Idea of the Day

We talked last week of the battle between the markets and the RBA in Australia, which has been perfectly illustrated by the latest minutes from the central bank today. Not for the first time, the RBA described the Aussie as “uncomfortably high” and suggested that a weaker currency was still needed to support the re-balancing of the economy. But the market appears to be increasingly resilient to such talk, with the currency largely brushing off the comments in Asia trade and being squeezed higher at the start of the European session. For now, it appears that markets are thinking the RBA is pretty powerless to push the currency down beyond the use of words, with lower rates building risks for the domestic economy.

Data/Event Risks

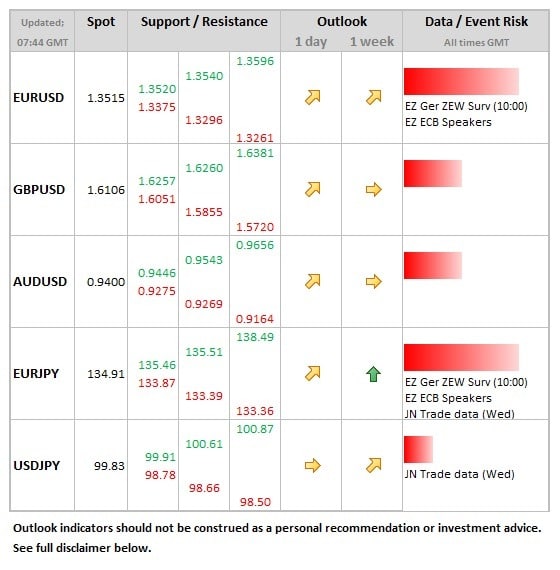

EUR: ZEW data can sometimes cause ripples on the euro as it is seen as having some leading properties towards the more followed IFO index of German business confidence. Market looks for the expectations balance to move up from 52.8 to 54.0. The 2009 peak was 57.7.

Latest FX News

JPY: The big focus this week is potential changes to the Government pension investment fund and there are also upcoming changes to Nippon savings accounts due to take place in January next year. Both are likely to push the yen lower, making it easier for overseas investments.

AUD: A double edged sword from the RBA minutes, both reflecting that previous rate cuts (taking rates to 2.50%) but also acknowledged the scope for more easing if needed. The Aussie sagged only modestly, pushing back above the 0.9400 level later on.

EUR: A slow start to the week, but there remains an underlying tendency towards appreciation, with a push to the 1.3540 level seen yesterday before pulling back, but still holding above the 1.35 level. We underlined the reasons last week in our blog.

Further reading:

EURUSD Approaching Resistance Zone (Elliott Wave Analysis)

Janet Yellen’s speech pushes indices to new highs; What to expect this week?