Trump’s victory was accompanied by a clean Republican sweep of Congress. What does this mean for the USD dollar? Here is the view by Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

We have argued in the past few months that the significance of the US election lies in what it means for US fiscal policy. We believe the outcome of a Republican clean sweep means fiscal loosening is now a foregone conclusion. We believe this will lead to both higher rates and a higher USD.

Beyond the noise: Higher rates and higher dollar.

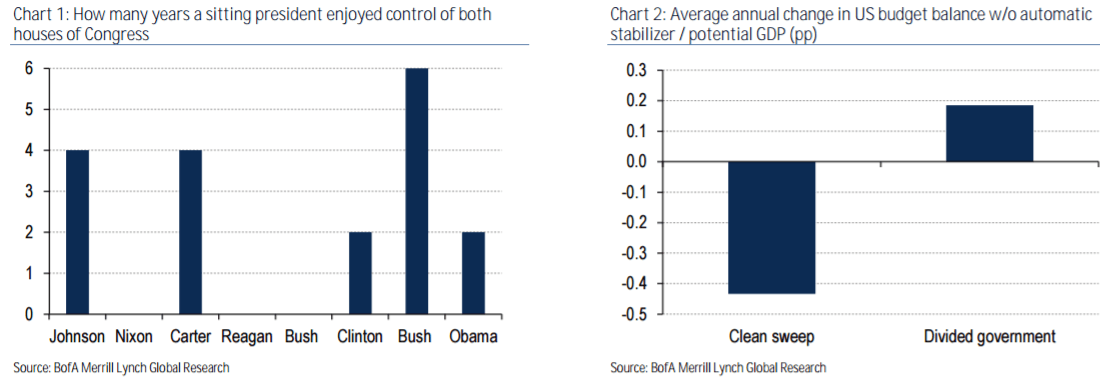

– A clean sweep is an exception rather than the norm in the US. There have been only 18 years since 1965 that a single party controlled the presidency as well as both houses of Congress.

– A clean sweep is a recipe for fiscal easing. During the eighteen years in which a single party controlled the presidency and both houses of Congress, US structural budget balance worsened by 0.4pp of potential GDP a year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

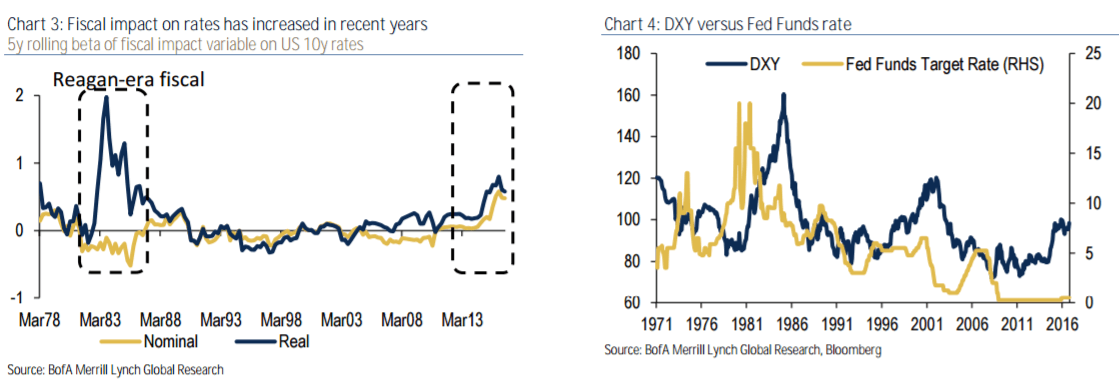

– Fiscal easing is bearish rates. A fiscal stimulus of 1% of GDP has been associated with 48bp increase in 10y yields. We expect 10y rates to test 2.25%-2.5% by Q1/Q2 next year.

– Higher rates is bullish for the USD. The last time the US unleashed fiscal stimulus when the economy was not in a recession was under Ronald Reagan (1981-84). This emboldened the Fed to enter a hiking cycle propelling the USD 60% higher.

– HIA 2.0 even more bullish the USD: We believe the lowest hanging fruit for the Trump administration will be tax reforms to encourage repatriation of the $2trn that US companies are sitting on. Our estimates suggest that nearly $400bn of overseas cash could be converted to USD, providing a positive USD tailwind. The only year from 2001 to 2008 in which the USD rallied was in 2005, during the first HIA.

– Deregulation: A combination of higher deficits and deregulation (lower buying of belly USTs from bank portfolios) leaves us biased towards tighter swap spreads in the 5y-10y part of the curve.

In FX, our highest conviction remains higher USD/JPY given its interest rate sensitivity. JPY is the most highly correlated to rate spreads within G10. Additionally, domestic flows are set to turn JPY-negative in 2017, further supporting our view. The biggest risk to our higher rates view is if Beijing takes advantage and pushes the RMB lower before the new president takes office. In such an event, we cannot rule out a risk-off environment that could drive down commodities, EM and inflation BEs.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.