Best Forex Brokers Singapore 2021

If you are based in Singapore and are looking to begin your forex trading journey, one of the critical steps is to choose a suitable broker to facilitate your trades safely and cost-effectively. There are many FX brokers to choose from for Singaporean traders – so ensuring that you do your research and pick an appropriate broker is crucial to your trading success.

To help you out with this process, this guide discusses the Best Forex Brokers Singapore 2021 – exploring their key features and showing you how to sign up and begin trading in under ten minutes.

Best Forex Brokers Singapore 2021 List

If you are looking for a quick overview of the top 10 forex brokers in Singapore, look no further. In the following section, we’ll review a selection of these top forex brokers – providing all the information you need to make an optimal broker choice.

- eToro – Overall Best Forex Broker in Singapore

- Libertex – Best Forex Broker in Singapore with ZERO spreads

- Capital.com – Best Forex Broker in Singapore for Low Fees

- Vantage FX – Best Forex Broker in Singapore for ECN trading

- Avatrade – Best Forex Broker in Singapore for MT4 and MT5

- Pepperstone – Best Forex Broker in Singapore for Advanced Traders

- Forex.com – Best Forex Broker in Singapore for Account Options

- CMC Markets – Best Forex Broker in Singapore for Asset Selection

- Skilling – Best Forex Broker in Singapore for Beginners

- FXCM – Best Forex Broker in Singapore with Stellar Reputation

Top Singapore Forex Brokers Reviewed

As you can see from the list above, there is a good selection of forex brokers for Singapore-based traders – many of which offer different features and fee structures to appeal to traders from various experience levels. However, sometimes it can be difficult to pick between the options and choose which one is right for you and your situation.

To help you out with this, the section below presents forex broker reviews for some of the best forex brokers in Singapore – ensuring you have all the information needed to make an effective decision.

1. eToro – Overall Best Forex Broker in Singapore

Through our experience and research, we’ve found that eToro is the best Singapore forex broker available to traders. eToro has a fantastic reputation, not just in Singapore but worldwide. With over 20 million registered users, eToro’s platform is a favourite of both beginner traders and experienced investors. What’s more, eToro is highly regulated by organisations such as the FCA, CySEC, and ASIC.

One of the most appealing things about eToro when it comes to forex trading is its attractive fee structure. eToro does not charge any commissions when you place a trade, with fees incorporated into the spread. These spreads are very tight – for example, EUR/USD and USD/JPY spreads tend only to be one pip. Aside from these spreads, eToro does not charge any hidden fees – no deposit fees, withdrawal fees, or monthly account fees will have to be paid.

