Hillary Clinton and Donald Trump clashed in the last presidential debate, in an ugly manner that only competes with the previous debates. The mud-fest included a refusal by Trump to accept the election results and other interesting tidbits for analysts.

However, there is no immediate impact on key currencies:

Update: Trump loses the debate – path open for Clinton – some currency reaction

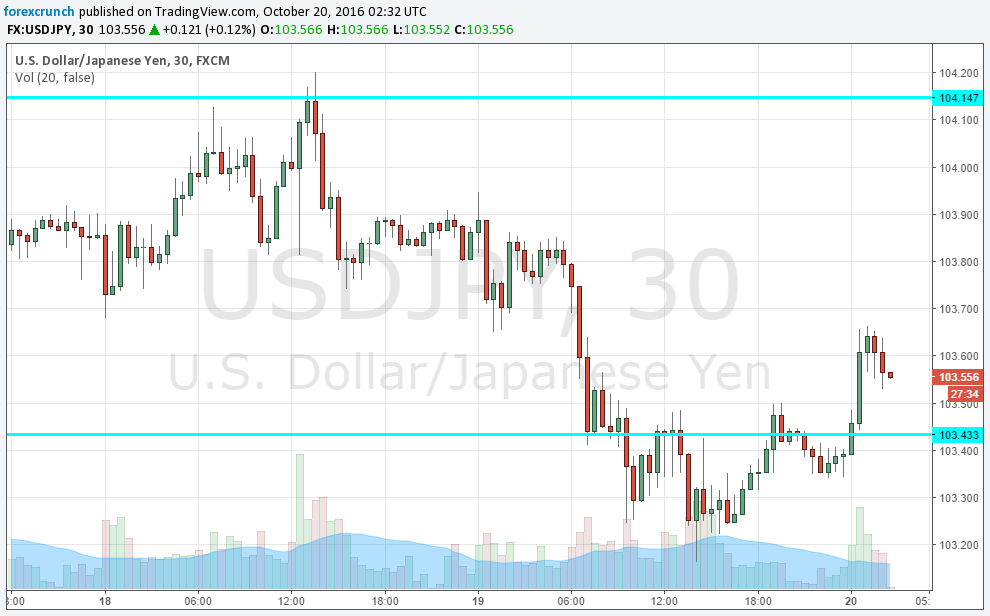

USD/JPY is sensitive to risk events: a Trump victory should have pushed the pair down as the yen attracts safe haven flows. This hasn’t happened.

The same dearth of action is seen in the Mexican Peso. The currency and the economy of the southern neighbor of the US could suffer from a Trump presidency, but USD/MXN is not moving up.

Also, other currencies such as the Canadian dollar (also a member of the NAFTA trade agreement) or the Russian ruble (rising on a Trump presidency) remain unchanged.

These are relatively thin hours of trade, during the Asian session, so we might see a response later on. In addition, the full debate analysis is yet to come. The opinion about who won the debate is not only determined in real-time but also by what pundits determine later on.

However, if this was Trump’s last chance to make a dent, he seems to be failing. Trump entered the debate in a losing position, even already looking for the exits. A victory in the debate would just be one step on the road to a comeback in the little time that’s left. And it looks that hasn’t made it, at least according to the initial market reaction.