Idea of the Day

The dollar took something of a beating yesterday in the wake of the debt deal. We wrote more about the reasons in our blog (see “Bad dollar deal”). Whilst there has been talk of relative policy differentials still providing support for the dollar (Fed eventually tapering, Eurozone potentially easing), this story failed to pan out in the third quarter, when the dynamics were supposedly stronger. For now, it will be a case of catching up with a backlog of data on the US economy. Estimates vary, but growth will have taken a hit in the current quarter and the on-going uncertainties regarding both the budget and debt ceiling, spending and investment delayed in the current quarter may yet not come either later this year or early next.

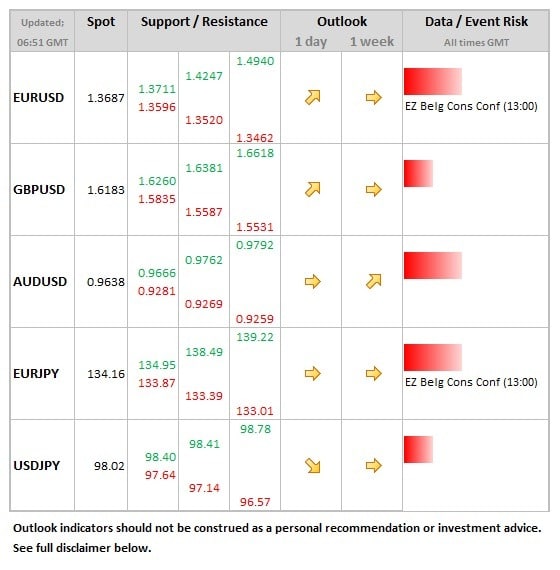

Data/Event Risks

CAD: Headline inflation has averaged 0.9% so far this year in Canada. Expectations are for prices to move lower to 1.0% (from 1.1%). The CAD has naturally strengthened against the US dollar for the past two days, but the hit to the US economy from the shutdown will have a small knock-on effect for Canadian growth going forward.

Latest FX News

USD: Dollar taking a beating, seeing the biggest down move since the Fed’s no-tapering decision mid-September and biggest move against the Swissie. Hard to call this a ‘risk-on’ move.

AUD: The beating given to the US dollar yesterday allowed the Aussie to push further higher and against most other currencies, with AUD holding above the 0.96 level in Asia trade.

CNY: The slew of data releases from China causing some relief in the market. GDP was 7.8% on the annual measure, rising 2.2% on the quarterly measure. Along with retail sales and industrial production data, which rose 10.2% and 13.3% respectively. CNY and CNH have been appreciating in the past 5 sessions.

Further reading:

Philly Fed Index drops to 19.8 points – it could be worse

Risk sentiment boosted by Boehner’s “unconditional surrender”