Idea of the Day

The kiwi is firmer overnight after the latest interest rate decision. The cash rate was held steady at 2.50%, with the RBNZ again hinting at rate hikes to come next year. The kiwi jumped around 0,6% in the early part of the Asia session, with AUDNZD the biggest movers as the Aussie weakened on the latest jobs data. AUDNZD had been on a near one way street April to July, with more corrective activity seen August and September, but the 1.12 low seen early August is again in focus after the overnight move below the 1.14 level. But as we mentioned yesterday, the bearish arguments for the Aussie are looking a lot weaker at present, so a sustained move below 1.12 could be hard to come by in the coming 1-2 months.

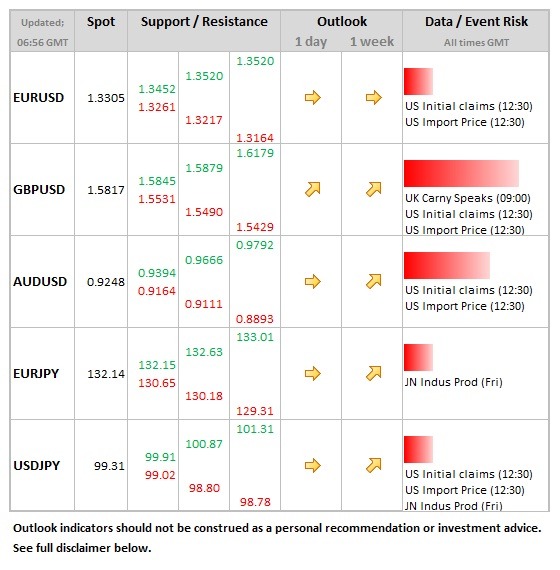

Data/Event Risks

USD: There has been a continued underlying improvement to the claims data in recent weeks, with last week’s reading of 323k, not seen to be bettered as 330k expected. Further fall though would be supportive for the dollar in re-establishing tapering expectations for next week.

GBP: The Bank of England governor appears before the parliamentary select committee today, so we could see some comments on the economy potentially impacting sterling.

Latest FX News

JPY: The yen strengthened during the Asia session, with data showing Japanese again net sellers of overseas bonds for the fourth consecutive week. USDJPY is back below the 100 level for the time being, with underlying impetus for a renewed period of yen weakness not that strong.

AUD: The jobs data fell to the disappointing side, employment falling 10.8k, the second consecutive monthly decline. As expected, the rate nudged up to 5.8%. After the push above 0.93, the Aussie has looked a little more tired on the data, back down to the 0.9250 area.

GBP: The surprise fall in the unemployment rate gave a decent lift to sterling during Wednesday, pushing cable above the mid-June high and above the 1.58 level, last seen in mid-February. The good news continues to push sterling ahead, in defiance from the Bank’s message that rates aren’t set to rise for up to 3 years, which this latest data has undermined in a more forceful way.

Further reading: