The pound has dropped quite a lot after last week’s rally, and the pain is seen also against the euro.

Nevertheless, this could be actually a buy opportunity for sterling against the common currency. The team at Credit Agricole explains:

Here is their view, courtesy of eFXnews:

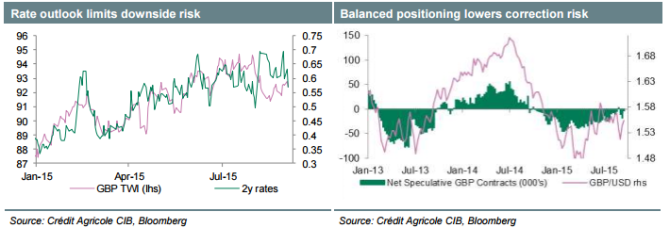

The GBP has been capped of late, mainly due to falling expectations of the BoE being close to consider higher rates anytime soon. The central bank’s chief economist Andy Haldane just recently indicated that subdued world growth and prices, and the higher currency, whose effects in lowering import prices have yet to fully pass through, make him less confident in raising interest rates.

However, it must still be noted that constructive domestic conditions have been preventing medium-term inflation expectations from falling. In that respect it must be noted that 5Y forward breakeven rates have remained well supported close to 3%. This stands in contrast to the Eurozone, where muted growth conditions and the higher EUR have been increasing downside risks to inflation.

As such we see room of diverging monetary policy expectations to the detriment of crosses such as EUR/GBP. We stay short the pair as a trade recommendation.

In terms of data next week’s focus will be on manufacturing PMI and revisions to Q2 GDP.

CA maintains a short EUR/GBP from .7313 with a stop at .75 and a target at .70.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.