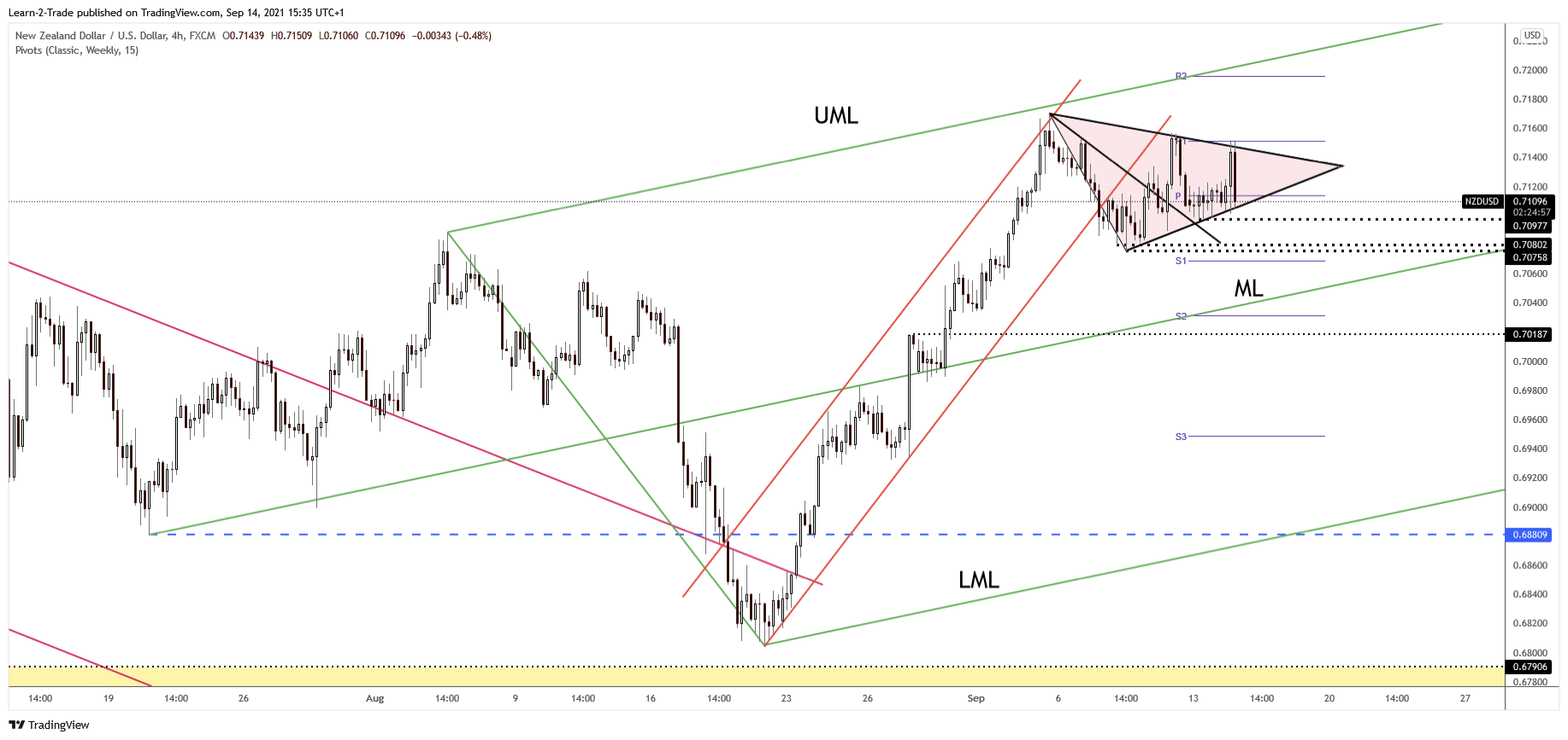

- The NZD/USD continues to be trapped within a triangle pattern.

- United States data could move the price during the week.

- Only a new lower low and dropping below the median line (ML) could really bring a larger drop.

The NZD/USD pair plunged and now it stands at 0.7108 level below 0.7150 today’s high. The price action has developed a triangle pattern, so I’ll wait for a valid breakout before taking action.

Surprisingly or not, the US Dollar has managed to recover and to take control even if the US inflation data has come in better than expected, which makes a hike in rates less pressing that might otherwise have been the case, for now.

The CPI rose by 0.3% in August failing to reach the 0.4% growth expected. It was reported below 0.5% growth registered in July. In addition, the Core CPI rose only by 0.1% versus 0.3% expected and compared to 0.3% in july.

Tomorrow, New Zealand is releases the Current Account indicator which is expected to grow from -2.90B to -1.74B. Fundamentally, the US Industrial Production, Empire State manufacturing Index, and the Capacity Utilization Rate could really move the pair.

Moreover, the New Zealand GDP and the US retail sales data will be released on Thursday. These high-impact figures could bring a clear direction and fresh trading opportunities.

NZD/USD Price Technical Analysis: Resistance at R1 (0.7151)

The NZD/USD has found resistance at the weekly R1 (0.7151) and at the triangle’s resistance. Now it’s pressuring the weekly pivot point of 0.7113 and the triangle’s support, the downside line. It’s premature to talk about a downside movement as long as it stays within this chart formation.

The price could print a major bearish engulfing if it closes the current H4 candle here around these levels. 0.7080 – 0.7075 is seen as a critical support zone. It could still rise as long as it stays above this area. From the technical point of view, only a valid breakout through the R1 (0.7151) and a new higher high could activate an upside continuation.

The NZD/USD has shown some overbought signs after failing to reach the ascending pitchfork’s upper median line (UML). Personally, I believe that the price may develop a downside movement only after dropping below 0.7075 and under the median line (ML). In the short term, it could move sideways, developing a range pattern.