The pound has been hit by the BOE. However, it is down but not out. Can it further fall? Here is the view from Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

That was the month that was.

Political and economic events have continued to move apace in the UK, following the EU Referendum. A new Prime Minister and her cabinet are now in place, whilst political turmoil continues to engulf the opposition Labour party. The contours of the Brexit strategy will emerge in the coming months with David Davis tasked with laying out the roadmap of the UK’s exit from the European Union. Meanwhile, the anecdotal evidence is mounting that the Referendum result has already had a negative impact on sentiment, with July preliminary PMI data showing significant signs of weakness. Indeed, our UK economics team has already made meaningful downgrades to their UK growth forecasts with a three quarter recession likely, whilst the Bank of England has delivered a substantial package of monetary accommodation in line with our expectations.

At this stage, and with little over a month since the Referendum result, the outlook is subject to a great deal of uncertainty and GBP will be sensitive to a larger number of variables than usual. Chief amongst these is the injection of heightened policy uncertainty into what has traditionally been a relative haven of political stability. Given these complexities surrounding the issue of Brexit, conversations with our investors have been diverse and wide ranging. However, we have been confronted with some recurring questions, which we will address in this note. The key focus for investors has been how much further can GBP fall.

Current GBP sell-off is similar to the 1992 ERM crisis.

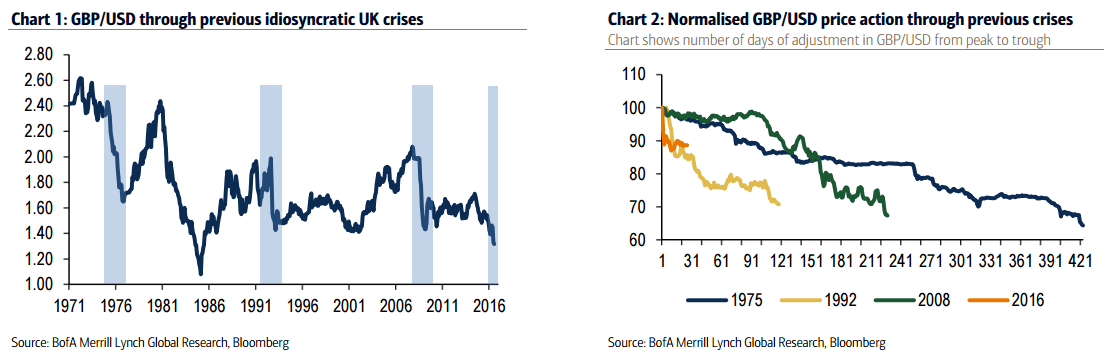

The fall in GBP/USD so far is around half of the average peak-to-trough falls seen during previous UK idiosyncratic crises. But the size and the pace of the current phase of GBP selling is similar to the post ERM II depreciation in September 1992. Both events effectively represented a break from the prevailing status quo and caused significant uncertainty on the macro outlook.

GBP likely to fall further after pause

Previous idiosyncratic GBP crises point to further GBP weakness in the months ahead with risks that GBP/USD hits our 1.25 Q1 2017 target sooner rather than later.

Some investors expect a deeper retracement towards 1.10/1.15 but this would require a perfect storm of events. EUR/GBP has rarely sustained a break above 0.90 and we think should be capped by concurrent ECB policy accommodation weighing on EUR.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.