- S&P500 Price Once Again In The Green After A Torrid Week

- Instability in Afghanistan Slowly Subsiding With Investors Returning To The Fray

- Important Events Such as Housing Data And Upcoming Central Bankers Meeting At Jackson Hole Closely Monitored

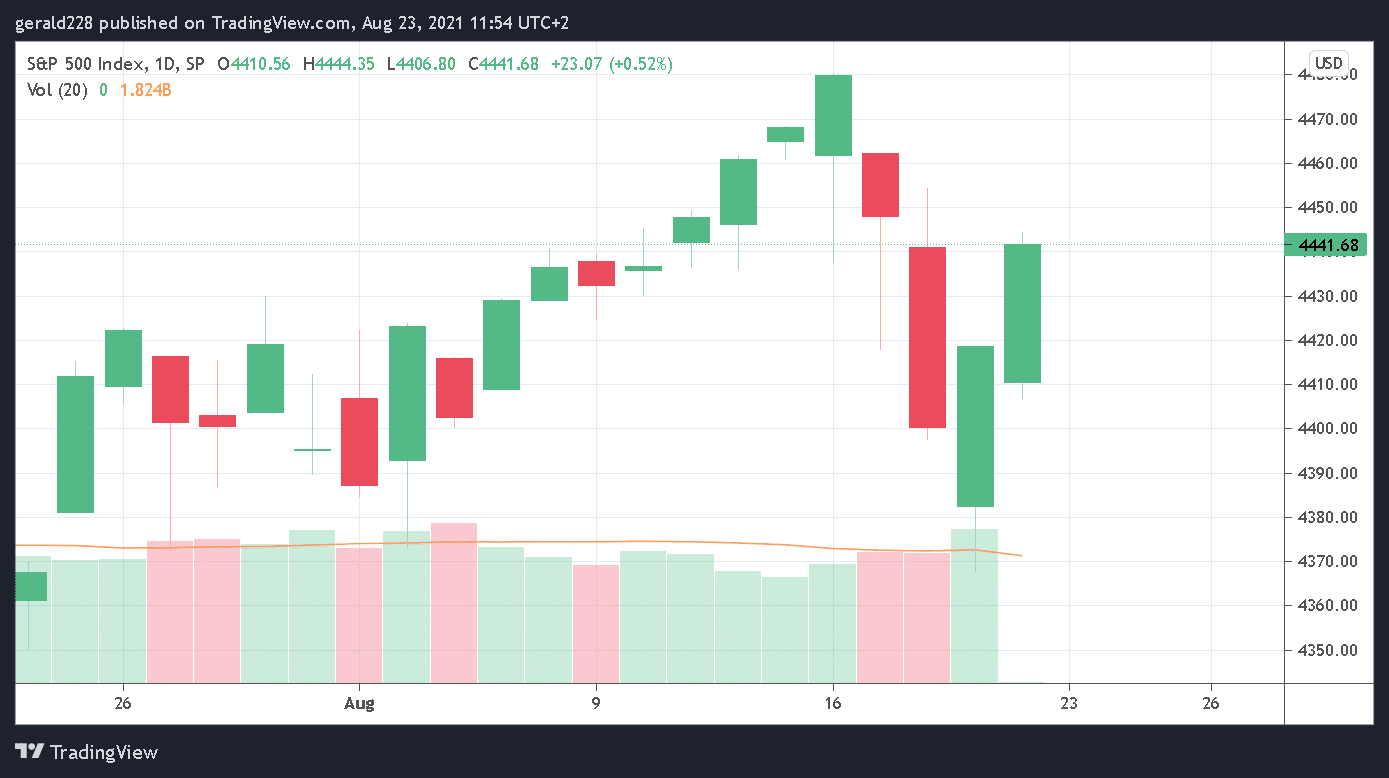

The S&P500 price is once again in positive territory after a torrid last week when the benchmark index fell no less than 100 points, or around 2.5%. With the situation in Afghanistan stabilizing, investors are once again focused on economic issues closer to home with a number of important announcements coming up.

At present, the S&P500 price is trading at the $4440 level, just 40 points or so off its All-Time High of $4480 reached on 16 August. Two heavy sell-off sessions then followed with the S&P500 descending considerably but the last two sessions have been positive, at least so far.

A number of important events are coming up which could affect the index. The Jackson Hole meeting which starts on the 26 August (Thursday) is closely watched while figures such as the US Flash PMI later today and new home sales on Tuesday should also prove interesting. US GDP on Thursday 26 August is also an important statistic. Friday’s speech by Fed Chair Powell at Jackson Hole is an important indicator for future economic policy and how the markets will react to this.

If you haven’t started trading forex yet, take a look at this Trading Forex For Beginners’ Guide.

Short Term Forecast For S&P500 Price: Back To The Climb Up As Economy Continues To re-Open

The S&P500 price is expected to continue moving forward as the economy re-opens although blips such as the Afghanistan issue could provide some minor pullbacks. The next target for the S&P500 price should by the 4700 level where considerable resistance is to be expected.

If a bullish thesis prevails, the S&P500 will sail over the 4500 level and if the economic data this week will prove positive, the price should climb even more. As the situation in Afghanistan de-escalates, investors should regain confidence.

A bearish thesis will occur if economic data proves tepid or the international situation in Afghanistan continues to worsen. The Covid19 issue is still fluid although President Biden’s recent confirmation of a booster shot for all adults gave an impetus to the markets. If bears take control, the price should retreat to the 4300 level where it would then probably bounce back.

If you wish to begin trading forex then take a look and review these Top Forex Brokers.

Long Term Prediction For SPX: Still Bullish And 5000 Possible By End Of Year

Several intrinsic factors continue to affect the S&P500 index. These include; the Covid19 situation, a tepid economic recovery, and the beginning of the tapering off of economic support by the Fed. However, the long-term prediction for the S&P500 price is quite bullish.

Further guidance should be given with Fed Chair Powell’s speech on Friday. The plan for the retreating of economic measures to support businesses affected by the Covid19 situation will definitely be closely watched.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.