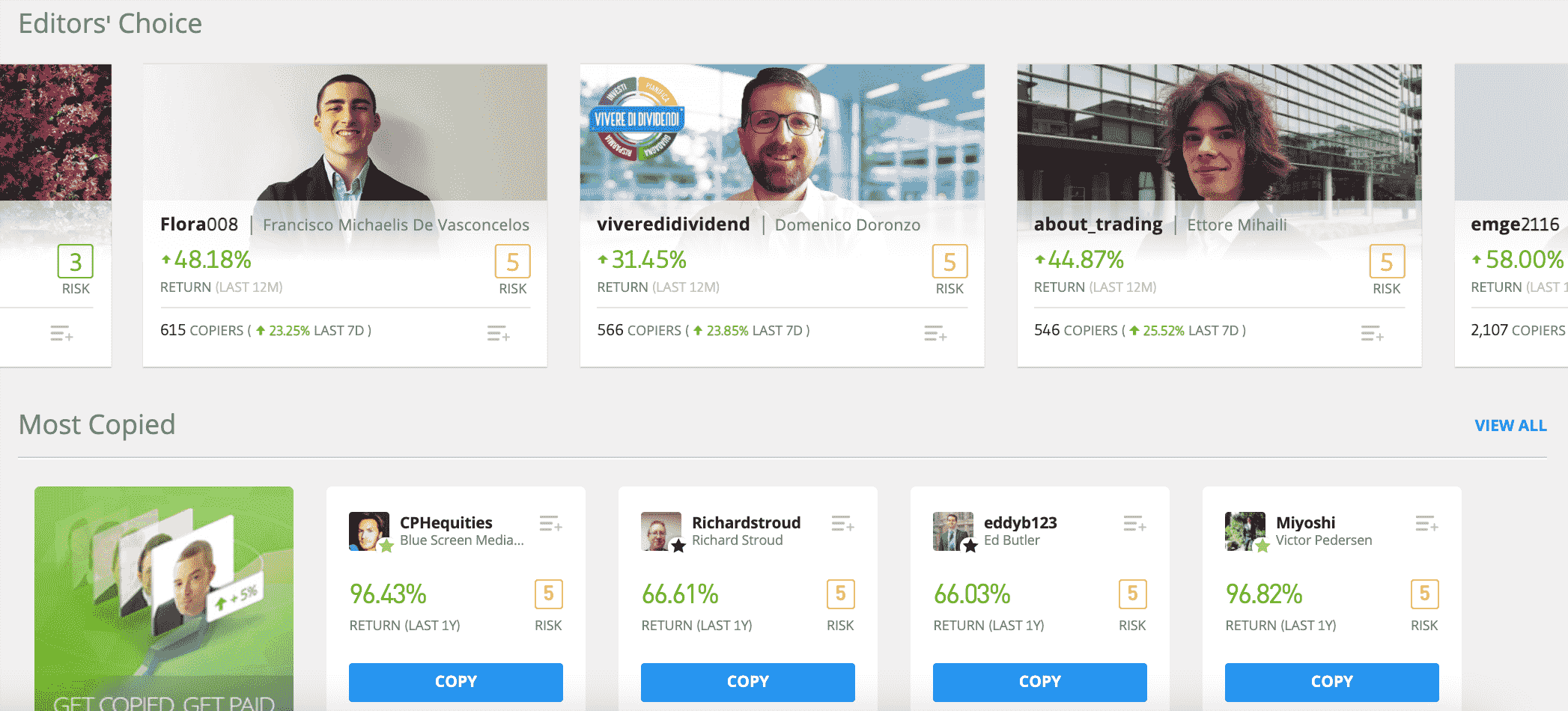

eToro also offers a whole host of valuable features for forex traders – most notably, their innovative CopyTrader feature. This feature allows users to quickly and automatically copy the trades of experienced traders, providing a great way of generating profits without having to be on the charts all day. This makes eToro one of the best social trading platforms for forex traders.

