The Canadian dollar is looking for a new direction as many moving parts pull it in different directions. What’s next? The team at TD sees downside for the loonie.

Here is their view, courtesy of eFXnews:

The focus for CAD this week turns to data. Top of mind for markets are Dec trade and the Jan employment report. Stronger exports of both energy and non-energy goods should lead to a widening of the trade surplus in Dec while modestly higher imports will provide a limited offset. Markets will be keen to watch the non-energy exports, which continue to languish despite the weakness in CAD. We expect the economy added 10k net jobs in January, keeping the pace with the decent trend in hiring seen the last few months. Still, the bulk of the employment gains have come in the form of part-time jobs. Indeed, the annual trend in part-time employment is running at nearly double the level of full-time.

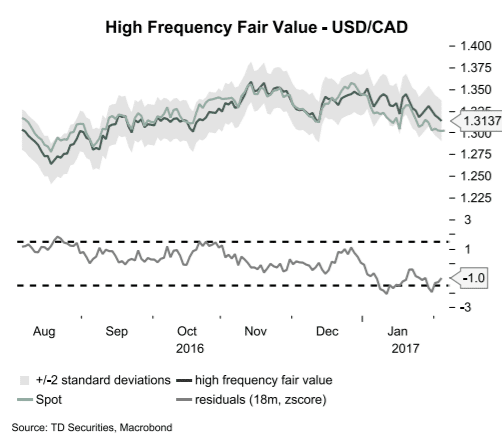

Against a backdrop of flat wage growth, this strengthens the case the economy is running with ample capacity. This mean that the breakdown of the employment report will arguably matter more than the net change, which the market sees at zero. TD is looking for 10k so we could see a positive CAD response to the data. Still, we think CAD is unlikely to benefit much from weakness in the USD given its weaker growth backdrop and low real rates. Our preference is sell on the crosses and stay long USDCAD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.