After the Canadian elections impacted CAD, we now have a more important event: the decision by the Bank of Canada.

Here is a preview by Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

The Bank of Canada (BoC) will likely hold rates at the October meeting on Wednesday, projects Bank of America Merrill Lynch.

“Our expectation for the BoC to keep rates at 50bp in the near term is largely reflected in market pricing with only 2bp of cuts priced into Wednesday’s meeting, likely leaving CAD little changed.

However, in contrast with market expectations, we still see the BoC cutting rates again next year, which alongside commencement of Fed hikes will continue to put upward pressure on USD/CAD. A relatively balanced statement tone likely means the meeting will be a non-event.

But, risks here could be on the dovish side for CAD as a result, should the statement and/or press conference show increasing concern about US/global growth and its impact on the BoC’s assumption for export- and business-investment-led growth,” BofA argues.

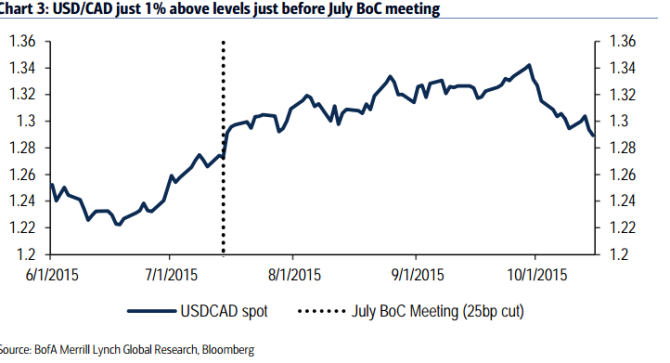

“Importantly, USD/CAD is now below levels prevailing just after the July rate cut. As we have argued, the move is fundamentally justified as short-term rate differentials have moved in CAD’s favor in recent months while oil prices rose.

However, given the importance of the currency in the transmission of policy, the risk for some commentary (even if indirect) on the currency could challenge current-market pricing and the C$’s recent rally.

We still see the pair range bound to modestly higher into year-end unless a clearer pickup in US data increases clarity for Fed hikes this year before ultimately rising to 1.35 by end-1Q ‘1,” BofA adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.