Better than expected inflation figures in Britain: headline inflation is up to 0.5% y/y with a monthly rise of 0.4%, both better than expected. In addition, core inflation is up to a level of 1.5%, and that’s already 0.2% better than the 1.3% that had been anticipated.

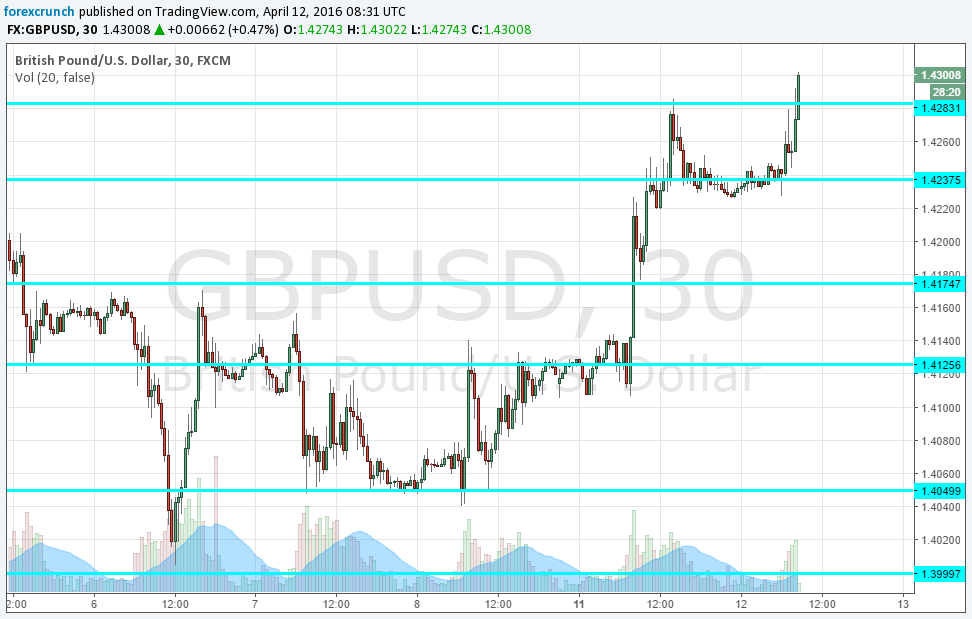

GBP/USD is rising above 1.43, extending the gains.

These are the highest inflation reads since December 2015, a 15 month high. The early Easter holiday is pinpointed as the reason for this positive surprise. The early shopping season impact is reflected in a nice rise in the Retail Price Index (RPI) to 1.6%.

Is UK inflation gaining real momentum? Or is it just an Easter bunny?

The United Kingdom was expected to report a rise to an annual level of 0.4% in March after 0.3% in February. Core inflation was predicted to edge up as well: from 1.2% to 1.3%.

GBP/USD was moving to the upside ahead of the publication, thanks to fresh weakness of the greenback more than any strength of sterling.

The BOE is not expected to raise rates anytime soon. The pound is suffering from political uncertainty concerning the EU referendum.

Here is how this rise looks on the 30 minute chart. As in many cases, the markets front-ran also this UK publication. However, it can be easily attributed to the USD sell-off in this particular case.

More: GBP/AUD: Over the Hill