The Australian dollar dipped its feet to a new low under 0.73 and continues feeling the RBA pressure. There may be more to come:

Here is their view, courtesy of eFXnews:

RBA not finished cutting rates, China woes to resurface

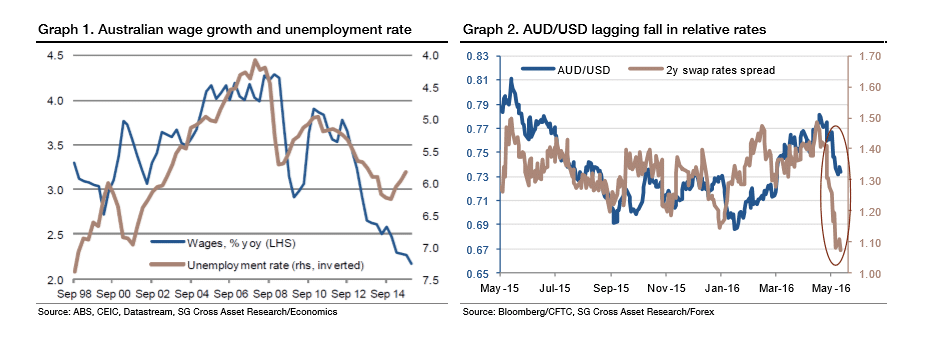

The RBA has not finished cutting interest rates, and markets should refocus on China woes in H2. AUD/USD is lagging the dovish pricing of rates, the technical picture shows vulnerability and long positioning is stretched.

We think that the timing is now right to reset bearish AUD positions via options, since the RBA is not finished making cuts and China woes should undermine confidence again in H2.

In the volatility space, downside skew is overpriced given the low sensitivity of volatility to spot moves. It suggests selling downside vega.

We recommend Buying a 3m put strike 0.72 with a knock-out set at 0.66, two figures below the year-to date low.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.