The New Zealand dollar certainly showed some strength, rising above the previous range. The milk auction stands out amid various events in the first week of March. Will the positive trend continue? Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

New Zealand enjoyed a surprising trade balance surplus in January, and albeit small, it did give the kiwi the necessary boost to rise above the previous range. In the US, new home sales were a big disappointment but durable goods orders were very positive, leaving a mixed picture.

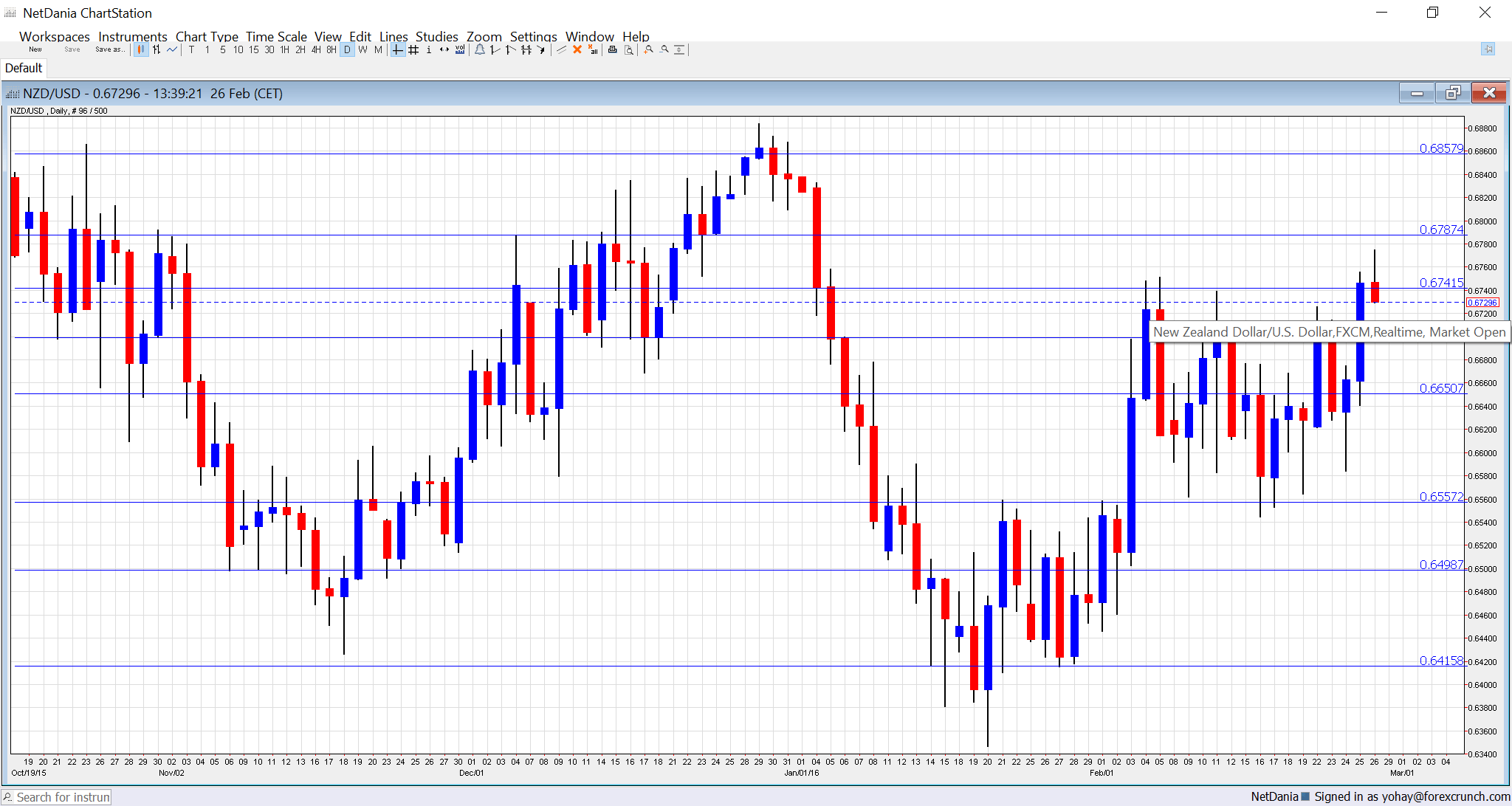

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Building Consents: Sunday, 21:45. The number of building approvals is a good indicator for the state of the housing sector. After a rise of 2.3% last time, we may see a small slide this time.

- ANZ Business Confidence: Monday, 00:00. This important survey has been positive in the past three months, advancing to 23 points in December. After a break in January, the figure for February could be lower.

- Overseas Trade Index: Monday, 21:45. This measure takes into account the exchange rate: it is the current “Terms of Trade”. In Q3, there was a significant deterioration of 3.7%. Another slide could be seen now, but it may be smaller this time.

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade fell 4 times in a row, with a large drop of 2.8% last time. The bi-weekly measure of New Zealand’s most important export, milk, could bounce back up again. It’s important to remember that prices are volatile.

- ANZ Commodity Prices: Thursday, 00:00. The indicator is well behind the GDT one in terms of importance. Nevertheless, another drop after the 2.3% slide seen last month, could hurt.

NZD/USD Technical Analysis

Kiwi/dollar broke above the 0.67 level (mentioned last week).

Technical lines, from top to bottom:

The round level of 0.70 is already in sight. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6860 was a low point as the pair dropped in June 2015.

It is followed by 0.6790 that capped the pair in recent months. The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

Below, we find 0.6415, which cushioned the pair in January, as support. 0.6350 provided support in January 2016.

I am bullish on NZD/USD

Milk prices could give the kiwi another shot in the arm, reminding us that the situation there is not too shabby. A move to the upside depends on a OK market mood of course.

Our latest podcast is titled Time for Regrets? Referendum and Rates version