- S&P500 price had an excellent end to the week reversing almost all previous losses

- More upside expected following Fed Chair Powell’s speech

- Investors seem not to be too spooked with situation in Afghanistan and Covid19 concerns

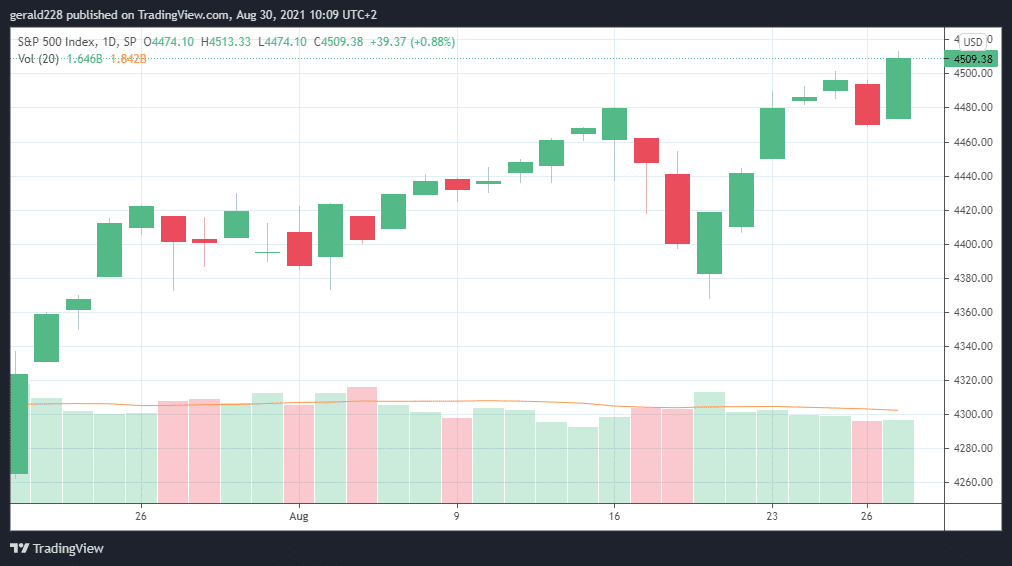

The S&P500 price had an excellent end to the week with a rise of almost 40 points or a 0.88% increase to the 4508 level which is another all time high. After Fed Chair Jerome Powell gave the clearest indication so far that economic support for Covid19 affected businesses would begin tapering off soon, markets reacted pretty positively. The S&P500 in fact posted its best gain in some weeks.

This situation seems rather perplexing as investors continue to shrug off the worsening situation in Afghanistan as well as Covid19 concerns. With terrorist attacks once again becoming an almost daily reality, the situation can only get worse but investors seem to have already priced in their concerns on that one. As for Covid19 concerns, large rises in cases where vaccination has been sluggish do not seem to be affecting investor confidence or markets in general.

If you haven’t started trading forex yet, then you should take a look at this Trading Forex For Beginner’s Guide.

Short Term Prediction For S&P500 Price: Bulls Seem Back In Town

On a short term basis, the S&P500 appears to be heading for more gains this week as economic data continues to be digested. We still have to see the full effects of the Powell speech sinking in.

One has to note that the S&P500 price has been on an ascending triangle since 21 July when it was trading at the 4262 mark. Today’s price of 4509 means an increase of almost 6% which is quite remarkable in the current context.

As already noted, investors seem to have brushed off the Afghanistan situation and Covid19 concerns with most indexes moving forward.

If one had to assume that the bullish trend was to continue, then the next level of resistance for the S&P price would be the 4600 level. If that is overcome then a push to the 4800 mark would not be untoward by mid-September. Several factors remain tightly balanced however.

A bearish scenario would likely have the S&P500 price quickly move below the 4500 mark and drop to the low 4400’s. However something drastic would have to happen for this kind of crash to occur and the market’s risk appetite does not seem to indicate anything similar happening.

If you wish to start having a go at trading forex then you should take a look at these Best Forex Brokers.

Long Term Prediction FOR SPX500: Onwards And Upwards To New Highs

Although Fed Chairman Jerome Powell indicated that tapering is soon on the way, markets have reacted by going to new record highs. The market seems to be interpreting things differently to how it used to. The general consensus is that investors are pleased with how the tapering is being paced.

More record highs should be expected in the future as the economy continues to re-open and investors become more confident of growth potential. The 5000 level for the S&P500 price should not be too far away, possibly even this year.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.