The Reserve Bank of Australia went for a rate cut, taking the dovish path. Markets were undecided towards the event, with no specific decision priced in.

When the news that Glenn Stevens and co. decided to opt for an even lower interest rate, passed immediately by some banks to their customers, the Australian dollar also received the pass and dropped all the way to 0.7555.

RBA slashes rates

The RBA continued complaining about the exchange rate in the statement. This may well have been the main reason for the cut, although they cite lower inflation. Indeed, the disappointing inflation read seen last week triggered higher expectations for a rate cut.

Regarding China, the actions taken by the authorities in Beijing are seen in a positive light. But while it does support near term growth outlook, they still see uncertainty about the global economy in general and mention policy settings.

And what about the housing market? In theory, rising prices of dwellings were supposed to prevent the RBA from acting. Well, they just say that they have taken a “careful note” of this.

And what’s next? Some commercial banks expect further cuts in the next few months with some setting long term targets at 1.25%.

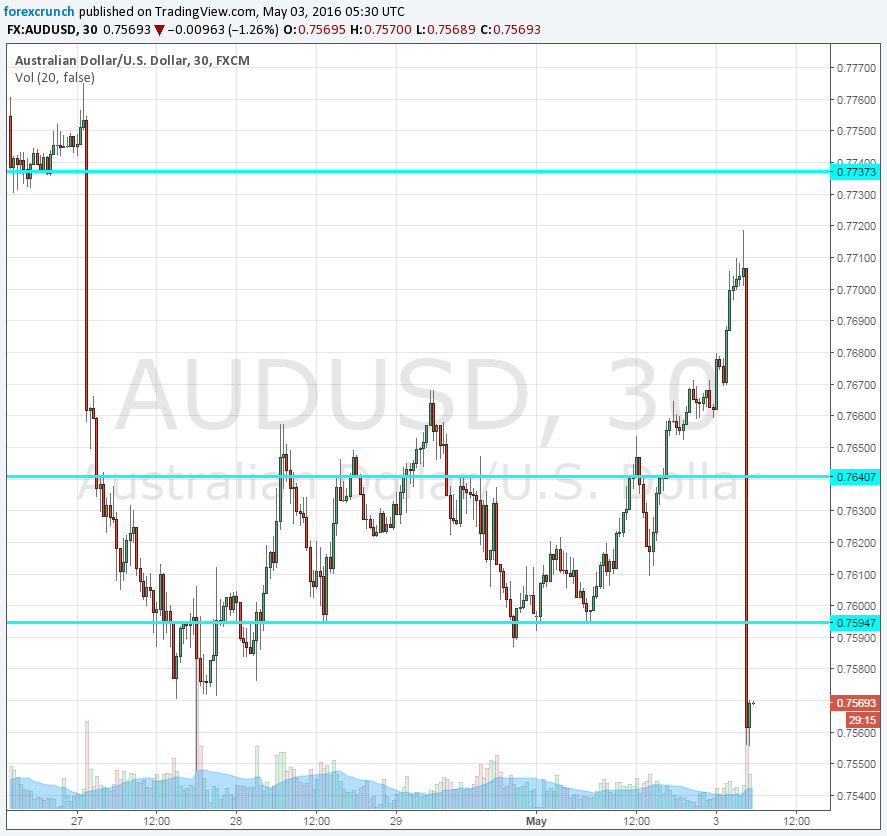

RBA hits AUD/USD

AUD/USD actually advanced towards the release, reaching a high of 0.7720 before getting hit hard by the RBA and dropping over 150 pips.

Support awaits at 0.7533 followed by 0.7480. Resistance at these levels is at 0.76, followed by 0.7640.

Here is how it looks on the chart: