For a second time this week, the Reserve Bank of Australia is weighing heavily on the Australian dollar. On Tuesday it was a rate cut, that was not fully priced in. Later in the week, the A$ did recover on positive data. But this doesn’t last too long.

In its quarterly report, the central bank in the land down under decided to slash forecasts. The next rate cut, from 1.75% to 1.50% is now on the cards for June instead of July after this report. Glenn Stevens seems to be leaving low rates to his successor, Lowe. They are probably on the same side of the assessment about “broad based weakness in cost pressures”.

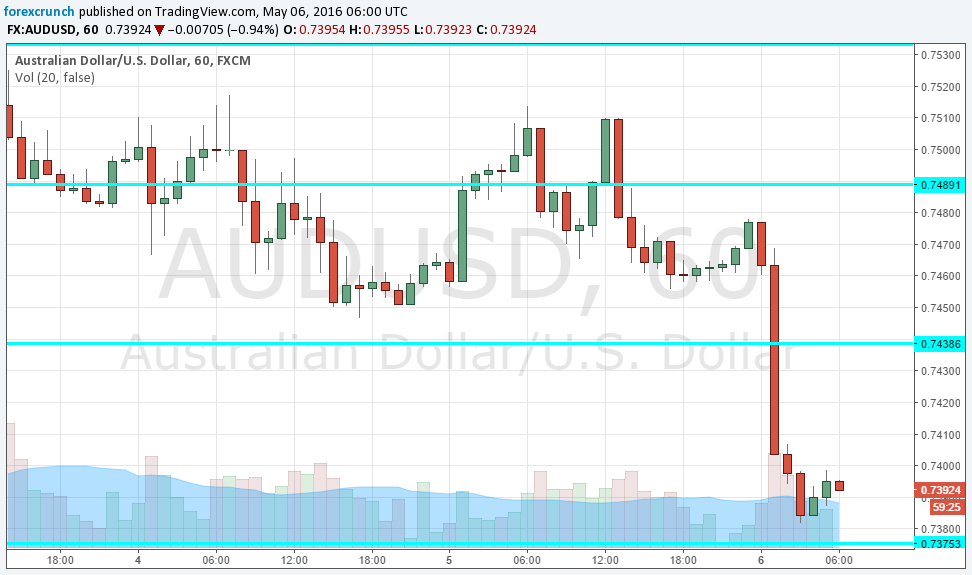

This sends AUD/USD to the 0.73 handle, with 0.7382 serving as the new low, just above support at 0.7375. Further support awaits only at 0.7280. Resistance is now at 0.7440.

The dovishness from the RBA could spread to other commodity currencies. In addition, copper prices are also on the fall, and this adds to the weight on the Aussie.

Will we see a breach of support at 0.7375? The next big event on the calendar is the US Non-Farm Payrolls. See how to trade the NFP with EUR/USD.