The US presidential elections offer very different candidates for voters and also for markets. The polls, which are extremely close, are already left, front and center for the financial world. Here is all you need to know for the big event.

Here is all you need to know for the highly anticipated event: a quick background, expected currency reactions, the run-up to the results and the critical timetable of the election night.

Let’s start:

Elections 2016 Quick Background

A ton of words have been spilled on the campaign which is a never ending one, and we’ll stick to the basics. Markets usually prefer Republican presidents as these promote pro-business, pro-market policies. This election is very different.

The Republican nominee Donald Trump offers an anti-trade, populistic stance and an economic plan where the numbers don’t add up. Also, he has no political experience (something that appeals to some voters but not to markets) and a very erratic behavior. The level of uncertainty is huge.

Hillary Clinton is an unexciting, mainstream candidate who has her political baggage but is seen as a continuation of the current political situation, especially as she will probably face a Republican House. Her recent adoption of slightly anti-trade is not believed by markets, and her economic policies don’t sound outlandish.

It’s Clinton Continuation vs. Donald Disruption

Impact on currencies – 4 groups

Reactions of stock markets to the polls have been straightforward: they rise with Clinton and fall with Trump. With currencies, it’s slightly more complicated. The US dollar advanced with Clinton and slid with Trump, but there are differences between various currencies.

First and foremost, it is important to note that the reaction is not symmetric: a Clinton victory is far from being priced in but is still the more likely scenario and represents continuation. A win for Trump is still the less-likely scenario and represents uncertainty.

And, there is always the possibility of a contested election: it might be similar to the 2000 showdown between George W. Bush and Al Gore when the state of Florida was decided by 537 votes. Even on a wider margin, we may not receive a concession speech. Any significant uncertainty or recount could trigger a similar reaction to a Trump victory, as both represent uncertainty.

Clear safe havens

The most obvious reaction has been against the safe-haven currencies: first and foremost the yen, and also the Swiss franc returns to its role, despite the ever-present risk of an SNB intervention to weaken the franc. So, USD/JPY and USD/CHF rally with Clinton and plunge with Trump. This is a consistent reaction that has a very high probability of continuing on election night.

This response has been entirely consistent. Note that the SNB will be on high alert. Therefore a surge of the franc could be mitigated by the bankers in Switzerland. Also, the BOJ could intervene in an extreme case, as in Brexit, but they have less maneuvering space due to international scrutiny.

Clear risk currencies

The second group of currencies is commodity currencies: AUD, NZD, and CAD. The reaction has been mixed and somewhat less influenced by the elections. However, everything is now about the elections, and these are risk currencies. These commodity currencies are now moving up with Clinton and running down with Trump and this will likely continue.

Or in other words, the greenback falls against these currencies with Clinton and rides higher against these currencies with Trump. The most vulnerable currency on a Trump victory is the Canadian dollar, due to a potential worsening of trade relations.

EUR and GBP – depends on the outcome

The third group is more complicated: the euro and the pound. So far, the euro traded with the yen and the franc, rising with Trump and falling with Clinton, repeating the safe-haven behavior it had back in 2015 (rising on Greek issues, the counter-intuitive safe-haven reaction). The pound has been in its own world, as Brexit related issues such as the court ruling and BOE policy has a bigger impact, but usually followed the euro, yen and franc: up with Trump, down with Clinton.

However, there is a good reason to believe that the euro and the pound will follow most currencies on a Trump victory and fall against the US dollar. Both EUR and GBP are NOT classic safe-haven currencies and could fall in reaction to such a move. The US dollar will still lose out to the yen and the franc, but not to the euro nor the pound on a Trump victory.

How will the euro and the pound respond to a Clinton victory? These currencies could reflect the asymmetric risk with the elections: a relatively \small reaction in the very popular currency pairs: EUR/USD and GBP/USD. They could react positively on a “risk on” move, but quickly re-focus on domestic matters.

The exotic options

The fourth group is two more “exotic” currencies that have been in the news when the elections are discussed. The Mexican peso has been vulnerable to Trump advances and rallied with Clinton, due to Trump’s promise of building a wall on the Mexican border. This behavior could continue. On the other end of the spectrum, the Russian rouble could gain on a Trump victory, as the Republican candidate is an admirer of Putin, and fall if Clinton wins. Trading the RUB is riskier than the peso.

Conclusion

- Clinton wins: USD/JPY, USD/CHF rise; EUR/USD, GBP/USD mixed or a bit higher; AUD/USD, NZD/USD up, USD/CAD, USD/MXN down.

- Trump wins: USD/JPY, USD/JPY fall; EUR/USD, GBP/USD, AUD/USD, NZD/USD down, USD/CAD, USD/MXN up

Heading towards election night

The first results come out on Tuesday 7:00 EST which is Wednesday, 00:00 GMT. Many things can happen until then.

More polls and news

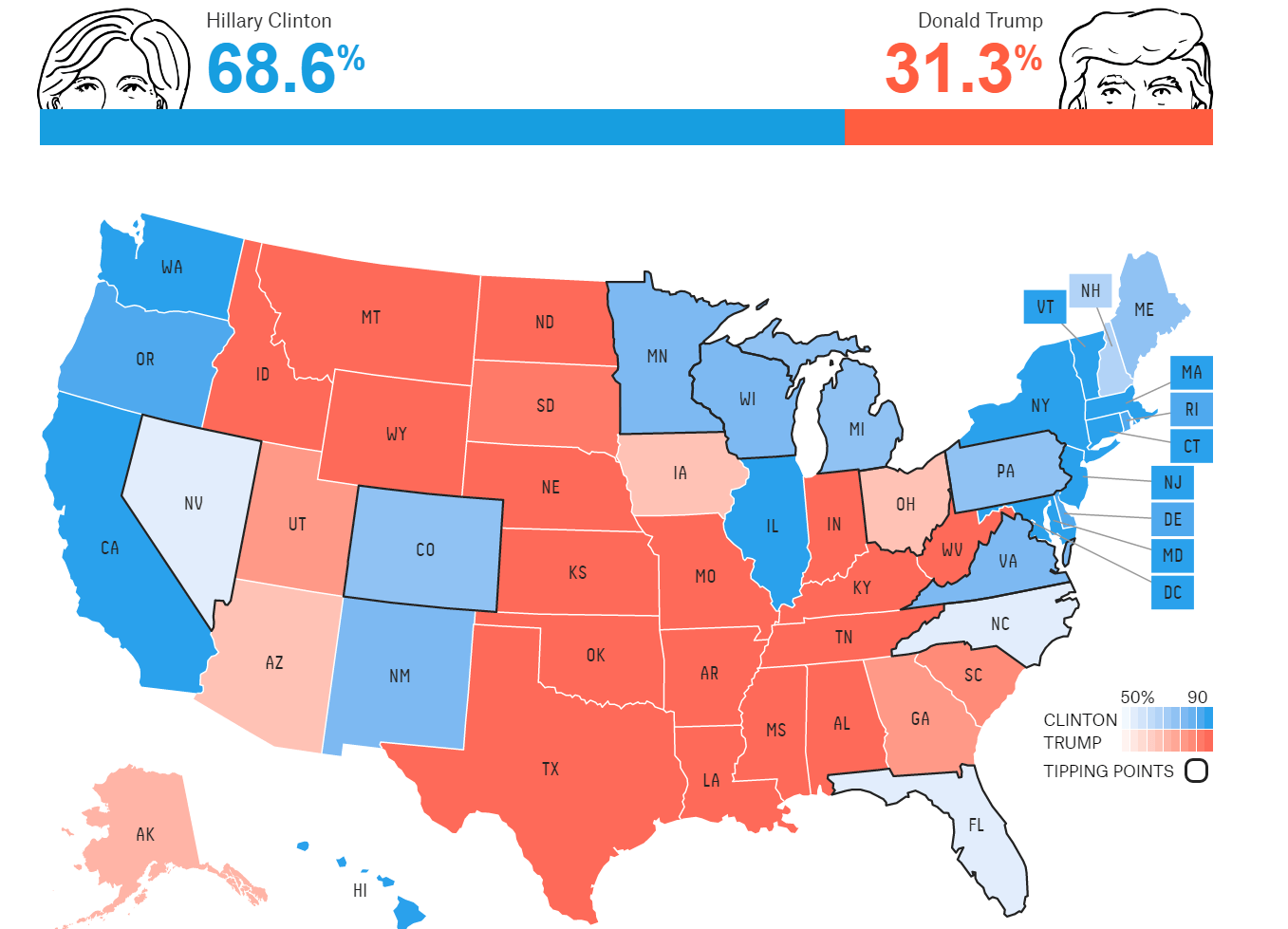

At the time of writing, Clinton has a small lead. In Nate Silver’s highly esteemed FiveThirtyEight site, the chances stand at 68.6% for Clinton and 31.3%, which is far from a clear-cut. Many opinion polls are still coming in on the national level and from swing states.

