The Bank of Japan did not introduce new policy measures in its first October meeting. Is the TPP one of its considerations?

In any case, there is a good chance that the BOJ will act in late October. Here is the explanation from Credit Agricole:

Here is their view, courtesy of eFXnews:

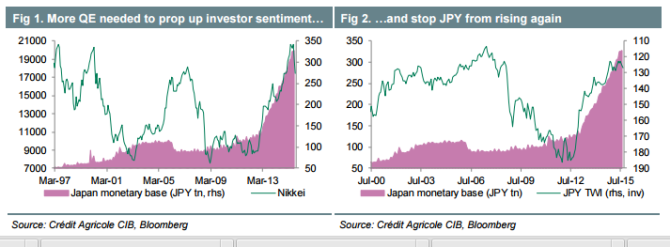

CACIB economists have frontloaded their call for BoJ QE to 30 October from January 2016. Subsequently, we revise our year-end forecast for USD/JPY higher to 125 from 123 previously.

This is consistent with the results from our model simulation that indicate that, under fairly conservative assumptions regarding the Nikkei and USD-JPY rate spread, BoJ QE could lift USD/JPY by 5 big figures.

Lingering risk aversion and a more subdued outlook for US rates could mute the USD/JPY gains beyond 125 for now. Further out, however, the combination of stock market gains and Fed tightening should push USD/JPY higher still.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.