EUR/USD dropped quite a bit on Brexit but showed some strength as well. It could further fall, say the people at BNP Paribas:

Here is their view, courtesy of eFXnews:

The still-elevated level of GBP volatility renders downside GBP structures very expensive after last Thursday’s UK referendum. Financial markets appear to view the UK’s vote to exit the EU as creating political stress within the eurozone. Positioning in the EUR has deviated from exposure to the JPY (+43) and CHF (+17) but is only moderately short at -16 compared to -45 for the GBP. Uncertainty and financial market stress are likely to remain high. In this environment, the EUR short exposure may catch up with the GBP’s short exposure.

We favour positioning for a grind downwards in EURUSD, rather than a sharp move, as we see two key factors preventing a sharp decline in the EUR:

1. European Central Bank policy (asset purchase programme) will limit the widening of peripheral spreads through its purchases. Hence borrowing costs should not return to levels which would compromise fiscal sustainability. Peripheral spreads (Spain and Italy) versus Germany did initially widen by around 30bp but have since narrowed back.

2. The EUR should draw support from its circa 3% of GDP current account surplus, which has expanded considerably since 2012. Furthermore, to the extent that global investor confidence is currently at a low level, eurozone investor outflows (recycling of the current account surplus) through portfolio outflows may slow.

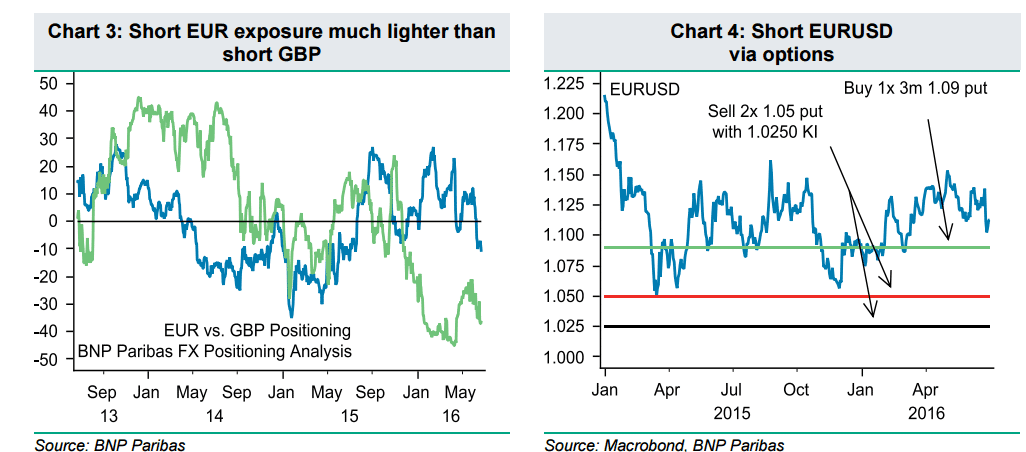

Finally, we note that BNP Paribas FX Positioning Analysis signals that short EUR exposure is much lighter than short GBP positioning (Chart 3). Short EUR positioning stands at -16 (on a scale of +/- 50), while short GBP positioning has reached -45. Therefore, there is considerable scope for investors to add to short EUR positions to position for further European stress.

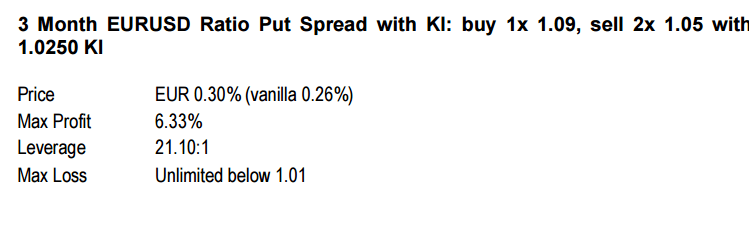

We favour the following trade recommendation which positions for a grind downwards in EURUSD but does not reach new lows below the 1.0524 of December 2015.

Adding a knock-in at 1.0250 is cheap as risk-reversals strongly favour EUR puts. The structure is flat vega at inception and has 6bp of positive rolldown over the first month. We would hedge the structure if the knock-in is activated.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.