Although Bitcoin is the best performing mainstream asset of 2020, beating out gold, stock indices, oil trading, and anything else, Ethereum has outperformed the leading cryptocurrency by market cap by a large margin.

Ethereum rallied from $130 to $490 in 2020 alone and remains up well over 180% year-to-date. Bitcoin, on the other hand, has just 60% ROI to show for the year. Ethereum’s added success was fueled by the momentum surrounding decentralized finance. Ethereum benefitted substantially as ETH gas fees soared due to DeFi tokens utilizing the ERC20 smart contract standard.

But DeFi has finally begun to cool off, and Bitcoin has already started to overtake Ethereum’s fundamental growth. Strong fundamentals in Bitcoin could soon cause the top cryptocurrency to “catch up” to Ethereum throughout the end of 2020, according to PrimeXBT analyst Kim Chua.

Ethereum And The DeFi Token Summer Of Love Leaves BTC Behind

DeFi, and the sudden emergence of dozens of new tokens designed to enable permissionless lending and borrowing, yield farming, and a slew of new crypto buzzwords, has lifted the crypto market out of the bear market and back into the spotlight. Crypto assets have been the best performing asset class of 2020, during a time when inflation is running wild, and stimulus money is abundant.

Most top DeFi tokens were built on top of Ethereum, causing demand to rise to pay for surging ETH gas fees as the network became congested. It helped keep Ethereum pumped far more than Bitcoin, setting a higher high that Bitcoin has yet to do.

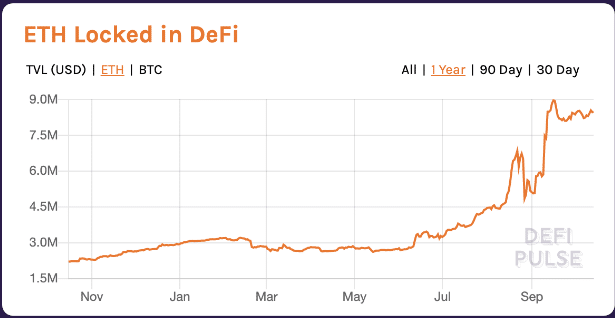

Ethereum’s rise almost perfectly mimics the total value locked in DeFi chart, which demonstrates an apparent parabolic surge. However, this rise may have peaked, as top DeFi tokens have begun dropping by as much as 60% or more across the board.

The DeFi summer of love may have ended when the season turned to fall, and prices followed.

Bitcoin Technicals and Fundamentals Point To Strong Outperformance In Q4 2020

With DeFi finally cooling off a bit, the ETH/BTC trading pair is also targeting a retest of former resistance turned support, which also coincides with the bottom of a broadening wedge trendline, and what would form the right shoulder on a massive inverse head and shoulders pattern.

The fall toward the bottom of the right shoulder and retest of support would also point to Bitcoin outperforming Ethereum until that support level is retested and it holds. Completing the inverse head and shoulders would let Ethereum regain the upper-hand, but not until well into 2021.

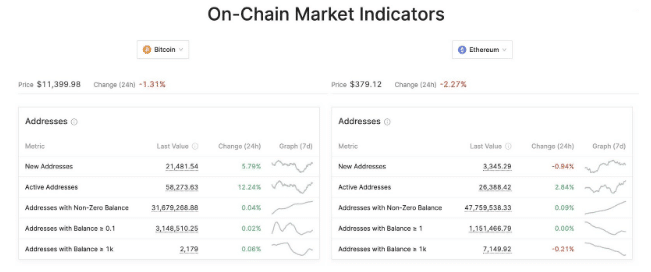

Part of the reason Chua expects Bitcoin to “catch up” to Ethereum during the end of the year is due to “problems in the DeFi space,” along with “weaker on-chain metrics” in Ethereum compared to Bitcoin as the reasons for the convergence.

Chua says that daily new and active BTC addresses have increased, while ETH addresses have fallen recently. The DeFi mini-bubble deflating has caused sentiment to sink. Meanwhile, Bitcoin is more bullish than ever before, thanks to several corporate purchases of thousands of BTC – a considerable blow to the limited BTC supply.

PrimeXBT Analyst: Bitcoin To Catch Up To DeFi Driven Ethereum Gains Into New Year

“Although Ethereum had a higher return gain over Bitcoin so far in 2020, we expect the ratio to reverse and BTC to catch up in percentage gain relative to ETH,” PrimeXBT analyst Kim Chua explains.

“Problems in the DeFi space have led to weaker ETH on-chain metrics as suggested by falling daily new and active addresses, while that of BTC has increased,” she continued.

PrimeXBT, an award-winning Bitcoin-based trading platform offering forex, crypto, commodities, stock indices, and more, also lets traders take advantage of the ebb and flow in the ETH/BTC ratio through crypto margin trading pairs. Other trading pairs include XRP/BTC, EOS/BTC, and LTC/BTC.