- Super user-friendly online forex broker

- Trade forex with tight spreads

- You can also trade stocks, indices, ETFs, cryptocurrencies, and more

- Deposit funds with a debit/credit card, e-wallet, or bank transfer

- Social and copy trading

- FCA and FSCS protections

Cons

- Not suitable for advanced traders that like to perform technical analysis

67% of retail investors lose money trading CFDs at this site

2. Libertex – Best Forex Broker in Singapore with ZERO spreads

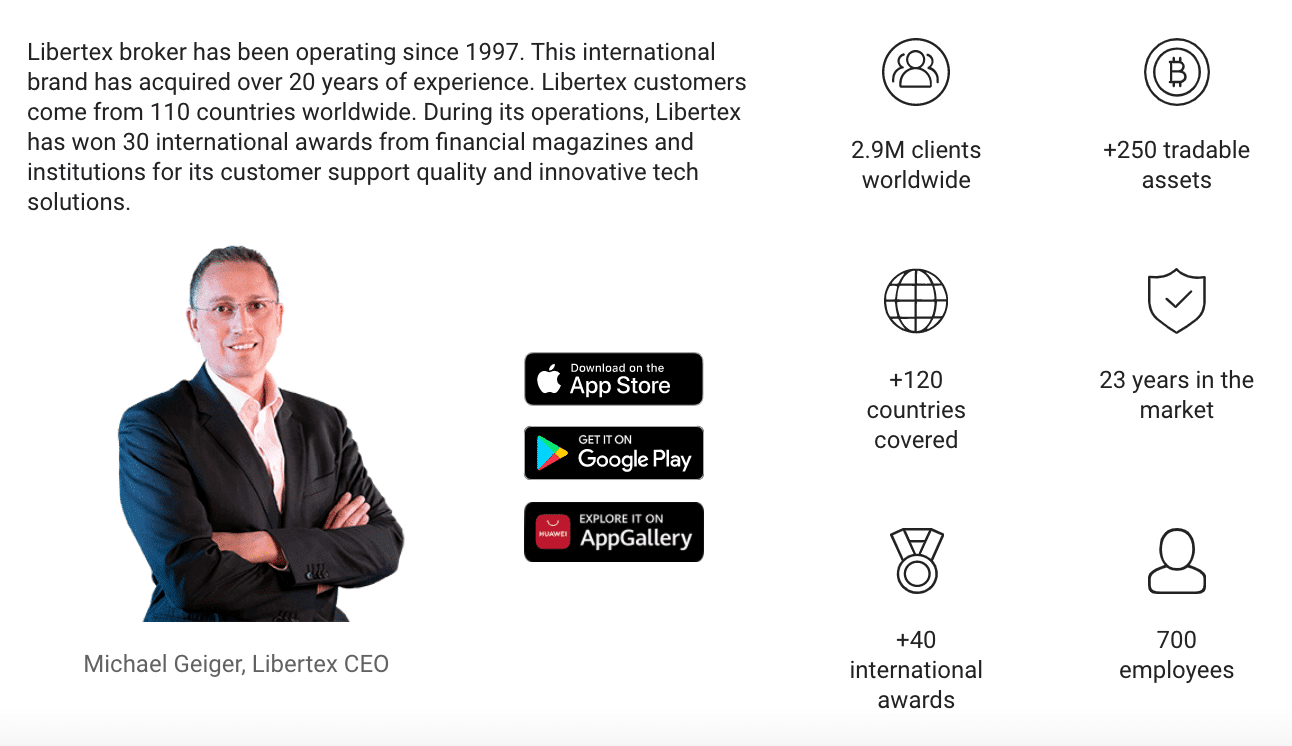

Another addition to our list of the best forex brokers in Singapore is Libertex. Libertex is an excellent option for traders looking to trade cost-effectively, as they offer a ZERO spread fee structure. This means that traders get market-leading rates when trading the forex market, ensuring they can maximise profits.

Instead of a spread, Libertex receives its fee through a small commission charged on each trade. Fortunately, this commission is minuscule, with some pairs only requiring a fee of 0.008% when placing a trade. Aside from this commission, Libertex users do not have to pay any deposit fees, withdrawal fees, or monthly account fees.

As Libertex are one of the best CFD brokers, users can employ leverage on their trades. This leverage provides the opportunity to boost potential profits massively, as Libertex offer leverage of up to 30:1 for traders. Furthermore, Libertex users can trade confidently, as the platform is regulated by top entities such as CySEC. This regulation ensures Libertex must utilise the highest levels of security on their platform, protecting traders’ personal information and capital.

- Zero spread forex trading

- Good educational resources

- Long established broker

- Compatible with MT4

- Competitive spreads

Cons

- Only offers CFDs

83% of retail investors lose money trading CFDs at this site.

3. Capital.com – Best Forex Broker in Singapore for Low Fees

If you are looking for a Singapore forex broker that offers low fees, then Capital.com is certainly an option worth considering. Capital.com has been in operation since 2016 and are currently regulated by the FCA and CySEC – two of the top regulators when it comes to forex trading. Capital.com is an ideal choice for people interested in forex day trading as their platform is highly user-friendly. Furthermore, Capital.com also offer a handy demo account feature, which is perfect for beginners who wish to gain risk-free experience in the markets.

Capital.com’s fee structure is one of its most appealing features, as the broker does not charge any commissions when placing a trade. Similar to other brokers, the fee is incorporated into the spread – and Capital.com offer some of the lowest spreads on the market. EUR/USD spreads can be as low as 0.6 pips, whilst GBP/USD spreads tend to hover around one pip. Notably, Capital.com does use a variable spread model, so these can change depending on market conditions.

