The New Zealand dollar managed to top 0.80 but eventually retreated and ended the week lower. The main event is the rate decision by the RBNZ. Will the central bank reaffirm expectations of holding on for longer? Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The initial weakness of the greenback helped the kiw top the 0.80 line, but this didn’t hold. A series of solid US figures, including stable inflation and jobless claims were joined by weak New Zealand data on the other side. Inflation badly disappointed and also the trade deficit topped 1 billion. On this background, we have a lower close for NZD/USD.

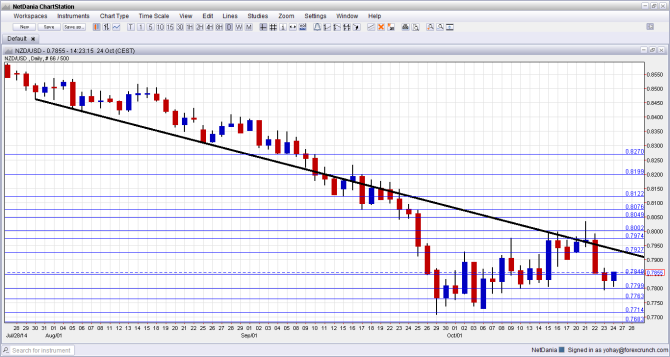

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- ANZ Business Confidence: Wednesday, 00:00. This highly regarded survey of around 1500 businesses always has a significant impact on the NZD. After reaching a multi-decade high in February, the indicator has been on a slippery slope, falling to 13.4 points in September, the lowest since 2012. This time, it could stabilize and not fall into negative territory.

- Rate decision: Wednesday, 20:00. The central bank last raised the rates in July, but has hinted that a long pause is expected now. From 3.50%, no change is expected now. Governor Wheeler and his colleagues are worried about the high exchange rate of NZD and a slowdown in global growth. Some see rates as staying unchanged until March, some see July, and others even think that a rate cut is on the cards. Every word in the statement will be watched very closely.

- Building Consents: Thursday, 21:45. This monthly barometer of the housing sector remained flat in August, after seeing a fall in July. For the month of September, a small rise is likely. Auckland’s housing is not as strong as it used to be.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar started off the week capped under the 0.7975 line (mentioned last week). It then broke higher, topping 0.80. However, it later dropped and found support only at 0.78.

Live chart of NZD/USD:

[do action=”tradingviews” pair=”NZDUSD” interval=”60″/]Technical lines, from top to bottom:

0.8312 was the low point in August 2014 and it also follows the downtrend support line. The next line is 0.8270, which was the low point in September.

Further below, the round levels of 0.82 is certainly worth watching. It is followed by the initial September low of 0.8120.

0.8075 was one of the cycle lows and now works as resistance. Even lower, 0.8050 provided support for the pair back in February and is the last line before the very round figure of 0.80.

0.80 is now key resistance on the upside. Just below, the old resistance line of 0.7975 is coming back to play after capping the pair in October.

0.7930 was a double top in October’s recovery and is important to watch. It is followed by 0.7850.

0.78 is a round number and provided support various times, including recently. Going deeper, 0.7765 worked as support, and is a line to watch on the way down.

0.7715 is stronger support after serving as a cushion for the pair in September 2013. 0.7685 is very strong support and it held the pair back in the summer of 2013.

Below this point, we are back to levels last seen in 2012: 0.7615 is initial support and the critical line is 0.7460.

Downtrend line comes into play

The pair traded above a downtrend support line that accompanied it from July and eventually dropped below this line. However, the recent recovery sent it to tackle the line once again, but couldn’t break above it.

I turn from bullish to bearish on NZD/USD

A pause in rate hikes for a long period of time seems to be priced into the kiwi. However, the RBNZ may certainly react to the stronger kiwi and offer words to push it lower, as it did in the past. In addition, the situation in the US is better than the dollar reflects, and we can get that with the end of QE (removing the doubts), and a strong GDP number for Q3.

More: NZD/USD appears on the list of the 5 most predictable currency pairs.

In our latest podcast, we preview the all important Fed decision, digest China and examine bitcoin against gold:

Subscribe to our podcast on iTunes.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.