The New Zealand dollar dropped to new lows. Yes, once again. Can the bleeding stop now? Trade balance is the main event. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Yet another week of dollar dominance hit the kiwi. The FOMC main some minor hawkish tweaks and that was enough to send NZD down, despite better than expected GDP growth. Can the better outcome eventually help the kiwi? Perhaps the elections will: the National party increased its hold in parliament and the markets certainly like this continuity.

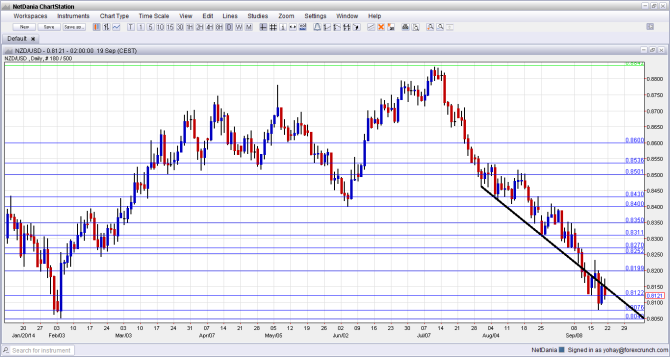

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Westpac Consumer Sentiment: Sunday, 22:00. This quarterly survey of 1500 consumers has shown strong optimism in Q1, with 121.2 points. A small slide is expected for Q2, as the economy did not grow as fast as in Q1.

- Trade Balance:.Tuesday, 22:45. New Zealand’s trade balance for July disappointed with a turn to a larger than expected deficit of 692 million NZD. A much bigger deficit is expected now: 1.125 billion. The low expectations mean that a smaller deficit could benefit the kiwi.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar started the week with a small gap, that was quickly closed. However, once the pair lost the 0.8312 line (mentioned last week), it struggled to recover.

Live chart of NZD/USD:

[do action=”tradingviews” pair=”NZDUSD” interval=”60″/]Technical lines, from top to bottom:

We start from lower ground once again. The round number of 0.84 was a swing low in June and also capped the pair in August. It is followed by 0.8350, which was the low recorded during August.

0.8312 was the low point in August 2014 and it also follows the downtrend support line. The next line is 0.8270, which was the low point in September.

Further below, the round levels of 0.82 is certainly worth watching. It is followed by the initial September low of 0.8120.

0.8075 is the new cycle low and works as weak support. Even lower, 0.8050 provided support for the pair back in February and is the last line before the very round figure of 0.80.

Even lower, the round number of 0.79 provides support further down the line. It is followed by 0.7850.

Downtrend support fought over

As the black line shows, the pair is trading alongside downtrend support since the end of July. This line worked perfectly well and allowed the pair to bounce back. It was later broken and now somewhat shattered.

I am bullish on NZD/USD

The stronger than expected GDP growth and the favorable election results, could allow the kiwi to recover, at least for one week, until the dollar storm returns.

In our latest episode, we talk about the risk/reward ratio, the FOMC decision and what it means for the dollar and Chinese wobbles:

Subscribe to our podcast on iTunes.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.