Not all polls are born equal, and aggregate sites do good work in weighing them in. Apart from FiveThirtyEight, RealClearPolitics and Pollster are worth watching. Markets can indeed move on individual polls, even if they are not that important, so it is important to remain vigilant.

Also watch out for news: the FBI Effect or Trump’s sexual assault tape are good examples of how we had seen reactions in markets even before polls reflected them.

Election Day

The elections are held on November 8th, but about one-third of Americans will have voted before election day. At the time of writing, over 37 million have voted. The other two-thirds vote on the day. Demographics play a fundamental role in voting tendencies, and turnout among these groups makes a difference.

African-Americans lean heavily towards Clinton and have not shown up in the same magnitude in early voting as in 2012. Hispanics are turning out more massively than in the previous elections, and they also support Clinton. Non-college educated whites lean towards Trump. Women and men are split by a significant margin of around 20% between the candidates.

Reports about turnouts during the day can impact markets before voting closes. Note that some may be misinformation.

Election Night Timetable

* All times are GMT. These are the time when polls close, and then we get exit polls – which are a projection but not the official count. If the race is very close, we will have to wait until the votes are fully counted.

00:00 – Florida (first results) vs. Virgina

- Florida: polls close at the biggest swing state. Results may not be clear from exit polls. This is “must-win” state for Trump. If exit polls show a clear victory for Clinton (unlikely as the race is a dead heat), it’s over for Trump. Note that the results are not for all the state, but for most of it.

- Virginia: a must-win state for Clinton. If it is tight there, she is in trouble.

- Others: Indiana, Kentucky, Georgia and South Carolina should go for Trump and Vermont to Clinton. A close race in one of these races will be a big surprise.

00:30 Ohio must win for Trump & North Carolina

- Ohio: A big swing state that is also a must-win for Trump and he should win it. If not, it’s over.

- North-Carolina: Went for Obama in 2008 and Romney in 2012. The race is extremely close.

- Other: West Virginia, should go for Trump.

1:00 Clinton’s firewall: PA, MI & NH – an opportunity for Trump

- Pennsylvania: A critical state for Clinton and a big battleground. If the results are unclear, she is in trouble.

- Michigan: Part of Clinton’s firewall – if Trump leads here (thanks to blue-collar workers) he might be on the path to victory.

- New Hampshire: A small state where Trump gained ground. Despite its size, it could be the tipping point.

- Florida: the Western part of the state closes polls/

- Others: Connecticut, Delaware, DC, Maine, Maryland, Massachusets New Jersey, Rhode Island and Illinois for Clinton, Tennessee, Alabama, Kansas, Mississippi, Missouri, Oklahoma, South Dakota and Texas for Trump.

1:30

- Some real results will come in from the highly contested states.

- Arkansas for Trump (not a swing state).

2:00 Tests for Clinton

- Colorado: Leans for Clinton, but has sometimes been close

- Wisconsin: Part of Clinton’s firewall but became closer (blue collar)

- Minnesota: Deep Clinton territory, but also became closer

- Michigan: Also in her firewall – results from the Western side are coming in.

- Arizona: Should have been Trump territory, but became closer (Hispanics). Clinton could win there.

- Even more results after two hours passed since initial results with many other non-swing states reporting exit polls.

3:00 Nevada up for grabs

- Nevada is a small state with heavy early voting. This is the last swing state.

Full data is here.

4:00 Networks calling it?

If the outcome is clear, the television networks are expected to make their official “call” at 11:00 Eastern Time / 4:00 GMT. Markets will have already reacted by then.

Onwards – real voting, political reactions

More states end voting and exit polls are released. However, there are no apparent swing states left. At this point, if the results aren’t clear, it goes down to the counting of real votes, exit polls will not matter anymore.

Markets will not wait for the official results nor the calling of the elections by the television networks but will react to events as early as they can.

A clear result usually ends with a concession speech by the loser. This time is different, not only because of the close elections but because of Trump’s refusal to accept the results. The political reactions from all the relevant players, and mostly importantly the concession speech from the loser, may it be Trump or Clinton.

Conclusions

The US elections is a huge event. Note that the significant news events come out during the Asian session, with thinner liquidity. However, trading desks will probably be fully staffed. This is a very special night, and brokers are also getting ready with leverage limits and more. Stay tuned.