EUR/USD certainly dropped on the shocking result of the EU Referendum. A peak to trough move of over 500 was clearly a big move and seemed proportionate to the 1700 move in GBP/USD.

However, since that big night, EUR/USD is trading in a much narrower range. The post-Brexit range is lower than the pre-Brexit one, but remains narrow: 1.1040 to 1.1190, a mere 150 pip range.

What can take the pair out of the range? Here are some factors and perhaps only the one in the title can make the difference:

Euro-zone data

German business confidence, PMIs, GDP and inflation among other figures can shake the common currency. However, any reaction seems limited as well as short-lived. Perhaps forward looking business confidence surveys could have more impact. Why? They could reflect the potential for weaker growth following Brexit, or show that it’s business as usual, that the old continent is shrugging off the big event.

US data

Key figures such as the Non-Farm Payrolls always move the dollar, more against the yen but also against the euro. Also here, moves remain limited. Why? The Fed was already showing caution and dovishness before Brexit. A few Fed officials expressed concern after the vote as well. In any case, a rate hike does not seem to be on the cards anytime soon. And what about a rate cut? That isn’t coming anytime soon as the Fed would not like to reverse course. So, we would need amazing US numbers or horrifying ones to really rock the boat. With figures moving between mediocre and good enough, it is hard to see a big move out of range.

Bregrexit

If the economic situation in the UK deteriorates, public support of the EU Referendum outcome could subside as well. And if Theresa May is elected as the new PM, she could negotiate a deal that would not change the economic relationship too much. Just hinting about remaining an EU member in all but name would be good for markets and could push the euro higher. What are the chances? This is certainly possible, but if it happens, it will not come quite quick. Defying the will of the public cannot be done so soon.

Bank run

The ongoing issues of Italian banks are coming to a head following Brexit. The global risk aversion mood, alongside political pressures in Italy towards a referendum in October and the will of the EU to maintain austerity against Italy’s are all bringing names such as Banca Monte dei Paschi di Siena to the headlines. Currently this is one bank and the dilemma is a bail-in or bail-out.

However, as the crisis continues, there is a chance that savers in this specific bank and in others could get worried. If they get worried, they could withdraw more and more funds. We have seen what happened in Greece last year. Greece defied austerity and was punished with a closure of its banks. Italy is a whole different story, at least in size, but such a move cannot be totally ruled out. And it can spread to other countries as well, such as Spain and Portugal.

In this case, perhaps we will get a bigger move in EUR/USD. But will it necessarily be to the downside? Not so fast. With all the ECB’s money printing using the QE program and a negative deposit rate, we could see a repatriation of funds. This is what happened in 2015 with the Greek crisis as well as the Chinese stock market crash. The euro could enjoy safe haven flows, even if the haven is Piraeus or Venice.

EUR/USD levels

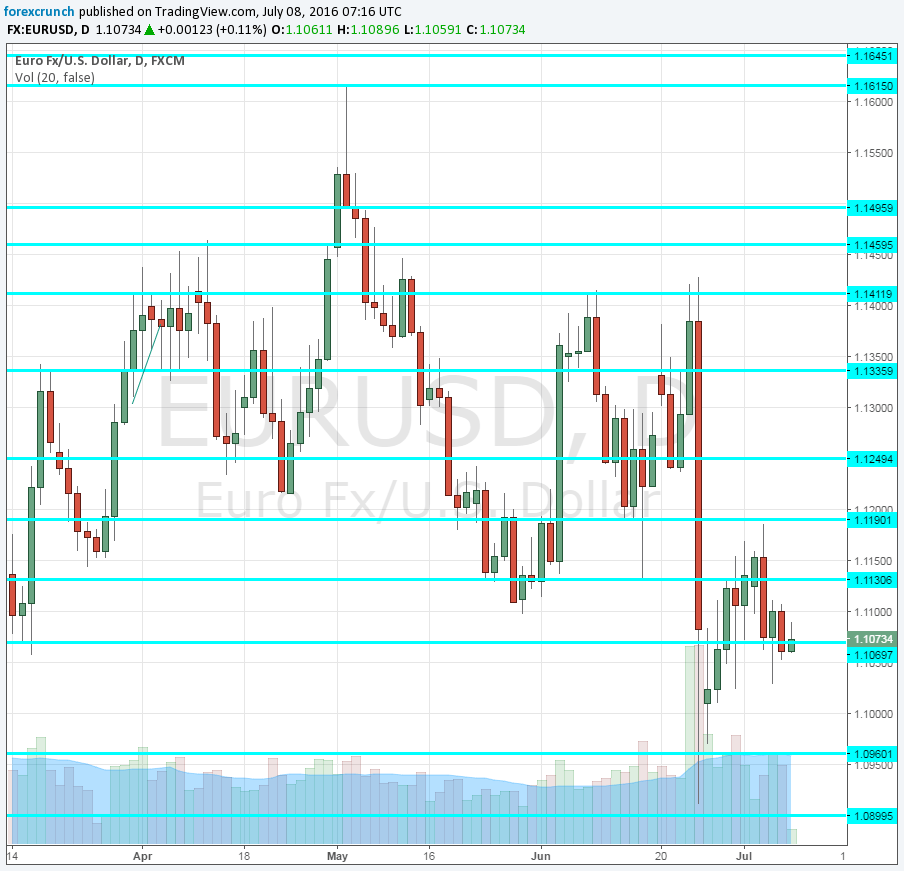

To the downside, 1.1040 is the low seen recently in the range. Below the round number of 1.10 we find 1.0960 as a weak line of support, after serving as a stepping stone on the way up from the Brexit blow. The post Brexit low is 1.0905.

Below this level, we have 1.0820, which was the low in March and a double bottom. It is followed by 1.0710 which served as support beforehand.

On the topside, 1.1190 is the immediate line of resistance. Above, we find 1.1250 as weak resistance and then 1.1335.

The post Brexit high of 1.1425 serves as the next line of resistance and it is strong. Above the round level of 1.15, we find 1.1616, the 2016 high and then 1.1712, the 2015 high.

More: EUR/USD: En-Route To 1.05 On Brexit Contagion – BofA Merrill

Here is the EUR/USD chart: