting from the general weakness of the US dollar. However, if another surge in the Delta variant is seen in the country, it may dampen the bullish spirit.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The NZD/USD pair started the week above the 0.7000 mark and hit the multi-week highs at 0.7170. The pair maintains the bid tone and looking to post further gains.

US ADP and NFP reports

The most important event of the week was the employment report of the United Stated. On Wednesday, the ADP employment report released widely missed the expectations of 640k jobs against the current reading of 374k.

On Friday, the US nonfarm employment number also came too worse than expected. Only 235k jobs were added in August, while the expected figure was 750k. However, the unemployment rate reduced to 5.2%, and average hourly wages increased by 0.6%.

The US dollar had already been under pressure throughout the week, but the dismal US NFP report weighed further and helped the major currency pairs to sharply rise. The NZD/USD pair broke important levels above 0.7100 area.

RBNZ and Delta variant

On the other side of the equation, the Delta variant can be tough against the economic growth and may keep RBNZ on the backfoot.

Grant Robertson, the Deputy Prime Minister of New Zealand, said 28 new Coronavirus cases on Friday, an improvement of 21 from the previous day. This is an “encouraging” sign that isolation in the country is working.

New cases were reported in Oakland and Wellington, which remain closed compared to the rest of the country. Currently, 764 people are infected with the outbreak.

The hospital has 43 patients, with nine under intensive care and three under ventilation.

In the intervening time, health officials have identified 37,620 people at risk of contracting Covid-19. A total of 84% attended a monitoring session, and 87% were tested.

As far as Governor Orr is concerned, a rate hike is likely to come soon, regardless of whether COVID-19 remains in the community. The Deputy Governor went even further by explaining that the suspension of hiking had more to do with the hike when the country saw a lockdown. Also, he acknowledged that the RBNZ was considering a rate hike of 50 basis points. Nevertheless, this scenario would be plausible if Covid were eradicated quickly.

COVID-19 will likely be contained more than anywhere else, which will allow the RBNZ to start tightening on October 6, helping to support the New Zealand dollar.

Key events from NZ during Sep 06 – 10

The economic calendar is too light for the week ahead. Only GDT price index data is due on Tuesday, followed by manufacturing sales on Thursday and visitor arrival numbers on Friday. However, none of the events is big enough to trigger volatility in the NZ dollar.

Key events from the US during Sep 06 – 10

The important events include the JOLTS job opening due on Wednesday ahead of Fed William’s speech in the US. Moreover, weekly unemployment claims are also important to note. Other than that, US PPI m/m data may also trigger volatility due on Friday. The figure is expected to slide to 0.6% against the previous month reading at 1.0%.

–Are you interested to learn more about forex signals? Check our detailed guide-

NZD/USD weekly technical forecast: Bullish crossover

The NZD/USD pair is maintaining the winning streak for the second consecutive week. The pair managed to break above the 100-day and 200-day moving averages. Moreover, the 20 and 50 DMAs are going to make a bullish crossover. However, the Friday close was off the highs, and the volume was higher than the previous bars. This is an indicator of retracement that we may see in the first half of next week. However, if bullish momentum persists, we may see a surge to 0.7300.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.