The New Zealand dollar made its way to new highs but stalled at resistance. The bi-weekly dairy auction is the key event Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Inflation in New Zealand is not as terrible as feared: prices rose 0.3% q/q, better than 0.2% that was expected. We also learned that New Zealand’s government enjoyed a surplus, quite a rare feat The kiwi enjoyed the weakness in the US dollar that followed the weak retail sales but then retreated on stronger inflation. With less US events now, the kiwi related data should have a bigger impact.

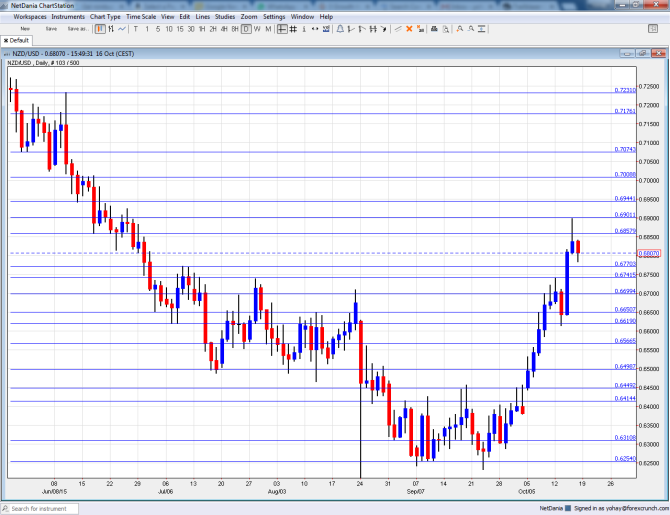

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade, or the price of milk if you wish, is key to the kiwi’s behavior, as the country depends on exports of dairy products. After 10 straight falls, prices rose in the past 4 auctions. The 9.9% seen earlier in the month certainly supported the local currency.

- Visitor Arrivals: Tuesday, 21:45. Tourism also plays an important role in the economy, hence the number of visitors makes a difference for NZD. After a rise of 0.2% in August, another move higher is on the cards for September.

- Credit Card Spending: Wednesday, 2:00. Retail sales are released only once per quarter, making this barometer an important figure. A y/y rise of no less than 10.5% was seen in August, showing the resilience of the consumer. Perhaps a more moderate rise will be seen now.

NZD/USD Technical Analysis

Kiwi/dollar extend its gains above the 0.67 level (mentioned last week). It then climbed all the way to hit 0.69 before sliding.

Live chart of NZD/USD:

[do action=”tradingviews” pair=”NZDUSD” interval=”60″/]Technical lines, from top to bottom:

We start from higher ground this time. 0.7075 is where the pair found support back May. It is naturally followed by the very round level of 0.70.

The low of 0.6940 allowed for a temporary bounce. The round 0.69 level is switched positions to resistance.

0.6860 was a low point as the pair dropped in June 2015. It is followed by the 0.68 level that worked as resistance when the pair was climbing a few years back.

Close by, the July high of 0.6770 serves as resistance. Quite close by, the high of 0.6740 seen in July is another cap.

It is followed by the round level of 0.67 that is a pivotal line in the range. The now previous July low of 0.6650 was a multi-year low and the break below it was not confirmed.

0.6620 is the new 2015 low and for now serves as minor support. The post crisis low of 0.6560 is still of high importance.

Below, the round 0.65 level is of high importance now. The last line is 0.6488, which was the low both in July and in August – a double bottom.

Minor resistance can be found at the October swing high of 0.6440. 6408 works as a pivotal line. Below, 0.6310 provides some support after doing so in early September.

I am neutral on NZD/USD

On one hand, milk prices and the weakness in the US keep the pair bid. On the other hand, we have fear from RBNZ action and also of bad news coming from China. These forces could keep the pair stable for now.

In our latest podcast we analyze Varoufakis’ 4 problems and 4 solutions, and more

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.