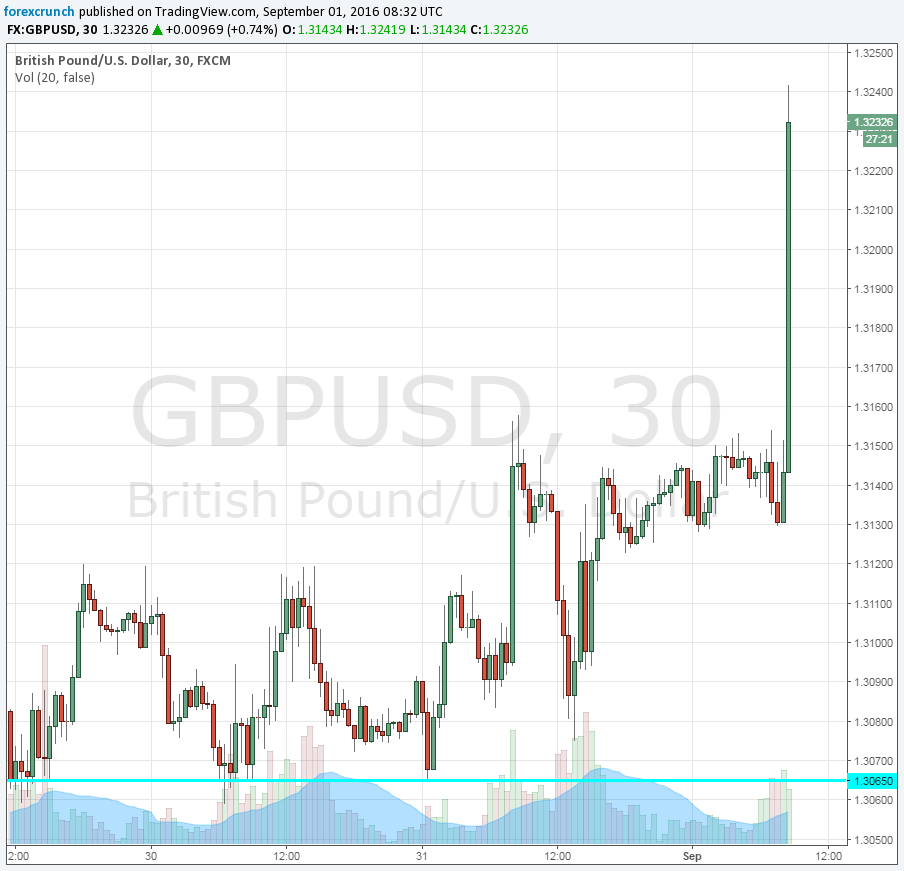

Big surprise: the UK’s manufacturing PMI jumps by no less than 5 points, a rarity, and this sends GBP/USD above 1.3220. Update: cable continues higher to 1.3247.

The soft data is catching up with the hard data. In addition, the weaker exchange rate of the pound certainly assists manufacturers which export their good. Brexit is probably not that horrible. It seems more than the mere blessing of the lower pound, but also a fresh bout of optimism. Is the worst of doom and gloom behind us?

More: Brexit impact on forex [Infographic]

Here is how the leap looks on the 30-minute pound/dollar chart:

assists amThe UK manufacturing purchasing managers’ index was expected to bounce up to 49.1 points in August. It dropped to 48.2 in July, the month after Brexit.

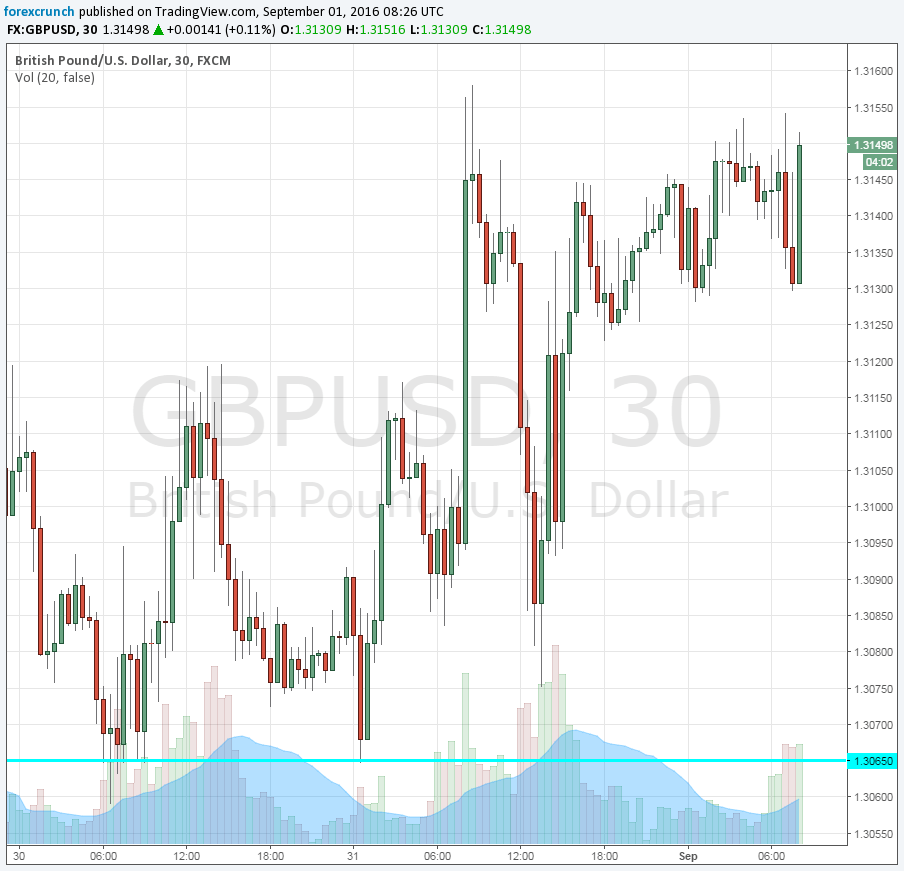

GBP/USD traded above the lows, but very much in range. At 1.3145, the pair was above

Today’s publication is the first of three PMIs. It is followed by construction tomorrow and services, the biggest sector, on Monday. PMIs are surveys. They are fresh assessment about the future, and they are considered trustworthy. However, predictions can get it wrong in hindsight.

The Bank of England was heavily influenced by these PMIs when it decided to introduce a comprehensive stimulus package on August 4th. The BOE cut the interest rate to 0.25%, added 70 billion pound worth of QE and added further measures.

These are exciting months: The forward-looking surveys have been quite gloomy: predicting a dire future due to Brexit. However, the hard data for the post-Brexit period has been better than expected and even quite good. Jobless claims fell in July, and retail sales jumped after the vote.

More: GBP/USD to extend falls? Two opinions