Technical Bias: Slightly Bullish

Key Takeaways

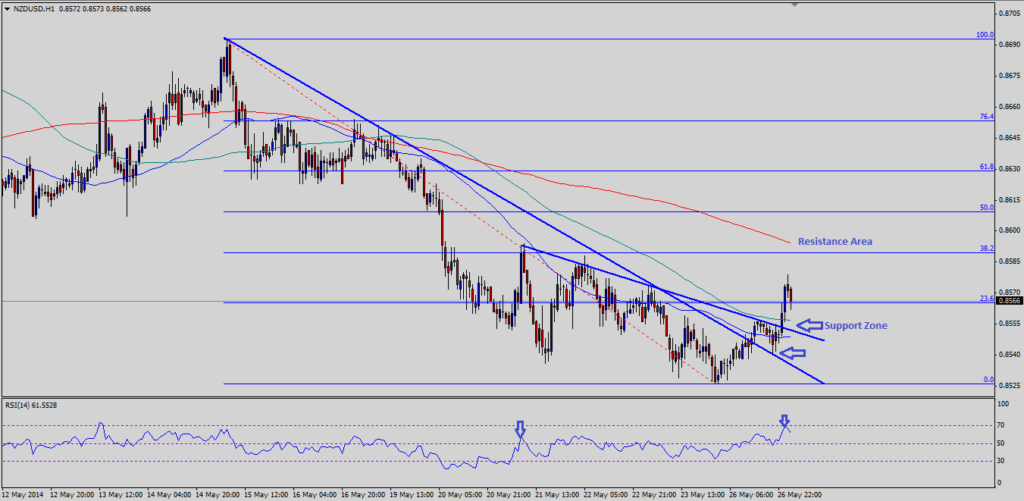

“¢ New Zealand dollar breaks higher against the US dollar.

“¢ NZDUSD pair breaches two important bearish trend lines to trade higher.

“¢ NZDUSD support seen at 0.8550 and resistance ahead at 0.8590.

New Zealand dollar buyers were seen aggressive earlier during the Asian session against the US dollar, as they managed to break two bearish trend lines which might now act as a support moving ahead.

Technical Analysis

The NZDUSD pair is trading a little higher intraday, and has managed to climb above few significant short-term resistance levels. The pair has breached two important descending trend lines, which were holding the upside in the pair. One of these after the break acted as a support. The broken resistance zone around the 0.8550 might act as a support in the short term. It is crucial to note that the 50 and 100 hourly simple moving averages are also sitting around the same level. So, if the pair drops from the current levels, then it might find buyers around the mentioned support zone. Any further losses might take it back towards the recent low of 0.8526.

There is a probability that the pair might bounce in the short term, which might lead it towards the next resistance zone around the 38.2% Fibonacci retracement level of the last major drop from the 0.8693 high to 0.8526 low at 0.8590. Moreover, the 200 hourly SMA is also sitting just above the mentioned fib level. So, the pair could face hurdles around the 0.8590-0.8600 resistance zone.

Moving Ahead

There is a key RSI divergence noted on the hourly timeframe, which might result in a pullback. However, it would be interesting to see whether the pair can manage to hold the 0.8550 support area or not for another leg higher.