The greenback continues enjoying a virtuous cycle: good figures fuel its extending rallies. And now, the weekly measure of unemployment benefits contributes its share with a drop to 249K, the best figure since the financial crisis and better than expected for this week. Continued claims also beat predictions with a drop to 2.058 million. The 4-week moving average dropped to 253.5K, also a notable achievement.

The advantage of the US currency is most notable against the pound but it is not the only currency on the back foot. Also, the euro is moving back down in range to 1.1180.

Tomorrow we get the most important indicator: the Non-Farm Payrolls.

See how to trade the NFP with EUR/USD.

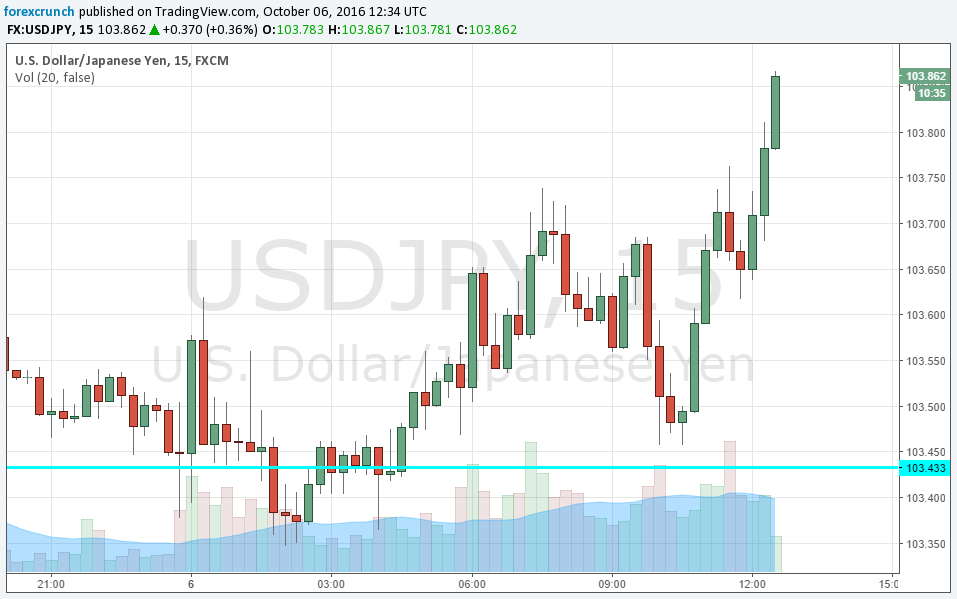

USD/JPY continues its advance after breaking resistance at 103.40. The pair advances to 103.86.

The US was expected to report a small rise in jobless claims this week: to 257K after 254K last week (before revisions).

The US dollar is quite dominant, to say the least.

Recent economic data has been quite positive with the ISM manufacturing PMI beating expectations, and this was followed by an even better ISM Non-Manufacturing PMI report. The miss on the ADP number was ignored, showing that most data is positive and that the momentum of a strengthening USD persists.