The Reserve Bank of Australia came back from the summer holiday in the land down under and left the interest rate unchanged at 2%, as widely expected. While the recent market turmoil and worries about China may have added some easing bias, domestic indicators including the inflation mandate looked quite healthy.

So what was in the statement? The team led by Glenn Stevens still has some kind of easing bias: an open door to act, but they don’t seem to be in a rush. The strength of the Australian economy, with not only CPI but also employment looking strong, it is hard to see why they will need to take some tools out of the shed.

And what about the Aussie? They are watching, but not eating their fingernails. The RBA sees the exchange rate as adjusting to the evolving economic outlook. They like its range.

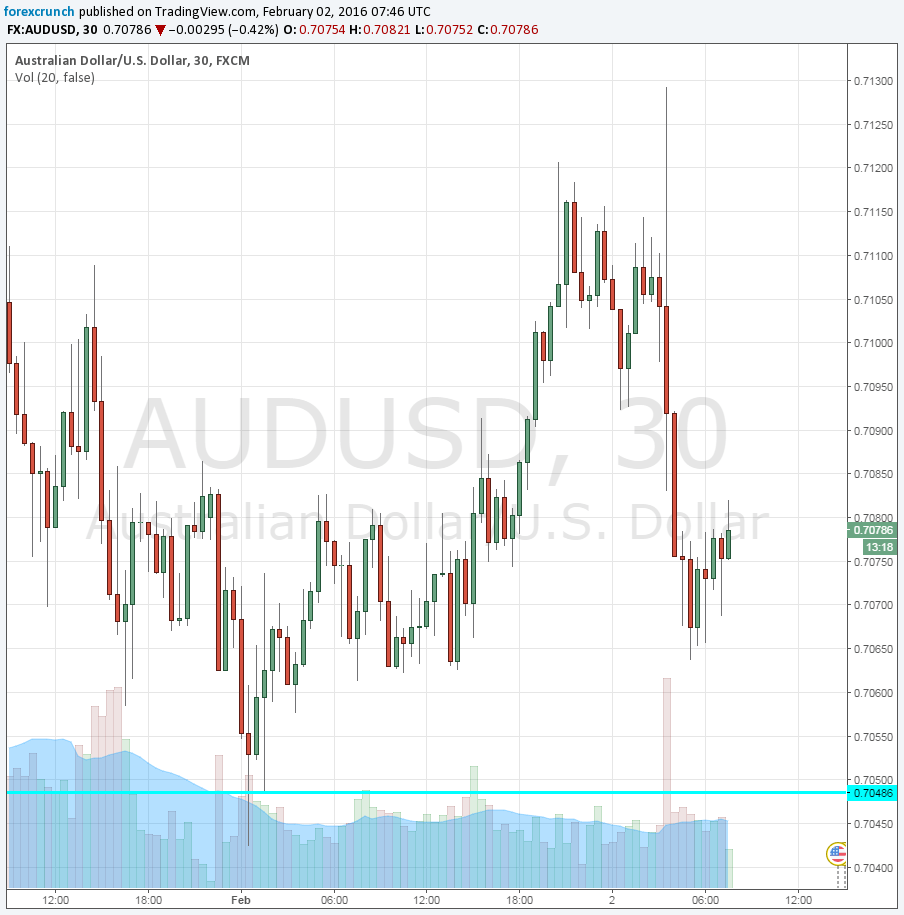

AUD/USD showed relatively little reaction to the news: it dropped a bit within the range, but this is a 70 pip range. After hitting a low of 0.7063, the pair is marginally higher. In addition, it is hard to say that the A$ dropped solely because of the RBA: there is a risk off mood in markets, with weaker oil prices, a weaker pound, weaker commodity currencies while the yen and the euro are on the rise.

In this environment, where the Aussie is sliding on risk aversion, the RBA event is not 100% to blame, to say the least.

More:

- Sell AUD/JPY – Barclays Trade Of The Week

- AUD/USD: Bullish Reversal Week Amid Positive S/T Momentum – NAB

Here is the AUD/USD chart: