Donald Trump was down in the polls ahead of the third and last presidential debate. A victory in this closely watched event could serve as the beginning of a comeback path. The debate was quite ugly, but as the dust settles, Trump’s mistakes stand out and post-debate polls point to a loss for Trump.

Polls show either 49% or 52% seeing Clinton as the winner and only 39% for Trump. The most quoted tidbit was “I will keep you in suspense” regarding accepting the election results. This is a big shift from longstanding American tradition. In addition, his comment on Clinton “very nasty woman”, will probably not bode well with reaching out to undecided women.

Markets usually prefer Republican candidates, seen as pro-market, pro-business. But, Trump is no normal candidate: ramping up nationalistic and anti-trade rhetoric scares many. On the other hand, Clinton is seen as a mainstream candidate that will maintain the status quo. Markets love certainty and it seems that Clinton is more certain to win now.

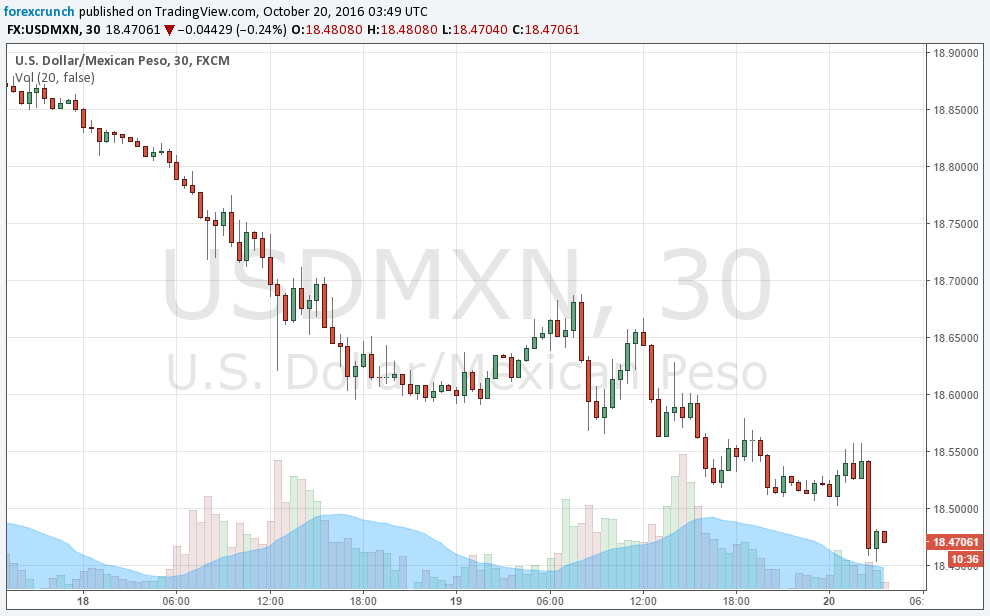

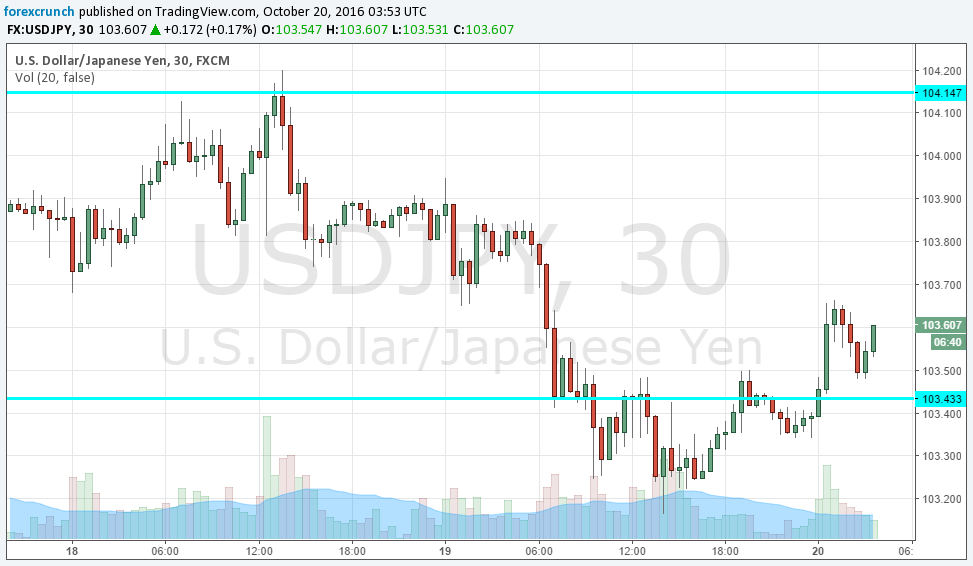

Key currencies did not move too much during the debate, but after the event, the Mexican peso is on the rise and the yen is not gaining: this shows less fear from Trump and less risk-aversion.

More: Clinton Continuation vs. Donald Disruption – what the race means for currencies.

USD/MXN chart: note the drop in the pair which reflects a stronger Mexican peso. A Trump presidency could weigh on trade and hurt the Mexican economy.

And here is USD/JPY: there is no big reaction, showing that the current path of a Clinton victory remains intact: