The single currency was feeling a little heavy yesterday, helped by the weaker manufacturing PMI data from Spain. That said, with the ECB meeting on Thursday and following on from the gains seen last month, especially vs. the yen, the euro feels vulnerable to some further profit-taking into Thursday.

Fresh policy measures by the ECB look unlikely, with the bigger danger being hints of further measures to come in the early part of next year. There has been more talk of the ECB undertaking quantitative easing from some quarters, but this would not be without risks and also likely political opposition, not least from Germany. Beyond Thursday, the broader picture for the euro remains modestly positive for reasons we have outlined before.

Latest FX News

EUR: Some of the weaker regional PMI data took the shine from the single currency yesterday, but this was from some fairly lofty levels after the strong gains seen during November and with the ECB meeting Thursday, the market appears reluctant to push the single currency to new highs.

GBP: The stronger manufacturing PMI giving sterling an early boost yesterday, but the gains on cable were unwound by the close of the European session on the back of the stronger dollar. That said, the data has given sterling renewed vigour and further push to 1.64 on cable being eyed once again.

AUD: Rates unchanged after the latest RBA meeting, with the central bank still describing the Aussie as “uncomfortably high”. This is hardly new news, as they say, so the Aussie itself holding a tight range of 0.9057 to 0.9131 during the Asia session.

Data/Event Risks

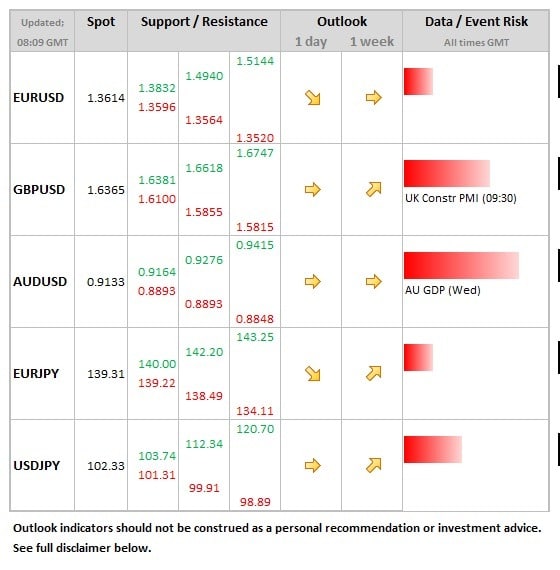

GBP: Sterling will place a close eye on the construction PMI data today after the stronger manufacturing data seen on Monday. The expectation is for a small pull-back to 59.0 (from 59.4). A firmer number could allow sterling push above the 1.64 level on cable on a more sustained basis.

Update: the actual number came out at 62.6, well above expectations.

Further reading: AUD/USD: Trading the Australian GDP