Another great thing about Capital.com is that their minimum deposit is only $20 (around 26.91 SGD). Users can fund their account through credit/debit card, bank transfer, or various e-wallets – all options are fee-free. Finally, Capital.com also offer a vast library of educational materials for traders to utilise. These include guides, tutorials, articles, and even video breakdowns of current market events.

- Educational app for new traders

- AI assistant identifies your weak points

- Trade ideas generated daily

- Excellent charting and analysis interface

- $20 minimum deposit

Cons

- Cannot build custom trading strategies

72.6% of retail investors lose money trading CFDs at this site.

4. Vantage FX – Best Forex Broker in Singapore for ECN trading

If you are looking for one of the best ECN brokers, Vantage FX certainly fits the bill. Vantage FX is heavily regulated by numerous top entities and benefit from having direct access to liquidity partners such as HSBC, JPMorgan, and CitiBank. This allows Vantage FX to provide excellent rates and fast execution speeds to forex traders.

One great feature of the Vantage FX platform is its RAW ECN account. This account provides direct access to the interbank market, meaning that trades are executed as quickly as possible, and spreads can be as low as 0 pips. Notably, this account does charge a commission of $3 per trade and requires a minimum deposit of $500 – yet if you are an experienced trader, it’s certainly worth it.

Vantage FX also offers an impressive leverage facility, up to 500:1 for certain traders. Leverage tends to be based on where you reside to comply with local laws, so you may be offered a lower amount than this. Finally, Vantage FX’s account opening process is super easy and only takes a few minutes to complete – ensuring traders can get access to the market as quickly as possible.

- ECN broker accounts

- Trade from 0 pips and a commission of $3 per trade

- Regulated in various jurisdictions

- Offers markets on forex, shares, energies, indices, and more

- Supports MT5

- Leverage of up to 1:500

Cons

- Mobile app isn’t the easiest to use

Your capital is at risk when trading financial instruments at this provider

5. Avatrade – Best Forex Broker in Singapore for MT4 and MT5

Rounding off our list of the best forex brokers in Singapore is Avatrade. Avatrade is one of the best MT4 brokers on the market, offering full support for the super-popular trading platform. Furthermore, Avatrade is regulated by various top entities worldwide, including ASIC, CySEC, and MiFID. These entities ensure Avatrade protect users’ capital and offer a safe trading environment.

As Avatrade offer support for MT4 and MT5 trading, users can gain access to custom indicators and forex robots if they wish. These tools can help optimise trading and give traders an edge in the FX market. In addition, Avatrade also offers their own proprietary trading platform for users that do not want to use MT4 or MT5; they also provide a platform called ‘AvaOptions’ which focuses solely on CFD options trading.

The minimum deposit at Avatrade is $100, which can be completed via bank transfer, credit/debit card, or various e-wallets. Notably, Avatrade does not charge any deposit or withdrawal fees, ensuring a cost-effective trading process for users. Finally, Avatrade offers multiple resources for new traders, such as a demo account, tutorial videos, articles, and webinars. These resources help beginner traders to navigate the market effectively and employ their capital wisely.

- Regulated in 6 different jurisdictions

- Supports CFD markets on forex, stocks, cryptocurrencies, and more

- 0% commission and low spreads

- Compatible with MT4 and MT5

- Minimum deposit of just $100

- Leverage offered on all markets

Cons

- Stock CFD department is limited in comparison to other MT5 trading platforms

71% of retail investor accounts lose money when trading CFDs with this provider

Best Forex Brokers in Singapore Comparison

As you can see from the section above, each broker tends to offer a slightly different trading environment and fee structure to try and set themselves apart from the competition. To make choosing a broker even easier, the table below presents a forex broker comparison for the options mentioned in the previous section. By using this table, you’ll be able to easily compare fees, spreads, and leverage offered by the best forex brokers in Singapore.

| Pricing (Spreads/Commissions) | Average GBP/USD Spread | Deposit Fee | Withdrawal Fee | Max Leverage | |

| eToro | 0% commission + variable spreads | 2 pips | 0.5% conversion fee for non-USD deposits | $5 | 30:1 |

| Libertex | ZERO spreads + variable commission (based on currency pair) | ZERO | None | None | 30:1 |

| Capital.com | 0% commission + variable spreads | 1 pip | None | None | 30:1 |

| Vantage FX | ECN: ZERO spreads + Commission

STP: 0% commission + variable spreads |

ECN: ZERO

STP: 1.6 pips |

None | None | Up to 500:1 |

| Avatrade | 0% commissions + variable spreads | 1.6 pips | None | None | 30:1 |

How to Choose the Right Forex Broker for You

As you are well aware, choosing a suitable forex broker is crucial to forex trading success. These brokers provide the platforms in which you will place all of your trades – so you must conduct your research and pick a broker that meets your trading needs.

To help streamline the research process, the section below highlights some of the critical things to look out for when choosing a forex broker – ensuring you make a decision that suits you and your trading goals.

Safety

Top of your list of criteria should be safety, as this is crucial to your trading success. Choosing a licensed and reputable broker will allow you to trade the FX market with confidence, as your personal information and capital will be protected. It’s essential to utilise a broker with regulatory oversight, preferably from a top-tier entity such as the FCA, CySEC, ASIC, or MiFID. These organisations ensure that brokers are using strict security protocols to protect users and their data.

For Singapore-based traders, it’s a good idea to look for MAS regulated forex brokers. MAS stands for the ‘Monetary Bank of Singapore’ and is the central bank and regulatory authority of Singapore. Many brokers offer MAS regulation – but if you find a broker that does not, yet offers excellent features, ensure another top-tier institution regulates them before opening an account.

Fees

Fees are another crucial element to consider, as these can quickly build up if you are an active trader. Typically, brokers will charge two types of fees:

- Commissions: These are stated as a percentage of your position size and are charged when you place a trade. Some brokers may also charge a commission when you exit a trade too.

- Spreads: The spread is the difference between the buy and sell prices on a currency. A broker will always buy for a lower price than they sell at, with the difference being kept as their ‘fee’.

Many brokers will only charge one of these fee types – for example, eToro does not charge any commissions, as the fee is incorporated into the spread. Some low spread brokers, such as Libertex, charge ZERO spreads and will instead charge a small commission.

Non-trading fees are also something to be aware of. These include deposit fees, withdrawal fees, inactivity fees, and monthly account fees. Make sure you research whether your chosen broker charges these before signing up, as they can make your trading experience more costly over the longer term.

