The New Zealand dollar traded in range during the first week of 2017. Yet again, we have a single event on the calendar. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Milk prices turned south once again, this time dropping by 3.9%. This kept the kiwi under 0.70. In the US, data was mostly positive at first, but things turned sour later on.

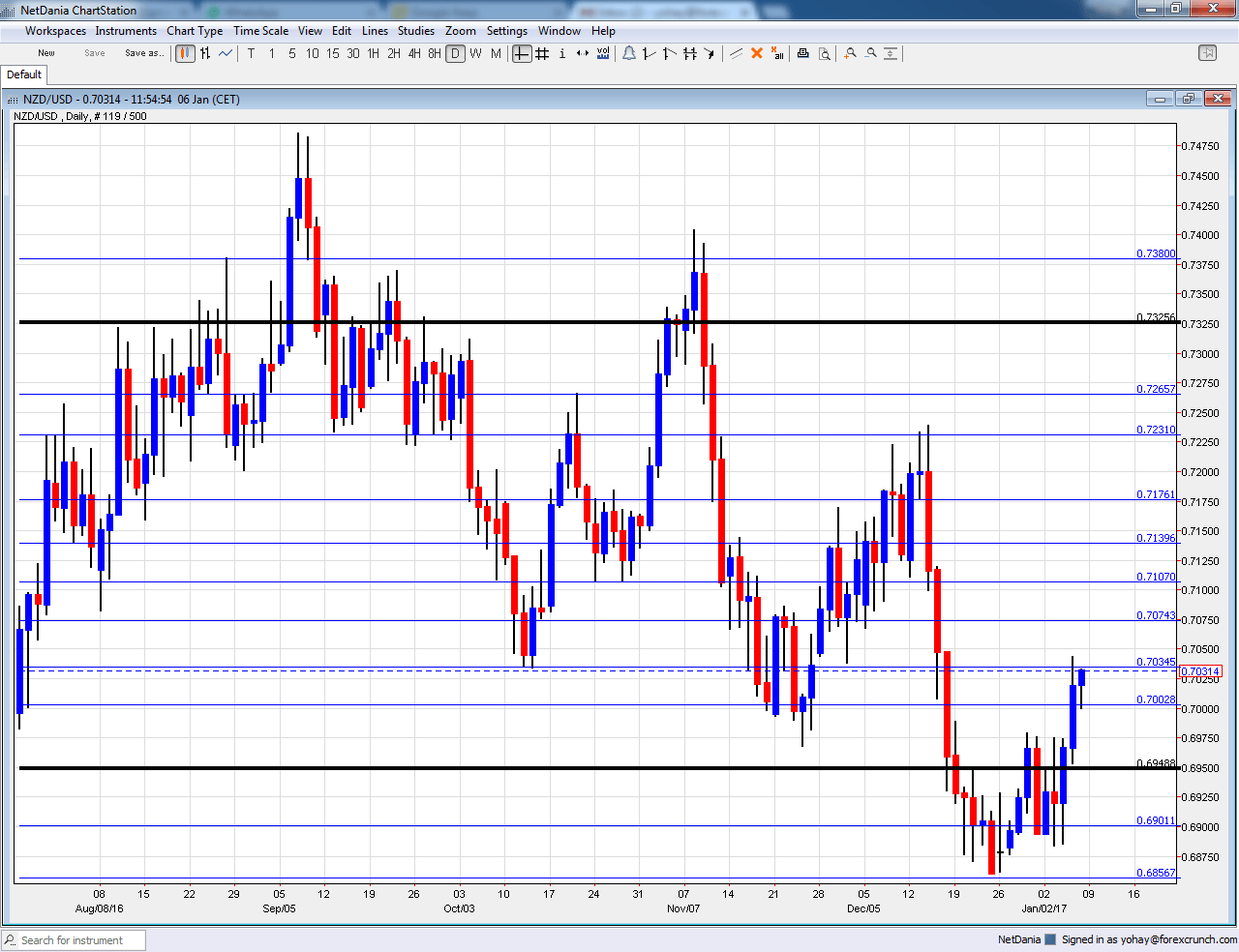

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- ANZ Commodity Prices: Thursday, 00:00. The commercial bank’s measure of commodity prices jumped by 2.7% back in November. A more moderate number is likely now. Note that while New Zealand exports quite a few commodities, dairy products have the upper hand.

NZD/USD Technical Analysis

Kiwi/dollar settled under the 0.70 level in the holiday week, after suffering beforehand from the Fed’s might.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7330 was an initial high in 2016.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterward as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am bearish on NZD/USD

The New Zealand dollar lost the momentum due to the fall in milk prices.

Our latest podcast is titled Is the FED Data or Donald Dependent?

Follow us on Sticher or iTunes

Safe trading!