Slightly better than expected data from the UK: the Claimant Count Change is at -2.4K, better than expected for April. Wages are mixed, with a beat on average hourly earnings at 2% y/y, but when excluding bonuses, we have a slide to 2.1%, worse than expected. The unemployment rate remains at 5.1% in the month of March, exactly as predicted.

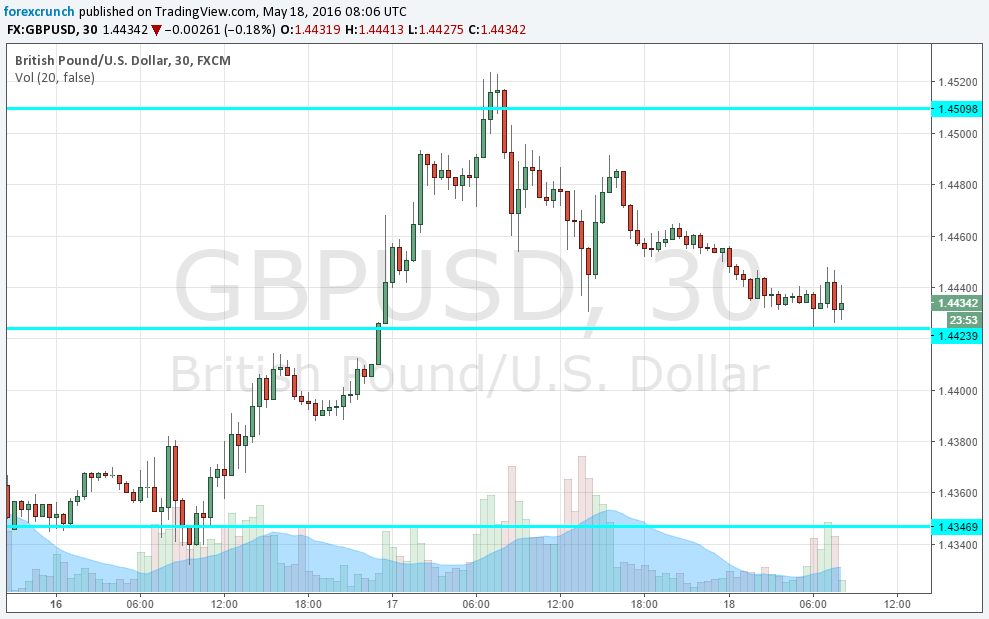

GBP/USD moves up above 1.4440. Resistance awaits at 1.4510 and support is at 1.4350. This is the second top-tier figure this week. We still have retail sales coming out tomorrow morning.

The UK was expected to report a rise of 1.7% y/y in wages for the month of March, down from 1.8% beforehand. Excluding bonuses a rise of 2.3% was predicted, up from 2.2% in February. The unemployment rate was predicted to remain unchanged at 5.1%. Jobless claims carried expectations for rising by 4.3K in April after 6.7K in March.

GBP/USD was showing relative strength thanks to the latest opinion polls showing a good chance for the UK to remain in the EU. The pound is in the Remain camp. Yet another opinion poll coming this morning shows the Remain camp leading 44% to 44% over the Leave camp. It’s a YouGov poll for The Times.

Yesterday the but this was short-lived as politics has the first and last word in pound trading.