The terrible NFP report sent shock waves in financial markets and hit the dollar hard. Nevertheless, the team at Credit Agricole sees the greenback gaining ground against specific currency pairs:

Here is their view, courtesy of eFXnews:

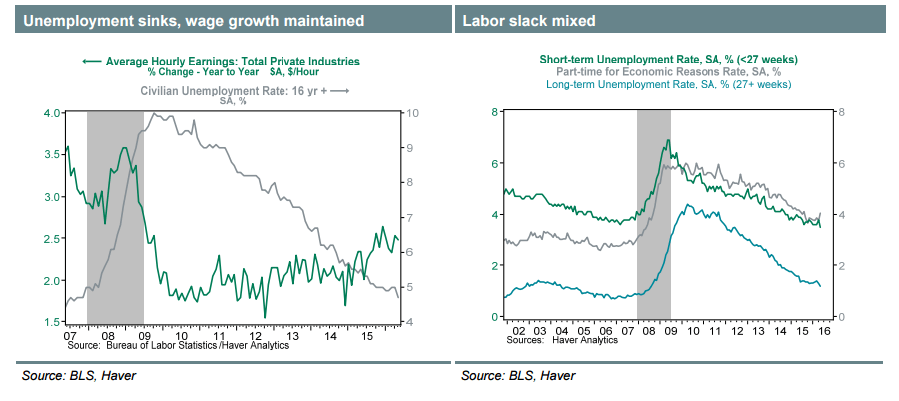

May nonfarm payrolls rose by a paltry 38K. The gain followed a downwardly revised 123K increase in April (originally reported +160K). The May unemployment rate dipped to 4.7% from 5.0%. May average hourly earnings rose 0.2%, and stood 2.5% above year- earlier levels. The average workweek or all employees remained sub-par at 34.4 hours though the factory workweek improved to 40.8 hours. Fed policy implications: No June rate hike expected but a July FOMC meeting hike remains in play.

Next week’s data calendar is fairly light and investors will focus on the upcoming Fed speeches. Indications, especially from the Fed Chair on Monday that rates will be going up before long could help the USD recover some gains.

We remain selective in our view and continue to see further USD outperformance mainly against G10 commodity currencies.

Indeed, the outlook for global commodity prices could worsen further from here on the back of returning oversupply concerns after the latest OPEC meeting. Demand fears may resurface as well if upcoming Chinese trade data disappoints next week. We further suspect that investors will adopt a more cautious stance on NZD, and especially on AUD ahead of the upcoming RBNZ and RBA meetings. Economic activity data releases out of Canada and Norway could further add to the headwinds for CAD and NOK.

The JPY seems to be rallying for all the wrong reasons and, that said, bad reasons – risk aversion, growing market disillusionment with Abenomics and deepening investor conviction that the BoJ has run out of tools to boost growth and inflation. Potential disappointments from next week’s data out of Japan could add to the market gloom and keep JPY close to the recent highs. In the longer-term, we still think that the BoJ could ease further as a way to complement recent government growth policies. Persistent policy divergence between the BoJ and the Fed should ultimately help lift USD/JPY over the longer-term.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.