It seemed all but over and now it is officially over: the networks have called the elections for Donald Trump, the Republican nominee, which will enter the White House on January 20th 2017. Wisconsin, the rust belt state, was the last nail.

We are seeing some “buy the rumor, sell the fact” reaction though.

The choice of Americans has implications. Financial markets have already reacted as the picture became clearer during the night.

- EUR/USD is up, enjoying a weak dollar and piercing through resistance. The common currency could still turn down as it is not a natural safe-haven currency

- GBP/USD is above 1.25. This is a mix of dollar weakness and the big turnaround in the pound on “Super Thursday“.

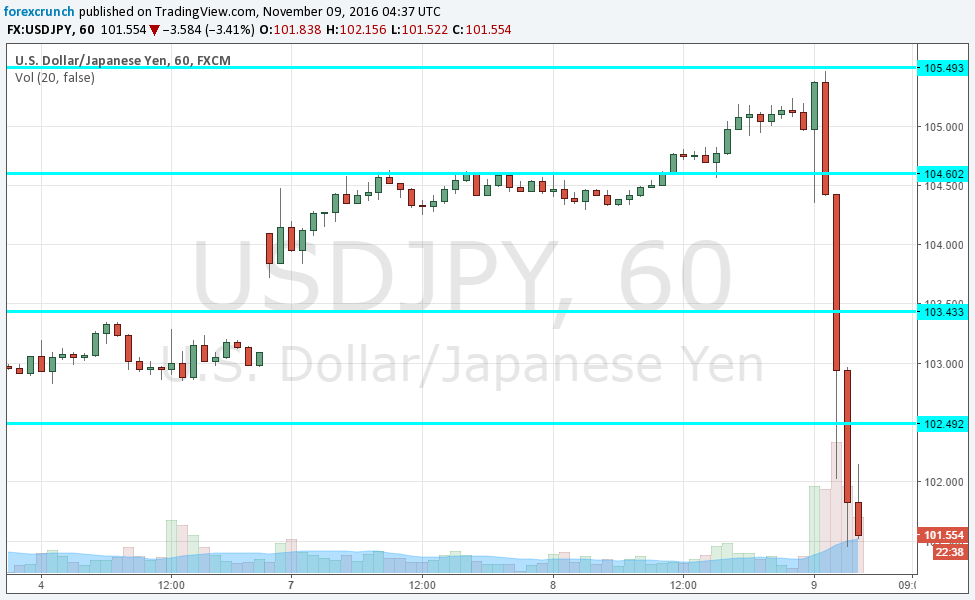

- USD/JPY is crashing: the yen is the ultimate safe haven currency. The prime candidate in our elections preview. Beware of interventions

- USD/CAD is moving higher, eventually breaking critical resistance – the Canadian economy and the dollar suffer from a worsening of trade relations.

- AUD/USD is sliding – it is also a risk currency

- NZD/USD is slightly lower, showing more resilience.

- USD/MXN is shooting higher – the Mexican peso suffers from Trump’s promise of a wall and worsening trade relations in general. This reaction was fully expected, but perhaps not a whopping 13%.

- WTI Crude Oil is falling, no appetite for risk.

- Stock markets in Asia are crashing and US futures are also deep down.

More: US elections – all the updates