Markit’s construction PMI for the UK dropped sharply to 46 points, way below 50.5 expected and 51.2 seen in May. Purchasing managers’ indices are forward looking indicators. They imply future growth or in this case, contraction. A score below 50 reflects contraction. The outcome is the worst since June 2009 – 7 years.

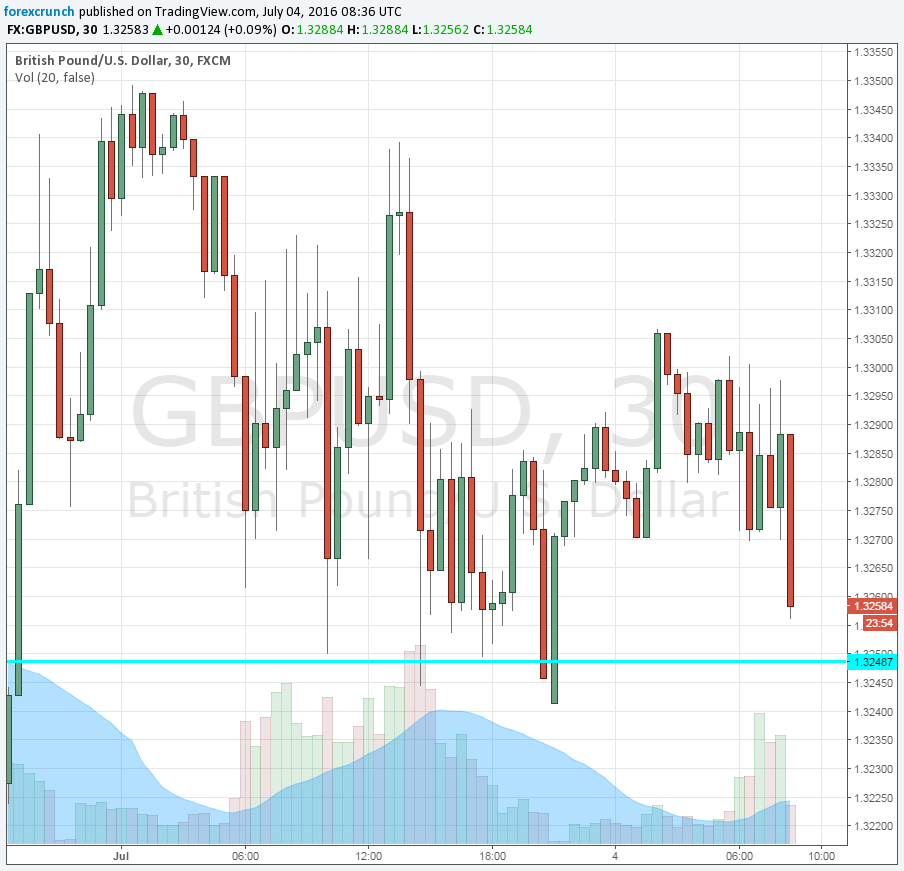

GBP/USD begins slipping down to 1.3260. All in all, trading is relatively stable as the US is on holiday today.

If tomorrow’s services PMI follows suit with falling into contraction territory, we could see further falls. The services sector is the largest in the UK and the most critical one.

The UK is not alone of course. Also the Sentix Investor Confidence in the euro zone crashed from 9.9 to 1.7 points, much worse than 8.1 expected. The expectations component went into negative ground and the survey clearly reflects Brexit. It was run between June 30th and July 2nd.

People that matter are certainly worried.

More: Brexit – all the updates in one place

Here is how the slide looks on the chart: