The economy of New Zealand lost 0.2% of its work force in the second quarter of 2017, a big miss against 0.7% that was expected. Year over year, the country still gained 3.1% but this was against an expectation of 4.1%.

And while the unemployment rate remained unchanged at 4.8%, it was only thanks to a big fall in the participation rate: 70% instead of 70.6% previously.

Wage growth also fell short of expectations, rising 0.8% instead of 0.9% expected. Looking from the outside, these numbers still point to a very robust economy. However, the New Zealand dollar had already risen quite a lot and found room to the downside.

NZD/USD falls

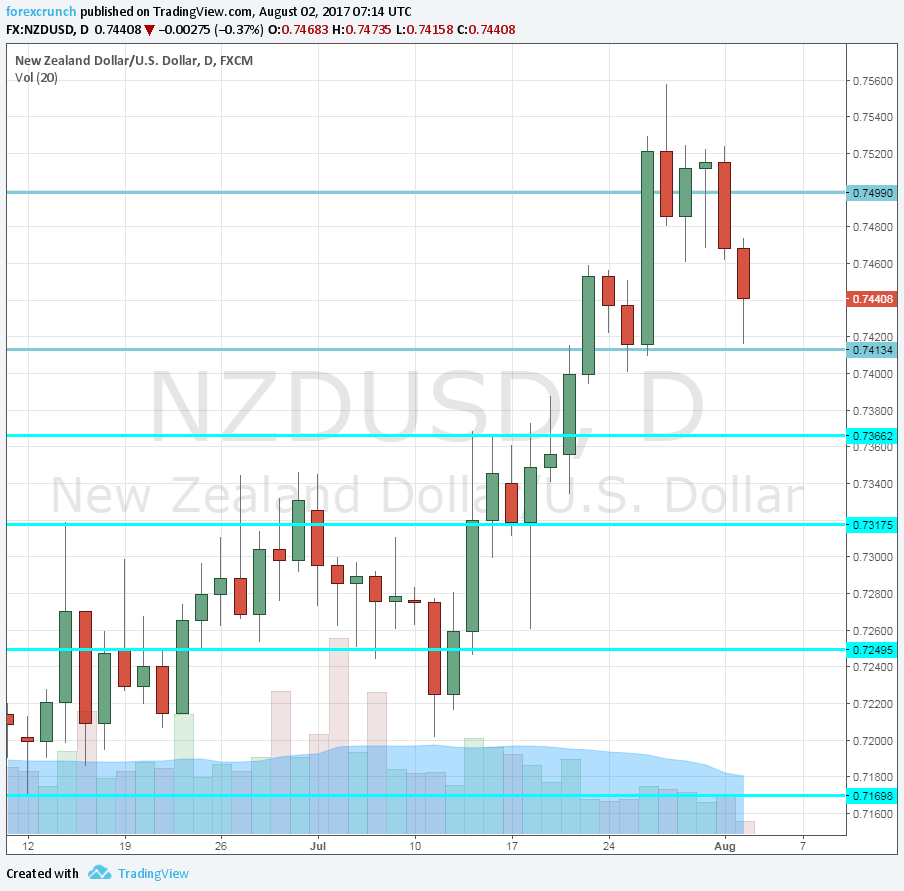

NZD/$ fell immediately from 0.7470 to 0.7415 before bouncing a bit. 0.7415 served as resistance in the past and works well right now. Further support awaits at 0.7365 and 0.7310. The pair had already

The pair had already reached the sky high levels of 0.7560, taking advantage of the weakness of the US dollar.

What’s next for the kiwi? As indicators from New Zealand are far and few between, the next big shifts depend on the US dollar. The Non-Farm Payrolls report on Friday is key.

Here is how things look on the daily NZD/USD chart: