Will they or won’t they? The Reserve Bank of Australia convenes amid higher expectations for a rate cut. But perhaps this is not the case? Here is an outlook from Citi:

Here is their view, courtesy of eFXnews:

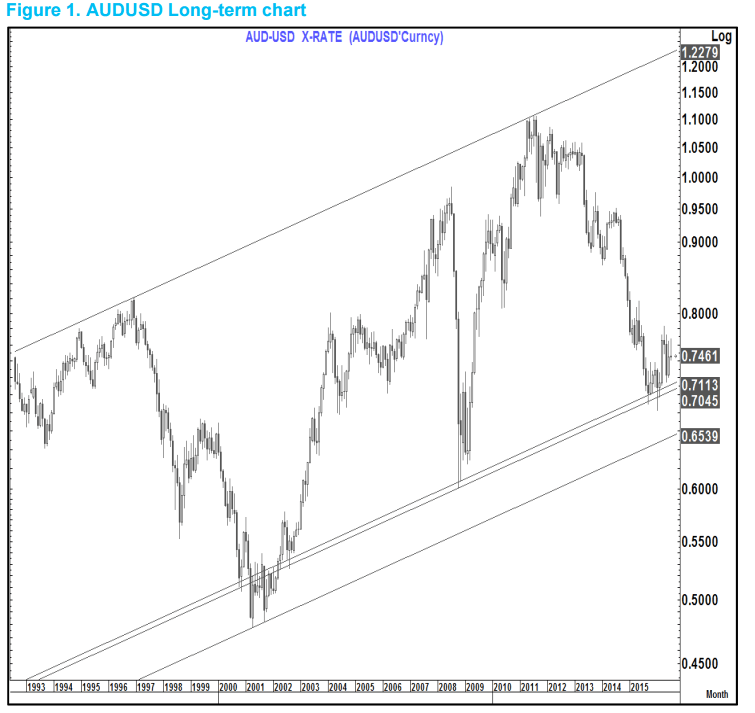

1.50% is greater than zero and 0.75 is less than 1.10. These two certainties form the backbone of our AUD-positive view and are among the reasons why we anticipate that the currency will appreciate well above 0.80 vs. the USD.

In an environment in which ever easier G4 policy is boosting asset prices and driving investors to seek yield, AUD presents an attractive mix of low political risk, high credit standing and significantly positive yield. Indeed, Australia may represent the best mix of these attributes of any of its peers. Given that valuation for AUD remains far more attractive than was the case in previous years when the currency approached highs near 1.10, we expect the currency to attract heavier inflows as longer-term investors begin to respond to recent market and policy developments.

A marginal decline in interest rates or moderate AUD appreciation is unlikely to change this merits and valuation based calculus. Thus domestic threats to AUD, such as cutting rates from 1.75% to 1.50%, are second tier.

…The tactical conclusion is that those looking for the RBA and underlying developments to rein in AUD’s performance may be disappointed amid the broader AUD-positive macro backdrop. We are not among those looking for the RBA to ease at its policy meeting this week, with the recent positive surprise on Australian CPI creating additional breathing room for the RBA to be patient. However, even if the RBA surprises us and fulfills market expectations on a possible move, it is not clear that this would represent a significant blow to AUD. Interest rates will still be higher than those elsewhere and much of the rest of the reasoning for AUD buying would be unchanged. Indeed, many investors who have been slow to participate in recent moves might simply view any dip in AUD as providing a more attractive entry point on valuation grounds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.