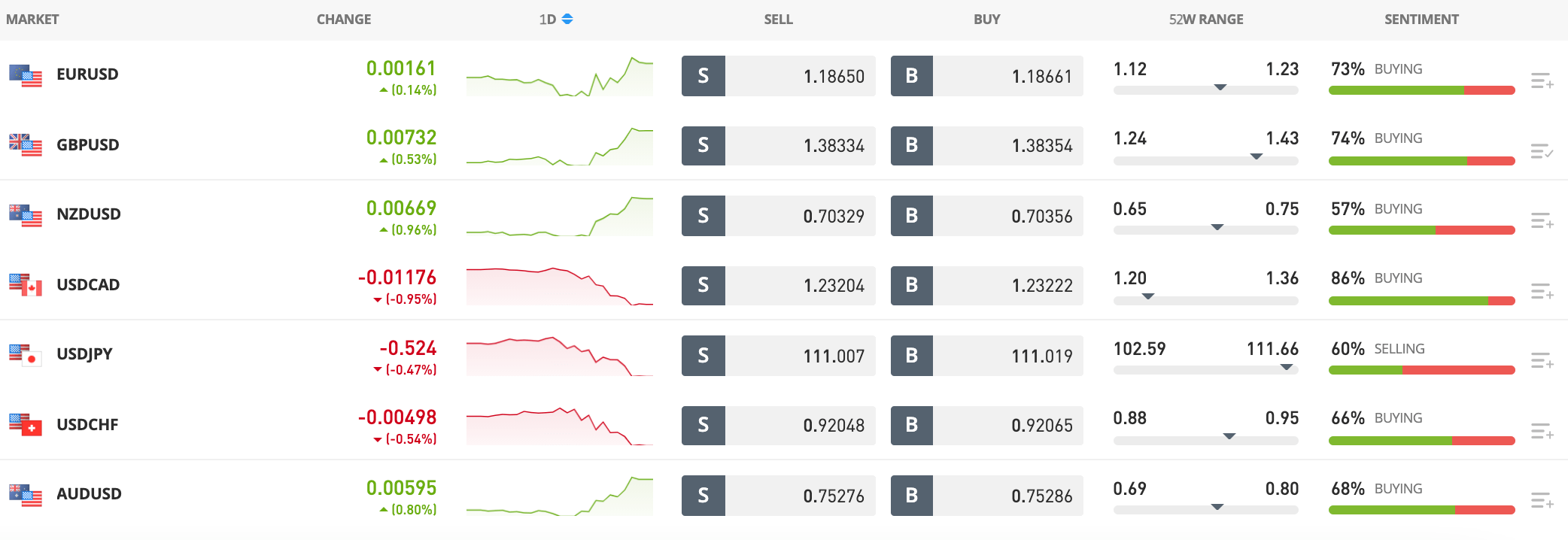

Range of Assets

The forex market includes hundreds of currency pairs, broken down into majors, minors, and exotics. Majors are the most popular pairs and also offer the highest liquidity levels. These include pairs such as EUR/USD, GBP/USD, and USD/JPY. All forex brokers will typically offer these, as majors make up the largest amount of trading volume in the market.

However, if you are an experienced forex trader, you might want to look for a broker that offers minors or even exotics. These pairs are less-traded and lower liquidity but can offer great trading opportunities for advanced traders. It’s important to note that minors and exotics will typically have larger spreads to compensate for the lower liquidity – so if you are a beginner trader, it’s best to stick to the majors first.

Trading Tools

Technical analysis is a crucial component of effective FX trading, so choosing a broker that offers various trading tools can be a huge benefit. Tools such as economic calendars, market updates, newsfeeds, and charting features are things to look out for when researching brokers in Singapore.

Some brokers will also offer innovative tools that can boost your trading experience. One of the best tools we’ve found is the CopyTrader feature provided by eToro. This feature allows users to automatically copy other eToro traders’ trades without having to do any of the research. This makes eToro one of the best copy trading platforms for Singapore-based traders.

Platforms

The trading platforms that a broker offers are also an essential factor to consider. Most brokers will provide a web-based platform in which users can scan the markets and place trades. Depending on the broker, these platforms can either be pretty basic or more advanced.

Certain brokers, such as Avatrade, will offer support for 3rd party trading platforms such as MT4 and MT5. These platforms are super popular with forex traders as they allow for valuable features such as custom indicators and automated trading. Furthermore, these platforms are also available via a mobile app – allowing users to trade the markets on the go.

Account Types

Certain brokers will offer a selection of account types to ensure they are appealing to various demographics. Accounts such as STP accounts and ECN accounts will provide faster execution speeds for trades, which is ideal for traders who use scalping or day trading strategies. The best STP brokers and ECN brokers will usually have a different fee structure than other accounts – so it’s best to check this beforehand.

Payments

Finally, the payment methods that a broker accepts is another factor to consider in your broker search. These days, most brokers will accept bank transfers, credit cards, debit cards, and various e-wallets when you make a deposit. Depending on the broker, specific methods may accrue a fee – for example, some brokers will charge a percentage fee when you deposit via credit card.

Another element to consider is how long the payment will take to reach your account. Due to the fast-moving nature of the FX market, it’s essential that you can deposit quickly and trade right away. Usually, credit/debit card deposits will arrive in your trading account instantly, whilst bank transfers may take a few days.

Also, make sure to check the minimum deposit threshold that your chosen broker requires. Again, this varies from broker to broker – as an example, eToro’s minimum deposit is $200. Furthermore, depending on the account you opt for, the deposit threshold may be larger. ECN and STP accounts will typically require a larger deposit than standard accounts.

