The New Zealand dollar enjoyed good data coming out of the country but but reversed course on the risk-off sentiment related to Britain’s EU Referendum. The upcoming week features 3 local events and the big Brexit decision. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The UK decided to leave the EU and this has implications also on New Zealand. It triggered a global “risk off” sentiment that hurt the kiwi alongside other currencies. In New Zealand, credit card spending was positive with 5.9% and visitor arrivals stabilized, but the markets are gripped by bigger events.

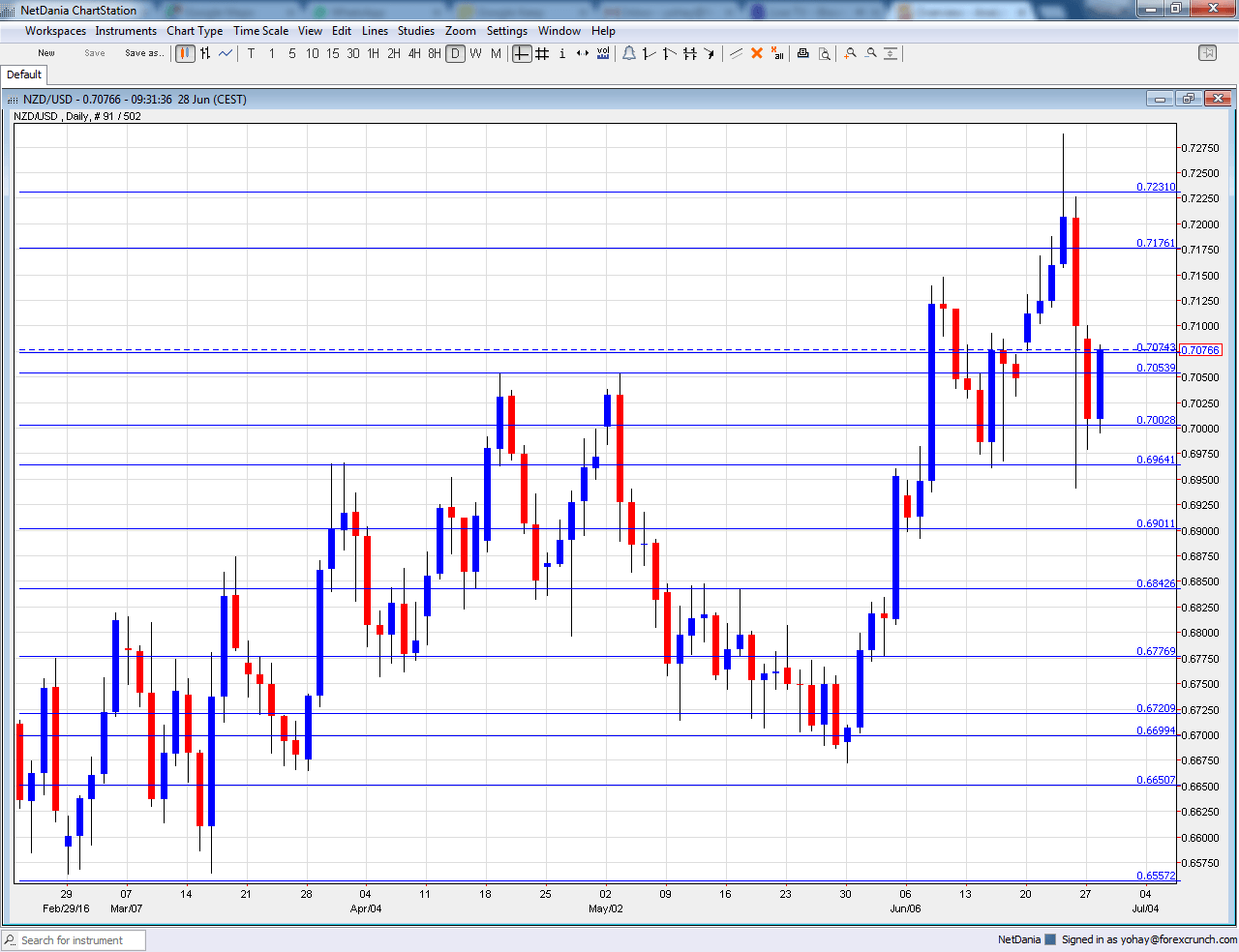

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Trade Balance: Sunday, 22:45. New Zealand enjoyed surprisingly positive trade balance reports of late. After a surplus of 326 million in April, a drop to 185 million was on the cards for May, but the actual result is 358 million, yet another beat.

- Building Consents: Wednesday, 22:45. This volatile figure still serves as an indicator for the housing sector. A jump of 6.8% was seen in April. Will we see a slide now?

- ANZ Business Confidence: Thursday, 1:00. This 1500 strong survey has advanced to 11.3 points in May, the second consecutive rise. A fall could be seen now, assuming Brexit is incorporated into this survey.

NZD/USD Technical Analysis

Kiwi/dollar was initially capped by the 0.7160 line (mentioned last week). It further advanced and reached a high of 0.7290 before totally changing course. and temporarily dipping under 0.70.

Technical lines, from top to bottom:

0.7290 was the pre-Brexit peak and serves as high resistance. The next line is 0.7220.

0.7160 worked as support when the kiwi was trading on much higher ground in 2014. 0.7050 was the high in April 2015.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6840 capped the pair during May 2016 and tops the range. 0.6720 is the low seen in May 2016 more than once providing the lower bound.

The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

I am bearsh on NZD/USD

The impact of Brexit is significant and could lead to rate cuts in New Zealand. This may be more significant than the expected hiatus in Fed hikes.

Our latest podcast is titled Oil, Brexit and the Big Fed Preview