Correlations we got used to are changing, and this is significant. What does it mean to for the dominant dollar? Here is the view from Deutsche Bank:

Here is their view, courtesy of eFXnews:

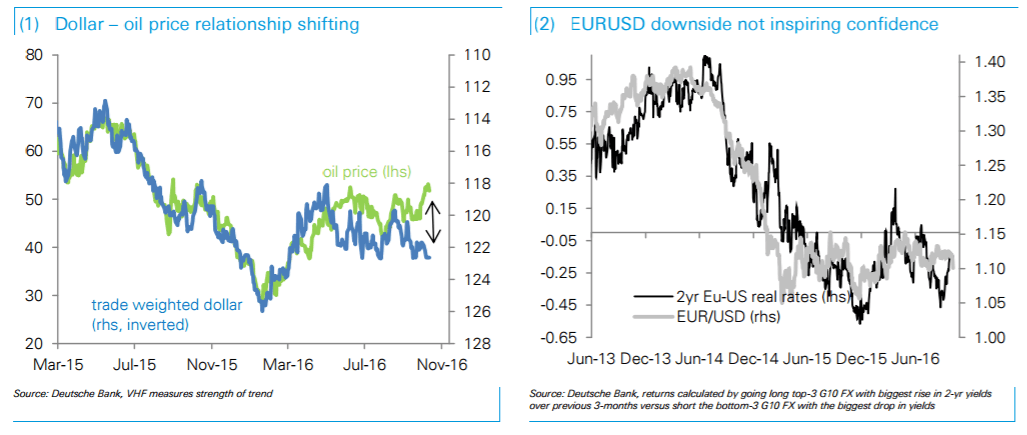

Something strange is happening in markets. While the dollar and the oil price have historically moved in opposite directions the correlation has suddenly flipped positive: a higher oil price is helping the dollar rally and vice versa (chart 1).

Is this sustainable? In many ways, it could be: Fed hawkishness was driving the dollar stronger against both currencies and commodities last year. This time round, the oil price rally is pushing US inflation expectations and US long-end rates higher.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

How important is this as support for the dollar?

For EM currencies reliant on unhedged local debt inflows it is critical: a US bear steepening driven by higher inflation expectations and bond risk premia is far more disruptive to EM FX than a slow Fed hiking cycle that keeps the US back-end stable.

For low-yielding G10 FX like the EUR and JPY, we’re less convinced that the current rate re-pricing is a material dollar support. Both currencies are more sensitive to short-end real rates, in turn, reliant on a hawkish Fed and/or better US growth data. Either of which has yet to happen, with the recent re-pricing of US breakevens pushing EUR/USD “fair value” on real rate differentials higher to 1.10, not lower. Our yearend forecast for EUR/USD is 1.05, but we are a little cautious that rising oil prices and US breakevens may not be sufficient to get us there.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.