How to Get Started with a Forex Broker

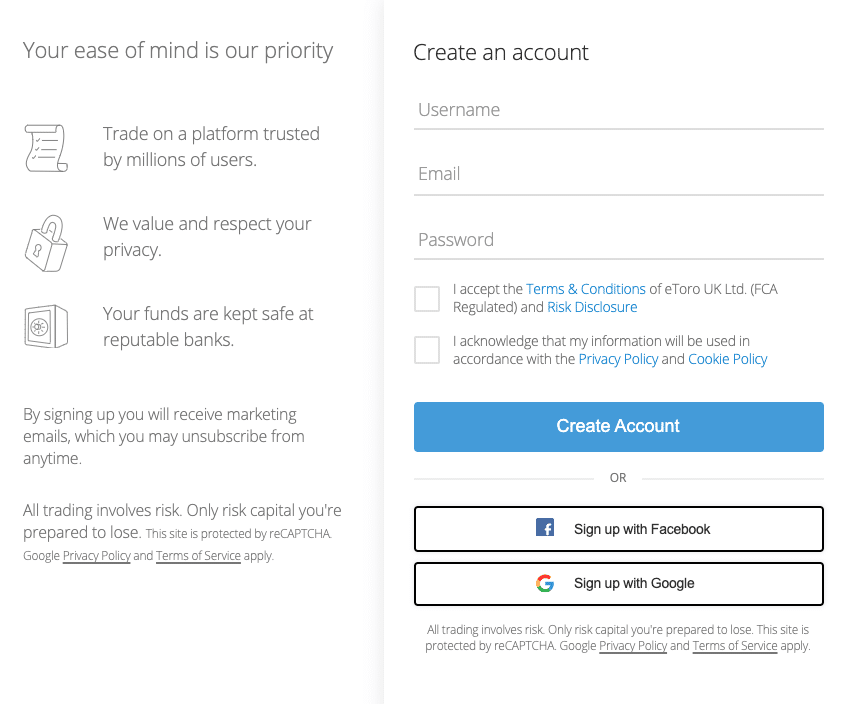

Now that you have a solid overview of the best forex brokers in Singapore and how to choose the right one for you, it’s time to take a look at the process of signing up and beginning to trade. By following the five steps presented in this section, you’ll be able to open an account and start trading with our recommended Singapore forex broker, eToro – all in less than ten minutes!

Step 1: Open an eToro Account

Head to eToro’s website and click the ‘Join Now‘ button. Enter a valid email address and choose a password to create your account. You can also complete this process through eToro’s smartphone app – one of the best forex apps available for traders.

Step 2: Verify your Account

As eToro are a heavily regulated broker, new users must complete some KYC checks and verify their identity before trading. Fortunately, this whole process is super quick and can be completed online. Simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). eToro will then verify your documents, which usually only takes a few minutes.

Step 3: Fund your Account

New eToro users must make a minimum deposit of $200 before beginning to trade – this equates to approximately 269 SGD. In terms of deposit methods, eToro accepts the following options:

- Credit card

- Debit card

- Bank transfer

- PayPal

- Neteller

- Skrill

- Klarna

Step 4: Search for Currency Pair

Click into the search bar on eToro’s trading platform and type in the name of the currency pair you’d like to trade. For the purposes of this guide, we’ll be looking to trade GBP/USD. When you see it appear in the drop-down menu, click ‘Trade’.

