The New Zealand dollar was well prepared for the Fed decision: recent data was positive and so were flows of money into real estate in the small country. When the FOMC announced the NO taper surprise, the New Zealand dollar jumped higher and didn’t really look back.

NZD/USD is over 600 pips above the lows seen early in month. Is it time for consolidation? Or can the year to date high of 0.8676 be challenged soon? Update.

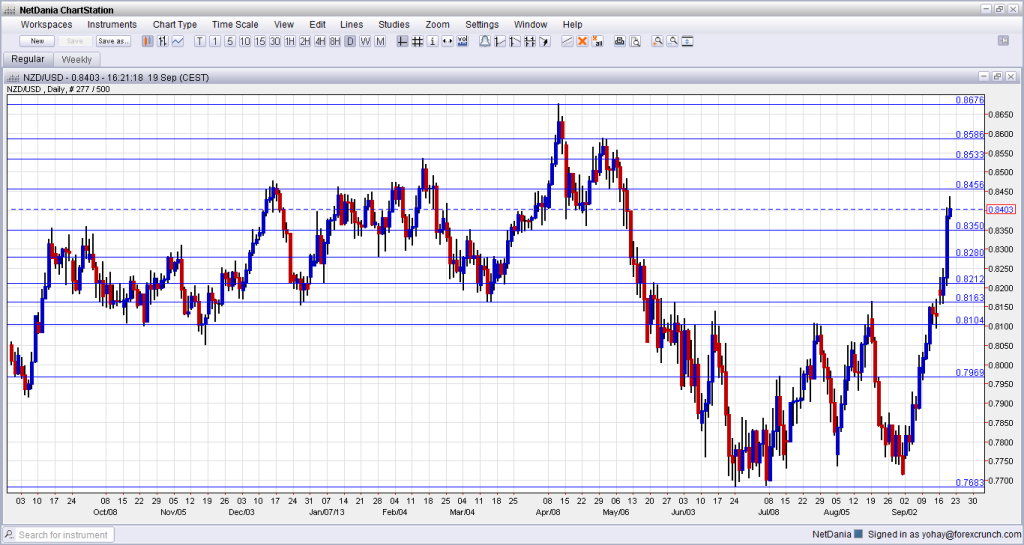

[do action=”autoupdate” tag=”NZDUSDUpdate”/]The daily chart of NZD/USD looks a bit one sided at the moment:

Taper boost to an already strong NZD

The New Zealand dollar is a “risk currency”: when investors seek a higher yield, the kiwi is one of the options. While the interest rate is relatively low in historic terms for New Zealand, only 2.5%, this is higher than the near zero levels in many developed countries. And, the money doesn’t necessarily go into government bonds, but to real estate.

A high level of QE in the US means more dollars printed looking for investments, and Auckland’s homes seem to be a good option for quite a few investors. The RBNZ, New Zealand’s central bank, tries to talk down the value of the kiwi at every opportunity, but this doesn’t always work. Macro prudential tools are considered to tackle the housing market.

In addition to QE tapering, the kiwi received a relatively positive GDP report: while the economy grew by only 0.2% in Q2, as expected, the YoY growth rate exceeded expectations with a rise of 2.5%. This was thanks to an upwards revision of Q1 growth from 0.3% to 0.4%.

All this led the kiwi to stronger levels.

NZD/USD technicals

The pair already broke above strong resistance of 0.8163 before the FOMC decision and managed to break above 0.812, which was only a minor line.

After the shock, it croseed 0.8280 and also 0.8350, which was a strong line of support in March and April. The pair reached a high of 0.8435 before retreating.

So now, important resistance awaits at 0.8450, which capped the pair around the turn of the year. Further resistance appears at 0.8533, a peak in February.

The highs of April: 0.8580 work as the last line of support before the peak of 0.8676. Can the kiwi make it?

Upcoming Events

Events are in New Zealand. All times are GMT

- September 24th, 22:45: Trade Balance

- 26th, 1:00: ANZ Business Confidence

- 29th, 21:45: Building Consents.

- October 2nd, 00:00 ANZ Commodity Prices

- 7th, 21:00: NZIER Business Confidence

- 9th, 21:00: Business NZ Manufacturing Index

- 10th, 21:45 Food Price Index

- 15th, 21:45 Quarterly CPI

- 18th, 2:00: Credit Card Spending

- 20th, 21:45 Visitor Arrivals

- 25th, 00:00: ANZ Business Confidence

- 28th, 21:45: Trade Balance

- 30th, 20:00: Rate decision, with accompanying statement.

* Note to readers: due to more and more requests, I will try to update the NZD/USD outlook section. However, the frequency may not be a weekly one. Thanks.

Further reading: Further kiwi strength