The New Zealand dollar continued its regular trading. Inflation data is the major event this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Last week New Zealand manufacturers became more pessimistic in the second quarter amid sluggish growth. Companies believe growth would return but reality does not match expectations. New Zealand’s economy grew at a pace of 1.1% in the first quarter, the fastest quarterly pace in five years, amid a boost in dairy manufacturing and the rebound in Canterbury after the earthquakes. Will NZ economy live up to expectations?

Updates: New Zealand CPI, a key indicator, is expected to remain unchanged, at 0.5%. The kiwi has edged downwards to start the trading week, as NZD/USD was trading at 0.7948. The kiwi was down following the news that the US Federal Reserve was refraining from taking any monetary steps to help the US economy. NZD/USD was trading at 0.7936. NZD took advantage of a weakening US dollar, and pushed above the 80 line. NZD/USD was trading at 0.8048. Visitor Arrivals will be released later on Thursday. The market estimate stands at -0.1%.

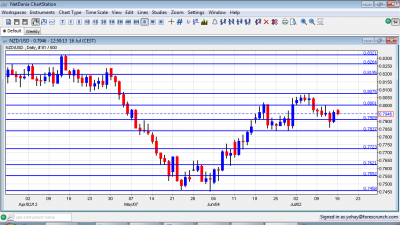

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Inflation data: Monday, 22:45. Consumer price index improved in the first quarter, rising 0.5% compared to a 0.3% decline in the fourth quarter of 2011. Economists anticipated a bigger rise of 0.6%. On yearly basis, CPI reached 1.6% in line with analysts’ expectations, following 1.8% a year earlier.

- Visitor Arrivals: Thursday, 22:45. international visitor arrivals declined 0.1% on a monthly base in May following 0.9% gain in April however on a yearly base the number of visitors increased by 0.4% in May compared to a year ago with 2.6 million arrivals to New Zealand for the year ending May 2012.

- Credit Card Spending: Friday, 3:00. Credit card spending rose by 4.0% on a yearly base to 3.9% in May following 3.7% in April. The increase in spending went in line with GDP growth figure.

* All times are GMT.

NZD/USD Technical Analysis

Technical lines, from top to bottom:

0.84 was resistance back in February 2012. 0.8320 was a wing high in April, just before the big dive.

0.8260 capped the pair during March, and is stubborn resistance. 0.8185 was resistance in the past and is now weaker.

0.8075 was the peak in July 2012 and replaces other lines in this region. This is the highest in 3 months. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance.

Another round number, 0.79, is key resistance, after being a very distinct line separating ranges. It proved its strength also in June 2012. 0.7840 provided support for the pair several times during June 2012 and also worked as resistance back at the end of 2011.

0.7723 supported the pair back at the beginning of 2012 and also worked in the other direction in June 2012. 0.77 provided support in December and now switches to support.

0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks. 0.7550 is resistance once again, even after the breakdown. It was a very distinct line separating ranges and had a similar role back in January.

Below, 0.7460 is significant support after working as support at the end of 2011 and also in May and June 2012. This is key support. 0.7370, which was the trough in December is low support. This is a significant line if 0.7460 breaks.

I remain bearish on NZD/USD

While the New Zealand’s economy remains strong, worries from China now take over the scene. The kiwi will find it hard to remain at these levels without any back wind, either from QE3 (which seems absent) or any Chinese boost.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss Franc, see the USD/CHF forecast.