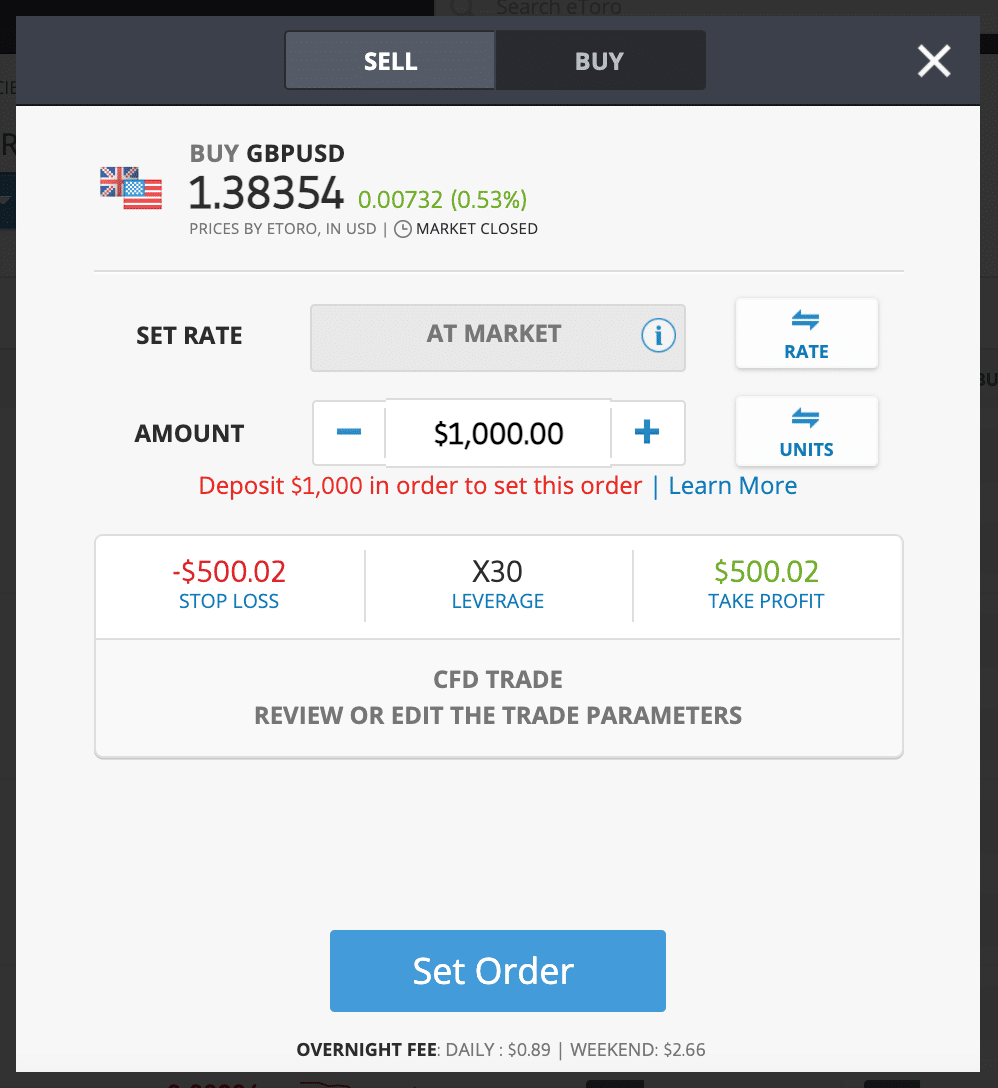

Step 5: Trade Forex

An order box will now appear, similar to the one below. You can now enter your position size, along with the amount of leverage you wish to use. In addition, you can also set your stop loss and take profit levels. Once you are happy with everything, click ‘Open Trade’.

And that’s it! You’ve just placed a forex trade with one of the best Singapore brokers – all without paying any commissions!

Best Forex Brokers Singapore 2021 – Conclusion

In conclusion, this guide has examined the best forex brokers in Singapore, providing you with all the information you need to make a suitable broker decision. If you are a Singapore-based trader, choosing a safe and reputable broker is an integral part of your trading journey – and by using this guide, you’ll be able to pick an appropriate broker and begin trading effectively.

However, if you’re looking to begin trading today, we’d recommend opening an account with eToro. Through our research, we’ve found that eToro offers the safest and most cost-effective trading environment for FX traders in Singapore. This is because eToro doesn’t charge any commissions whatsoever and allows traders to sign up in minutes!

67% of retail investor accounts lose money when trading CFDs with this provider.